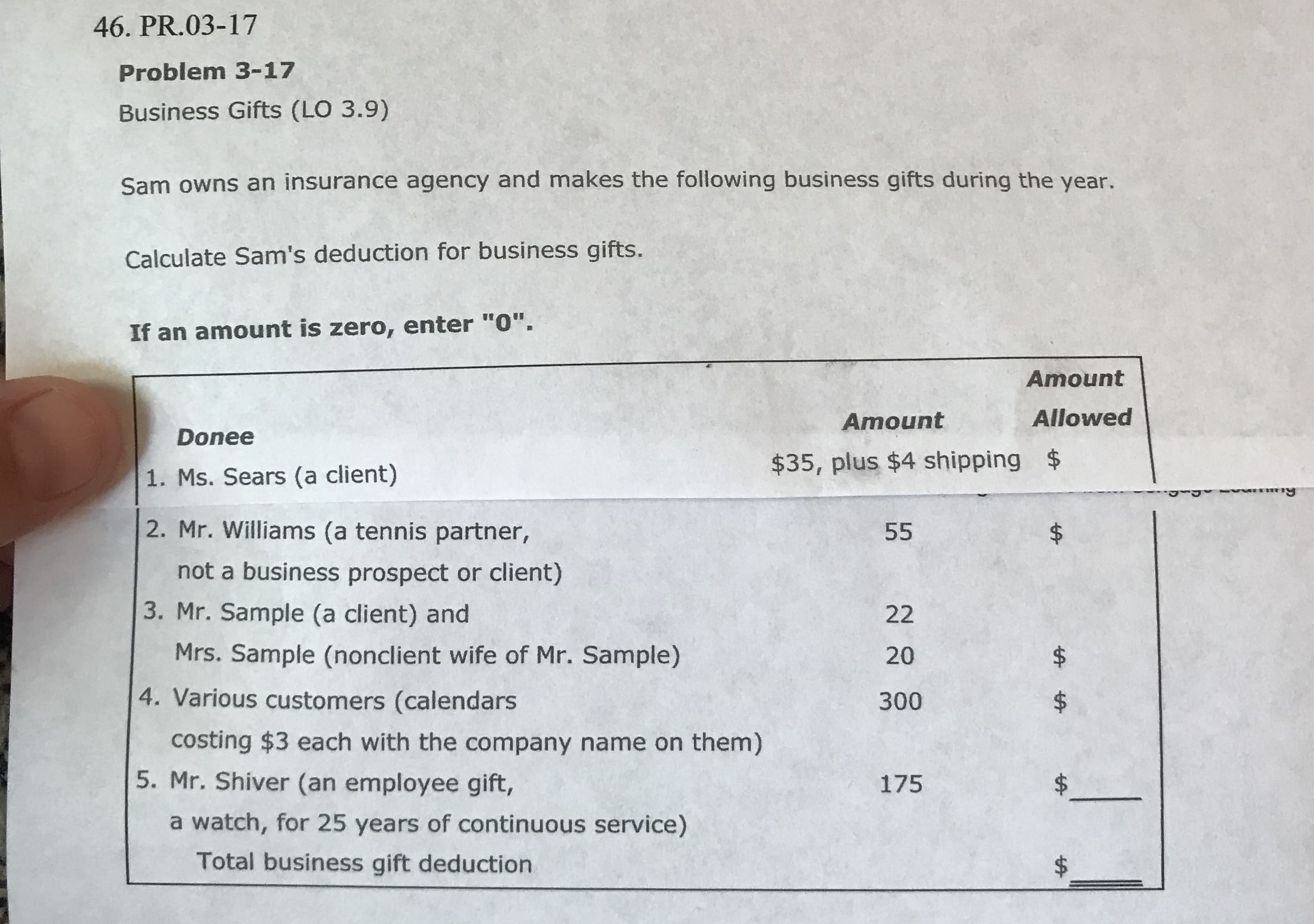

46. PR.03-17 Problem 3-17 Business Gifts (LO 3.9) Sam owns an insurance agency and makes the following business gifts during the year. Calculate Sam's deduction for business gifts. If an amount is zero, enter "0". Amount Amount Allowed Donee $35, plus $4 shipping $ 1. Ms. Sears (a client) 2. Mr. Williams (a tennis partner, 55 not a business prospect or client) 3. Mr. Sample (a client) and 22 Mrs. Sample (nonclient wife of Mr. Sample) 20 4. Various customers (calendars 300 costing $3 each with the company name on them) 5. Mr. Shiver (an employee gift, 175 a watch, for 25 years of continuous service) Total business gift deduction %24 %24 %24 %24 %24

46. PR.03-17 Problem 3-17 Business Gifts (LO 3.9) Sam owns an insurance agency and makes the following business gifts during the year. Calculate Sam's deduction for business gifts. If an amount is zero, enter "0". Amount Amount Allowed Donee $35, plus $4 shipping $ 1. Ms. Sears (a client) 2. Mr. Williams (a tennis partner, 55 not a business prospect or client) 3. Mr. Sample (a client) and 22 Mrs. Sample (nonclient wife of Mr. Sample) 20 4. Various customers (calendars 300 costing $3 each with the company name on them) 5. Mr. Shiver (an employee gift, 175 a watch, for 25 years of continuous service) Total business gift deduction %24 %24 %24 %24 %24

Chapter7: Deductions And Losses: Certain Business Expenses And Losses

Section: Chapter Questions

Problem 47P

Related questions

Question

Transcribed Image Text:46. PR.03-17

Problem 3-17

Business Gifts (LO 3.9)

Sam owns an insurance agency and makes the following business gifts during the year.

Calculate Sam's deduction for business gifts.

If an amount is zero, enter "0".

Amount

Amount

Allowed

Donee

$35, plus $4 shipping $

1. Ms. Sears (a client)

2. Mr. Williams (a tennis partner,

55

not a business prospect or client)

3. Mr. Sample (a client) and

22

Mrs. Sample (nonclient wife of Mr. Sample)

20

4. Various customers (calendars

300

costing $3 each with the company name on them)

5. Mr. Shiver (an employee gift,

175

a watch, for 25 years of continuous service)

Total business gift deduction

%24

%24

%24

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT