3. Prepare the journal entries associated with direct materials and direct labor. If an amount box does not require an entry, leave it blank or enter "0". Materials Direct Materials Price Variance Accounts Payable Record purchase of materials Work in Process Direct Materials Usage Variance Materials Record usage of materials Work in Process Direct Labor Rate Variance Direct Labor Efficiency Variance Wages Payable Record labor variances > > x > x x x x x > x > > >

3. Prepare the journal entries associated with direct materials and direct labor. If an amount box does not require an entry, leave it blank or enter "0". Materials Direct Materials Price Variance Accounts Payable Record purchase of materials Work in Process Direct Materials Usage Variance Materials Record usage of materials Work in Process Direct Labor Rate Variance Direct Labor Efficiency Variance Wages Payable Record labor variances > > x > x x x x x > x > > >

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter9: Evaluating Variances From Standard Costs

Section: Chapter Questions

Problem 1PB: Direct materials and direct labor variance analysis Lenni Clothing Co. manufactures clothing in a...

Related questions

Question

100%

Answer number 3 only

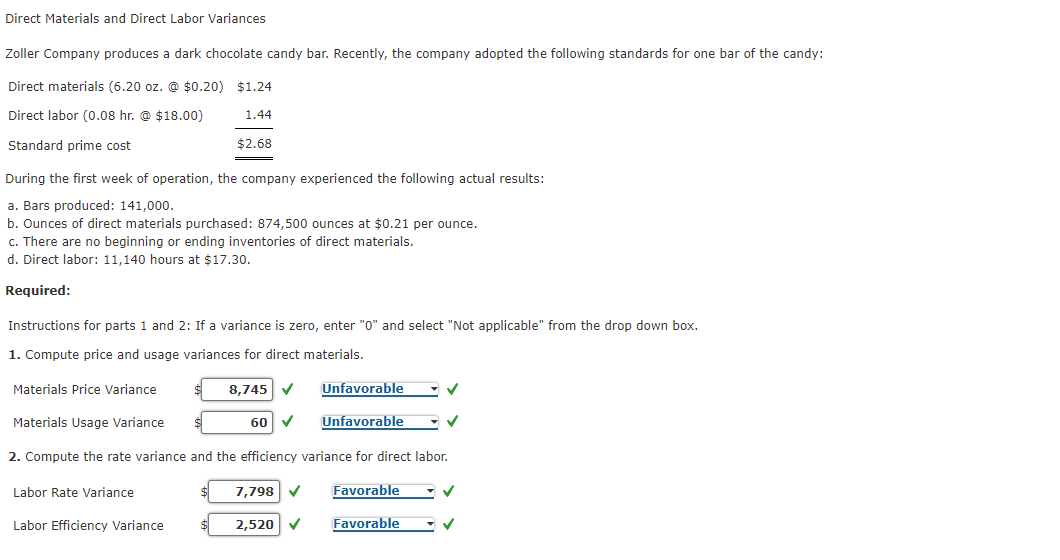

Transcribed Image Text:Direct Materials and Direct Labor Variances

Zoller Company produces a dark chocolate candy bar. Recently, the company adopted the following standards for one bar of the candy:

Direct materials (6.20 oz. @ $0.20) $1.24

Direct labor (0.08 hr. @ $18.00)

1.44

Standard prime cost

$2.68

During the first week of operation, the company experienced the following actual results:

a. Bars produced: 141,000.

b. Ounces of direct materials purchased: 874,500 ounces at $0.21 per ounce.

c. There are no beginning or ending inventories of direct materials.

d. Direct labor: 11,140 hours at $17.30.

Required:

Instructions for parts

and 2: If a variance is zero, enter "0" and select "Not applicable" from the drop down box.

1. Compute price and usage variances for direct materials.

Materials Price Variance

8,745

Unfavorable

Materials Usage Variance

60

Unfavorable

2. Compute the rate variance and the efficiency variance for direct labor.

Labor Rate Variance

7,798 V

Favorable

Labor Efficiency Variance

2,520 V

Favorable

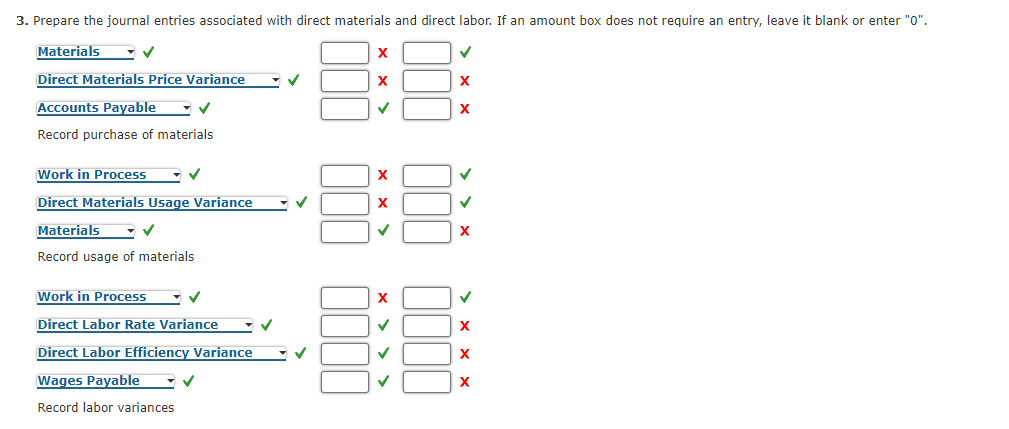

Transcribed Image Text:3. Prepare the journal entries associated with direct materials and direct labor. If an amount box does not require an entry, leave it blank or enter "0".

Materials

Direct Materials Price Variance

Accounts Payable

X

Record purchase of materials

Work in Process

X

Direct Materials Usage Variance

X

Materials

Record usage of materials

Work in Process

Direct Labor Rate Variance

Direct Labor Efficiency Variance

X

Wages Payable

Record labor variances

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning