40. How much is the remaining liability after the 6th payment?

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 1EA: Halep Inc. borrowed $30,000 from Davis Bank and signed a 4-year note payable stating the interest...

Related questions

Question

answer number 40, 41, and 42 with solutions

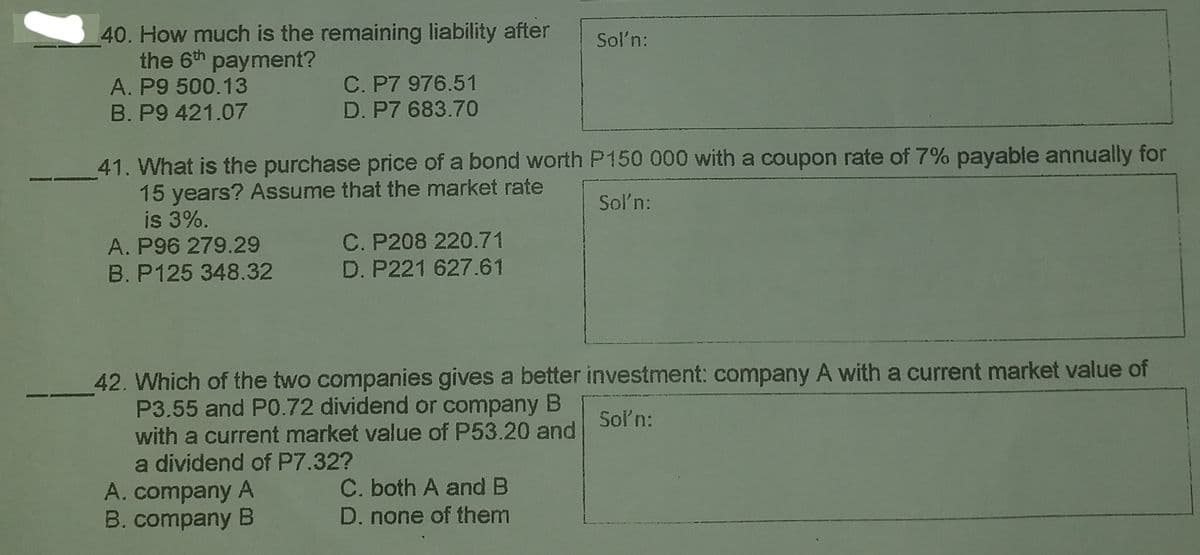

Transcribed Image Text:40. How much is the remaining liability after

the 6th payment?

Sol'n:

C. P7 976.51

D. P7 683.70

A. P9 500.13

B. P9 421.07

41. What is the purchase price of a bond worth P150 000 with a coupon rate of 7% payable annually for

15 years? Assume that the market rate

is 3%.

A. P96 279.29

B. P125 348.32

Soľn:

C. P208 220.71

D. P221 627.61

42. Which of the two companies gives a better investment: company A with a current market value of

P3.55 and P0.72 dividend or company B

Soln:

with a current market value of P53.20 and

a dividend of P7.32?

A. company A

B. company B

C. both A and B

D. none of them

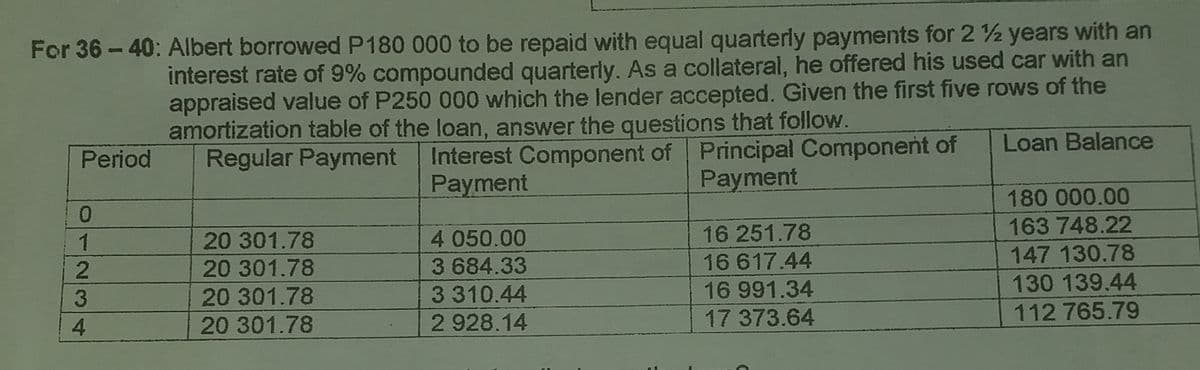

Transcribed Image Text:For 36- 40: Albert borrowed P180 000 to be repaid with equal quarterly payments for 2 2 years with an

interest rate of 9% compounded quarterly. As a collateral, he offered his used car with an

appraised value of P250 000 which the lender accepted. Given the first five rows of the

amortization table of the loan, answer the questions that follow.

Regular Payment Interest Component of Principal Component of

Loan Balance

Period

Payment

Payment

180 000.00

16 251.78

163 748.22

4 050.00

20 301.78

20 301.78

16 617.44

147 130.78

3 684.33

3310.44

16 991.34

130 139.44

20 301.78

2 928.14

17 373.64

112 765.79

20 301.78

1234

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning