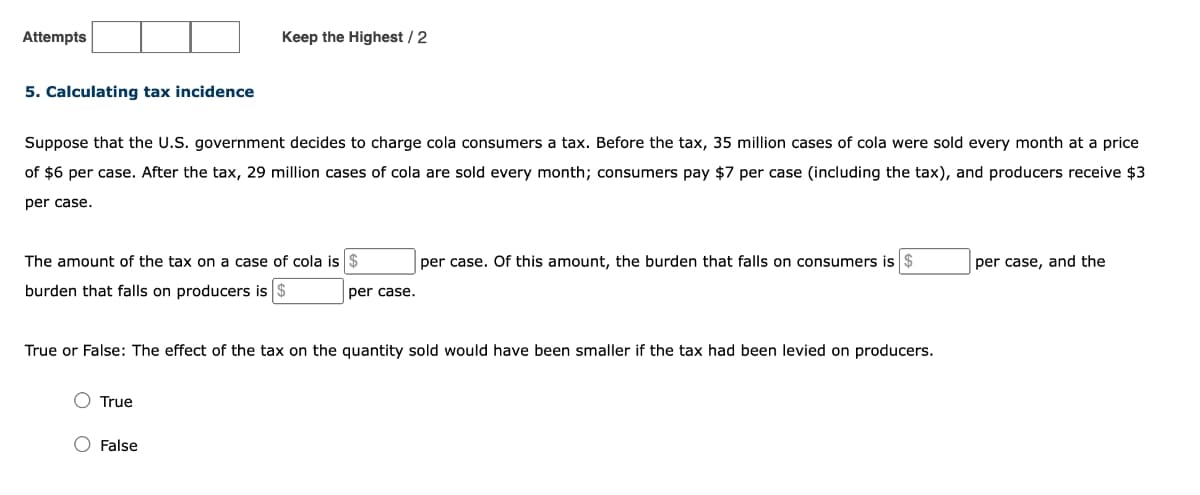

5. Calculating tax incidence Suppose that the U.S. government decides to charge cola consumers a tax. Before the tax, 35 million cases of cola were sold every month at a price of $6 per case. After the tax, 29 million cases of cola are sold every month; consumers pay $7 per case (including the tax), and producers receive $3 per case. The amount of the tax on a case of cola is $ per case. Of this amount, the burden that falls on consumers is $ per case, and the burden that falls on producers is $ per case. True or False: The effect of the tax on the quantity sold would have been smaller if the tax had been levied on producers. O True O False

5. Calculating tax incidence Suppose that the U.S. government decides to charge cola consumers a tax. Before the tax, 35 million cases of cola were sold every month at a price of $6 per case. After the tax, 29 million cases of cola are sold every month; consumers pay $7 per case (including the tax), and producers receive $3 per case. The amount of the tax on a case of cola is $ per case. Of this amount, the burden that falls on consumers is $ per case, and the burden that falls on producers is $ per case. True or False: The effect of the tax on the quantity sold would have been smaller if the tax had been levied on producers. O True O False

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter3: Demand And Supply

Section: Chapter Questions

Problem 50CTQ: Explain why voluntary Martians improve social welfare.

Related questions

Question

A4

Transcribed Image Text:Attempts

Keep the Highest / 2

5. Calculating tax incidence

Suppose that the U.S. government decides to charge cola consumers a tax. Before the tax, 35 million cases of cola were sold every month at a price

of $6 per case. After the tax, 29 million cases of cola are sold every month; consumers pay $7 per case (including the tax), and producers receive $3

per case.

The amount of the tax on a case of cola is $

per case. Of this amount, the burden that falls on consumers is $

per case, and the

burden that falls on producers is

per case.

True or False: The effect of the tax on the quantity sold would have been smaller if the tax had been levied on producers.

True

O False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax