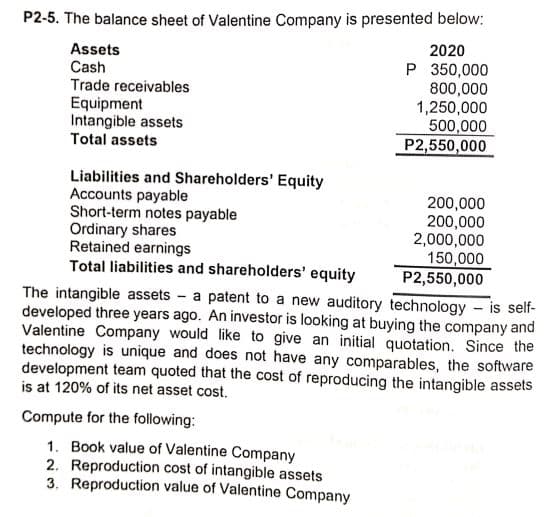

P2-5. The balance sheet of Valentine Company is presented below: 2020 Assets Cash Trade receivables Equipment Intangible assets Total assets P 350,000 800,000 1,250,000 500,000 P2,550,000 Liabilities and Shareholders' Equity Accounts payable Short-term notes payable Ordinary shares Retained earnings Total liabilities and shareholders' equity 200,000 200,000 2,000,000 150,000 P2,550,000 The intangible assets - a patent to a new auditory technology - is self- developed three years ago. An investor is looking at buying the company and Valentine Company would like to give an initial quotation. Since the technology is unique and does not have any comparables, the software development team quoted that the cost of reproducing the intangible assets is at 120% of its net asset cost. Compute for the following: 1. Book value of Valentine Company 2. Reproduction cost of intangible assets 3. Reproduction value of Valentine Company

P2-5. The balance sheet of Valentine Company is presented below: 2020 Assets Cash Trade receivables Equipment Intangible assets Total assets P 350,000 800,000 1,250,000 500,000 P2,550,000 Liabilities and Shareholders' Equity Accounts payable Short-term notes payable Ordinary shares Retained earnings Total liabilities and shareholders' equity 200,000 200,000 2,000,000 150,000 P2,550,000 The intangible assets - a patent to a new auditory technology - is self- developed three years ago. An investor is looking at buying the company and Valentine Company would like to give an initial quotation. Since the technology is unique and does not have any comparables, the software development team quoted that the cost of reproducing the intangible assets is at 120% of its net asset cost. Compute for the following: 1. Book value of Valentine Company 2. Reproduction cost of intangible assets 3. Reproduction value of Valentine Company

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.4C

Related questions

Question

Help me to answer the following requirements. Thank you

Transcribed Image Text:P2-5. The balance sheet of Valentine Company is presented below:

2020

Assets

Cash

Trade receivables

Equipment

Intangible assets

Total assets

P 350,000

800,000

1,250,000

500,000

P2,550,000

Liabilities and Shareholders' Equity

Accounts payable

Short-term notes payable

Ordinary shares

Retained earnings

Total liabilities and shareholders' equity

200,000

200,000

2,000,000

150,000

P2,550,000

The intangible assets - a patent to a new auditory technology - is self-

developed three years ago. An investor is looking at buying the company and

Valentine Company would like to give an initial quotation. Since the

technology is unique and does not have any comparables, the software

development team quoted that the cost of reproducing the intangible assets

is at 120% of its net asset cost.

Compute for the following:

1. Book value of Valentine Company

2. Reproduction cost of intangible assets

3. Reproduction value of Valentine Company

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning