estion 15 The "matching principle" is used in the Income Statement to report dividends & deferred taxes "revenues when they are legally earned" and "expenses when they were legally consumed" no matter when the actual cash changes hands cost of goods sold only ●"revenues when the cash is actually received" and "expenses when they are actually paid for" no matter when they were legally incurred VERSTE KTM

estion 15 The "matching principle" is used in the Income Statement to report dividends & deferred taxes "revenues when they are legally earned" and "expenses when they were legally consumed" no matter when the actual cash changes hands cost of goods sold only ●"revenues when the cash is actually received" and "expenses when they are actually paid for" no matter when they were legally incurred VERSTE KTM

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter5: Internal Control And Cash

Section: Chapter Questions

Problem 4SEQ: Adjustments to the company’s records based on the hank reconciliation are required for: A. additions...

Related questions

Question

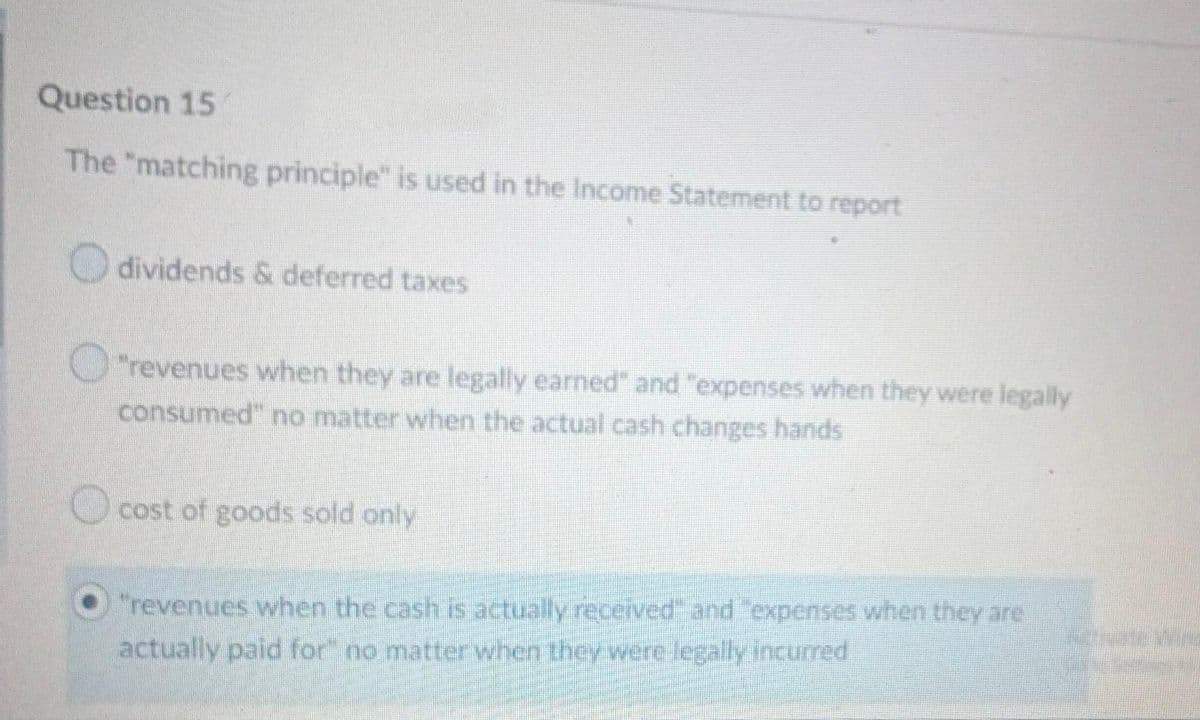

Transcribed Image Text:Question 15

The "matching principle" is used in the Income Statement to report

dividends & deferred taxes

"revenues when they are legally earned" and "expenses when they were legally

consumed" no matter when the actual cash changes hands

cost of goods sold only

"revenues when the cash is actually received" and "expenses when they are

actually paid for" no matter when they were legally incurred

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,