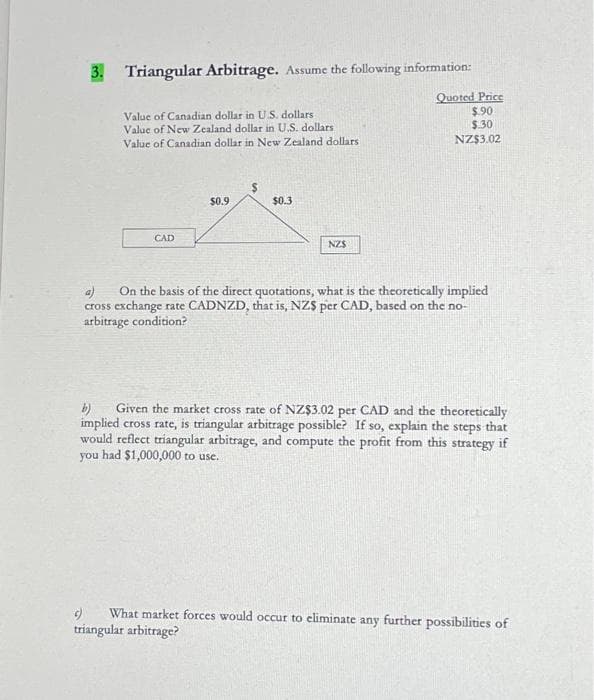

3. Triangular Arbitrage. Assume the following information: Quoted Price $.90 $.30 NZ$3.02 Value of Canadian dollar in U.S. dollars Value of New Zealand dollar in U.S. dollars Value of Canadian dollar in New Zealand dollars CAD $0.9 $0.3 NZS On the basis of the direct quotations, what is the theoretically implied cross exchange rate CADNZD, that is, NZS per CAD, based on the no- arbitrage condition? b) Given the market cross rate of NZ$3.02 per CAD and the theoretically implied cross rate, is triangular arbitrage possible? If so, explain the steps that would reflect triangular arbitrage, and compute the profit from this strategy if you had $1,000,000 to use. What market forces would occur to eliminate any further possibilities of triangular arbitrage?

3. Triangular Arbitrage. Assume the following information: Quoted Price $.90 $.30 NZ$3.02 Value of Canadian dollar in U.S. dollars Value of New Zealand dollar in U.S. dollars Value of Canadian dollar in New Zealand dollars CAD $0.9 $0.3 NZS On the basis of the direct quotations, what is the theoretically implied cross exchange rate CADNZD, that is, NZS per CAD, based on the no- arbitrage condition? b) Given the market cross rate of NZ$3.02 per CAD and the theoretically implied cross rate, is triangular arbitrage possible? If so, explain the steps that would reflect triangular arbitrage, and compute the profit from this strategy if you had $1,000,000 to use. What market forces would occur to eliminate any further possibilities of triangular arbitrage?

Chapter7: International Arbitrage And Interest Rate Parity

Section: Chapter Questions

Problem 51QA

Related questions

Question

Finance

3. Triangular Arbitrage. Assume the following information: Value of Canadian dollar in U.S. dollars. Value of New Zealand dollar in U.S. dollars Value of Canadian dollar in New Zealand dollars CAD $0.9 $ $0.3 NZ$ Quoted Price $.90 $.30 NZ$3.02 On the basis of the direct quotations, what is the theoretically implied cross exchange rate CADNZD, that is, NZ$ per CAD, based on the no- arbitrage condition? b) Given the market cross rate of NZ$3.02 per CAD and the theoretically implied cross rate, is triangular arbitrage possible? If so, explain the steps that would reflect triangular arbitrage, and compute the profit from this strategy if you had $1,000,000 to use. c) What market forces would occur to eliminate any further possibilities of triangular arbitrage?

Transcribed Image Text:3. Triangular Arbitrage. Assume the following information:

Value of Canadian dollar in U.S. dollars

Value of New Zealand dollar in U.S. dollars

Value of Canadian dollar in New Zealand dollars

CAD

$0.9

$0.3

NZS

Quoted Price

$.90

$.30

NZ$3.02

On the basis of the direct quotations, what is the theoretically implied

cross exchange rate CADNZD, that is, NZS per CAD, based on the no-

arbitrage condition?

b) Given the market cross rate of NZ$3.02 per CAD and the theoretically

implied cross rate, is triangular arbitrage possible? If so, explain the steps that

would reflect triangular arbitrage, and compute the profit from this strategy if

you had $1,000,000 to use.

What market forces would occur to eliminate any further possibilities of

triangular arbitrage?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning