4. Consider a closed economy of AU land that can be described by the following functions: All values C, I, and G are in billions of USD. Investment expenditure: lg 500 -50r, where r is real interest rate(in percent) = 3% Government expenditure: G = 125 Lump-sum constant taxes: T = 100 (a) Find the equilibrium Y, C and Ig Consumption expenditure: C = 100 +0.75(Y-T) 6. lintiitch (b) The Bank of Thailand (BOT) has recently announced that consumer confidence in Thailand fell. Let the decrease in consumer confidence to be equal to 10 points, from 100 to 90, so now C= 90+0.75(Y-T). Find the new equilibrium Y. (c) Suppose the Bank of Thailand (BOT) is trying to reverse this adverse effect on the economy. The Bank of Thailand (BOT) can cut the interest rate in order to stimulate investment spending (Ig). The increase in Ig has to be sufficient to push the overall Y level back to the original Y level that you have found in part (a). Solve for this new interest rate. Please leave it as a percent with two decimal places. (d) Based upon your answer in part (c), what should the central bank do with the discount rate (DR) to achieve the target real interest rate? Also, what is the type of such a monetary policy?

4. Consider a closed economy of AU land that can be described by the following functions: All values C, I, and G are in billions of USD. Investment expenditure: lg 500 -50r, where r is real interest rate(in percent) = 3% Government expenditure: G = 125 Lump-sum constant taxes: T = 100 (a) Find the equilibrium Y, C and Ig Consumption expenditure: C = 100 +0.75(Y-T) 6. lintiitch (b) The Bank of Thailand (BOT) has recently announced that consumer confidence in Thailand fell. Let the decrease in consumer confidence to be equal to 10 points, from 100 to 90, so now C= 90+0.75(Y-T). Find the new equilibrium Y. (c) Suppose the Bank of Thailand (BOT) is trying to reverse this adverse effect on the economy. The Bank of Thailand (BOT) can cut the interest rate in order to stimulate investment spending (Ig). The increase in Ig has to be sufficient to push the overall Y level back to the original Y level that you have found in part (a). Solve for this new interest rate. Please leave it as a percent with two decimal places. (d) Based upon your answer in part (c), what should the central bank do with the discount rate (DR) to achieve the target real interest rate? Also, what is the type of such a monetary policy?

Chapter1: Making Economics Decisions

Section: Chapter Questions

Problem 1QTC

Related questions

Question

100%

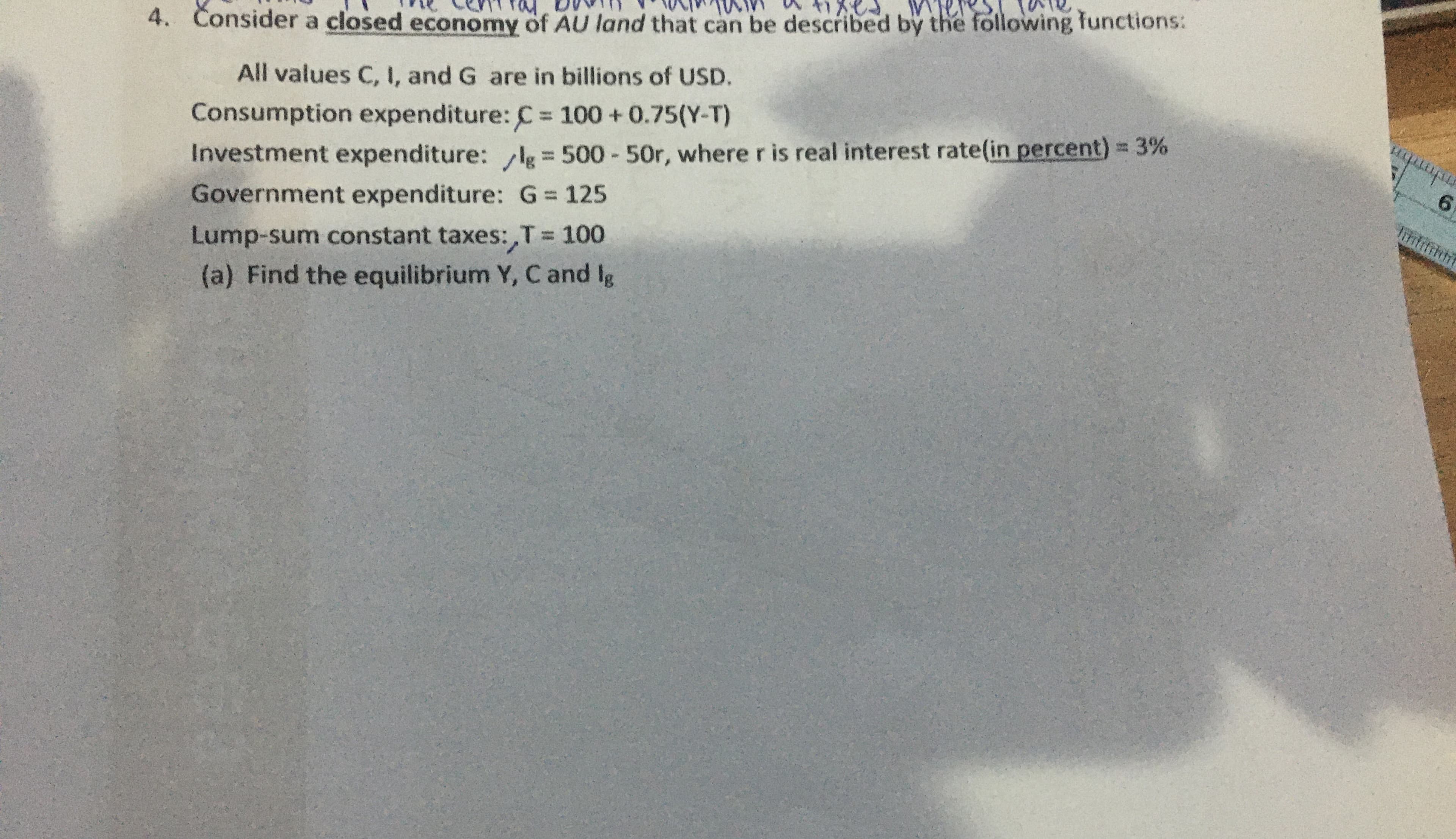

Transcribed Image Text:4. Consider a closed economy of AU land that can be described by the following functions:

All values C, I, and G are in billions of USD.

Investment expenditure: lg 500 -50r, where r is real interest rate(in percent) = 3%

Government expenditure: G = 125

Lump-sum constant taxes: T = 100

(a) Find the equilibrium Y, C and Ig

Consumption expenditure: C = 100 +0.75(Y-T)

6.

lintiitch

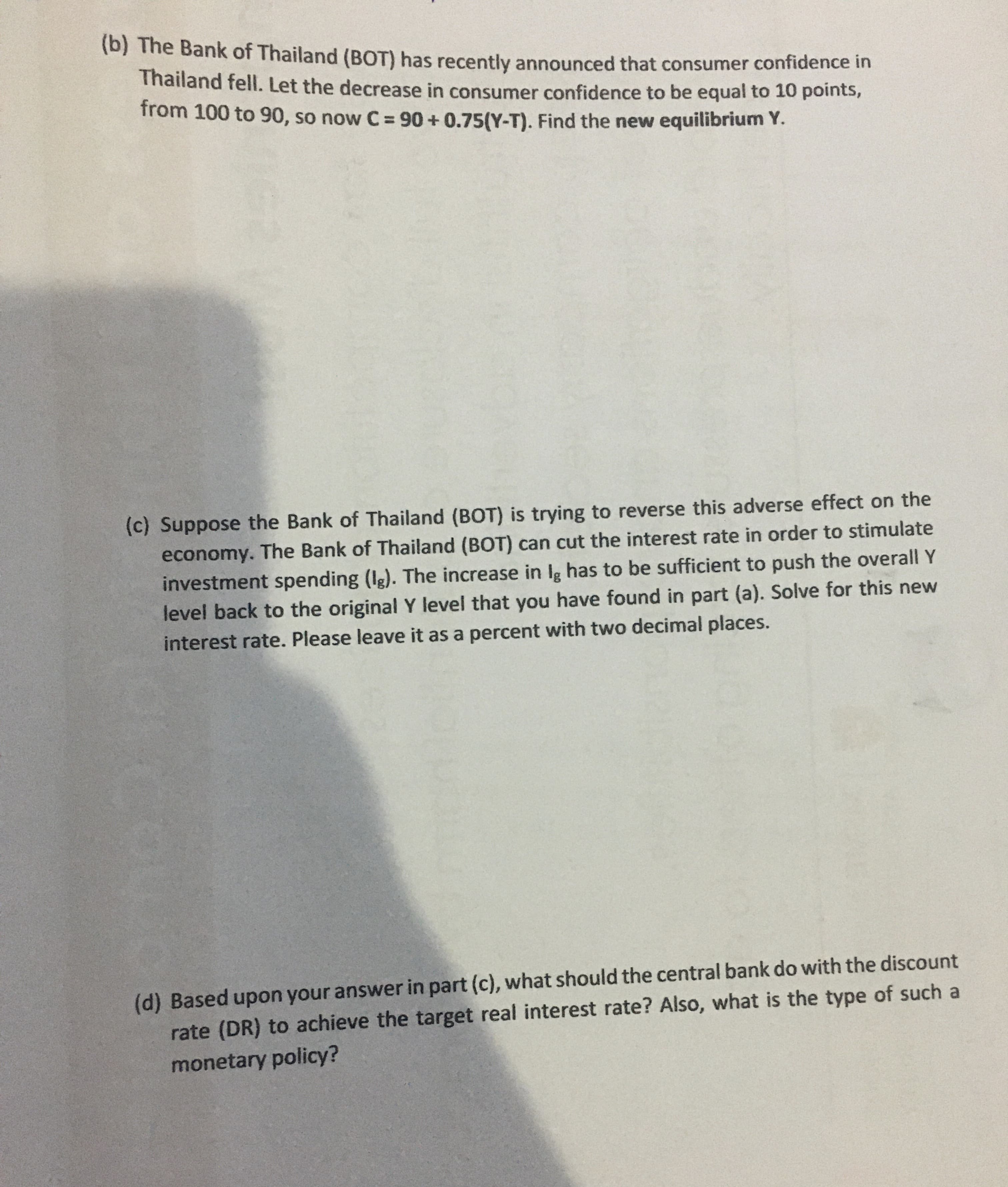

Transcribed Image Text:(b) The Bank of Thailand (BOT) has recently announced that consumer confidence in

Thailand fell. Let the decrease in consumer confidence to be equal to 10 points,

from 100 to 90, so now C= 90+0.75(Y-T). Find the new equilibrium Y.

(c) Suppose the Bank of Thailand (BOT) is trying to reverse this adverse effect on the

economy. The Bank of Thailand (BOT) can cut the interest rate in order to stimulate

investment spending (Ig). The increase in Ig has to be sufficient to push the overall Y

level back to the original Y level that you have found in part (a). Solve for this new

interest rate. Please leave it as a percent with two decimal places.

(d) Based upon your answer in part (c), what should the central bank do with the discount

rate (DR) to achieve the target real interest rate? Also, what is the type of such a

monetary policy?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-…

Economics

ISBN:

9781259290619

Author:

Michael Baye, Jeff Prince

Publisher:

McGraw-Hill Education