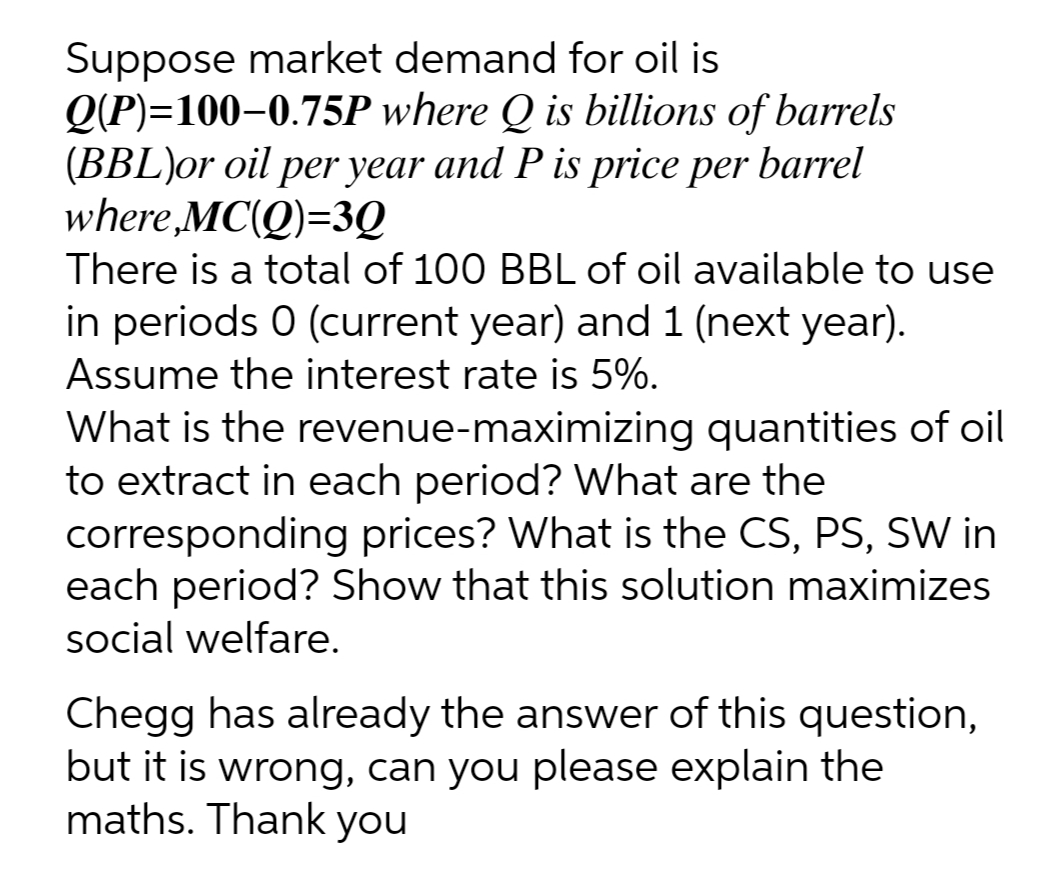

Suppose market demand for oil is Q(P)=100–0.75P where Q is billions of barrels (BBL)or oil per year and P is price per barrel where,MC(Q)=3Q There is a total of 100 BBL of oil available to use in periods 0 (current year) and 1 (next year). Assume the interest rate is 5%. What is the revenue-maximizing quantities of oil to extract in each period? What are the corresponding prices? What is the CS, PS, SW in each period? Show that this solution maximizes social welfare.

Suppose market demand for oil is Q(P)=100–0.75P where Q is billions of barrels (BBL)or oil per year and P is price per barrel where,MC(Q)=3Q There is a total of 100 BBL of oil available to use in periods 0 (current year) and 1 (next year). Assume the interest rate is 5%. What is the revenue-maximizing quantities of oil to extract in each period? What are the corresponding prices? What is the CS, PS, SW in each period? Show that this solution maximizes social welfare.

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter2: Fundamental Economic Concepts

Section: Chapter Questions

Problem 4E

Related questions

Question

2

Transcribed Image Text:Suppose market demand for oil is

Q(P)=100–0.75P where Q is billions of barrels

(BBL)or oil per year and P is price per barrel

where,MC(Q)=3Q

There is a total of 100 BBL of oil available to use

in periods 0 (current year) and 1 (next year).

Assume the interest rate is 5%.

What is the revenue-maximizing quantities of oil

to extract in each period? What are the

corresponding prices? What is the CS, PS, SW in

each period? Show that this solution maximizes

social welfare.

Chegg has already the answer of this question,

but it is wrong, can you please explain the

maths. Thank you

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 8 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning