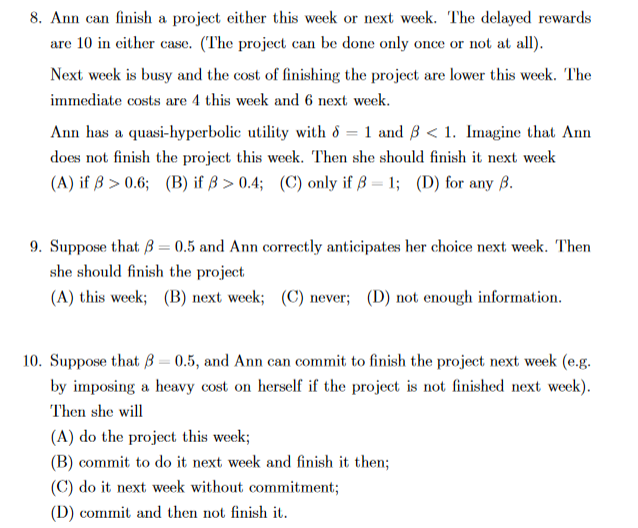

8. Ann can finish a project either this week or next week. The delayed rewards are 10 in either case. (The project can be done only once or not at all). Next week is busy and the cost of finishing the project are lower this week. The immediate costs are 4 this week and 6 next week. Ann has a quasi-hyperbolic utility with & = 1 and B < 1. Imagine that Ann does not finish the project this week. Then she should finish it next week (A) if ß > 0.6; (B) if ß > 0.4; (C) only if ß = 1; (D) for any ß. 9. Suppose that B = 0.5 and Ann correctly anticipates her choice next week. Then she should finish the project (A) this week; (B) next week; (C) never; (D) not enough information. 10. Suppose that ß = 0.5, and Ann can commit to finish the project next week (e.g. by imposing a heavy cost on herself if the project is not finished next week). Then she will (A) do the project this week; (B) commit to do it next week and finish it then; (C) do it next week without commitment3; (D) commit and then not finish it.

8. Ann can finish a project either this week or next week. The delayed rewards are 10 in either case. (The project can be done only once or not at all). Next week is busy and the cost of finishing the project are lower this week. The immediate costs are 4 this week and 6 next week. Ann has a quasi-hyperbolic utility with & = 1 and B < 1. Imagine that Ann does not finish the project this week. Then she should finish it next week (A) if ß > 0.6; (B) if ß > 0.4; (C) only if ß = 1; (D) for any ß. 9. Suppose that B = 0.5 and Ann correctly anticipates her choice next week. Then she should finish the project (A) this week; (B) next week; (C) never; (D) not enough information. 10. Suppose that ß = 0.5, and Ann can commit to finish the project next week (e.g. by imposing a heavy cost on herself if the project is not finished next week). Then she will (A) do the project this week; (B) commit to do it next week and finish it then; (C) do it next week without commitment3; (D) commit and then not finish it.

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter6: Consumer Choices

Section: Chapter Questions

Problem 1SCQ: Jeremy is deeply in love with Jasmine. Jasmine lives where cell phone coverage is poor, so he can...

Related questions

Question

#9 and 10

Transcribed Image Text:8. Ann can finish a project either this week or next week. The delayed rewards

are 10 in either case. (The project can be done only once or not at all).

Next week is busy and the cost of finishing the project are lower this week. The

immediate costs are 4 this week and 6 next week.

Ann has a quasi-hyperbolic utility with & = 1 and B < 1. Imagine that Ann

does not finish the project this week. Then she should finish it next week

(A) if ß > 0.6; (B) if ß > 0.4; (C) only if ß = 1; (D) for any ß.

9. Suppose that B = 0.5 and Ann correctly anticipates her choice next week. Then

she should finish the project

(A) this week; (B) next week; (C) never; (D) not enough information.

10. Suppose that ß = 0.5, and Ann can commit to finish the project next week (e.g.

by imposing a heavy cost on herself if the project is not finished next week).

Then she will

(A) do the project this week;

(B) commit to do it next week and finish it then;

(C) do it next week without commitment3;

(D) commit and then not finish it.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning