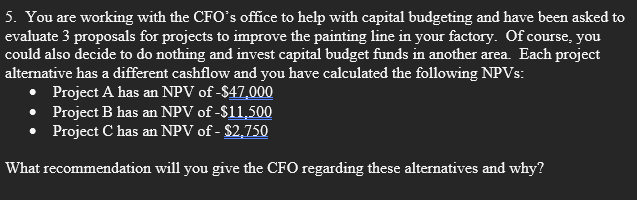

5. You are working with the CFO's office to help with capital budgeting and have been asked to evaluate 3 proposals for projects to improve the painting line in your factory. Of course, you could also decide to do nothing and invest capital budget funds in another area. Each project alternative has a different cashflow and you have calculated the following NPVs: • Project A has an NPV of -$47,000 • Project B has an NPV of -$11,500 Project C has an NPV of - $2,750 What recommendation will you give the CFO regarding these alternatives and why?

5. You are working with the CFO's office to help with capital budgeting and have been asked to evaluate 3 proposals for projects to improve the painting line in your factory. Of course, you could also decide to do nothing and invest capital budget funds in another area. Each project alternative has a different cashflow and you have calculated the following NPVs: • Project A has an NPV of -$47,000 • Project B has an NPV of -$11,500 Project C has an NPV of - $2,750 What recommendation will you give the CFO regarding these alternatives and why?

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter5: Investment Decisions: Look Ahead And Reason Back

Section: Chapter Questions

Problem 5.4IP

Related questions

Question

Transcribed Image Text:5. You are working with the CFO's office to help with capital budgeting and have been asked to

evaluate 3 proposals for projects to improve the painting line in your factory. Of course, you

could also decide to do nothing and invest capital budget funds in another area. Each project

alternative has a different cashflow and you have calculated the following NPVs:

Project A has an NPV of -$47,000

Project B has an NPV of -$11,500

Project C has an NPV of - $2,750

What recommendation will you give the CFO regarding these alternatives and why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning