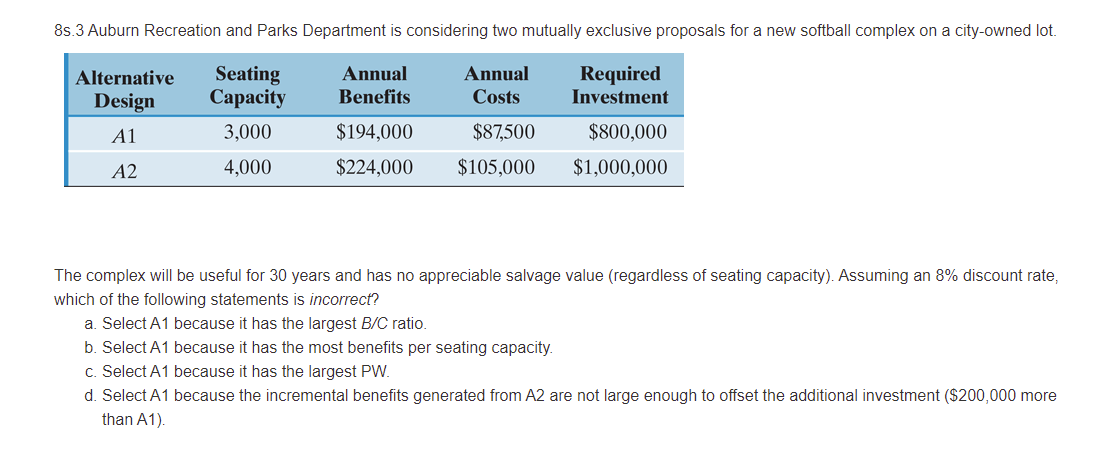

8s.3 Auburn Recreation and Parks Department is considering two mutually exclusive proposals for a new softball complex on a city-owned lot Seating Сараcity Annual Annual Required Investment Alternative Design Benefits Costs A1 3,000 $194,000 $87,500 $800,000 A2 4,000 $224,000 $105,000 $1,000,000 The complex will be useful for 30 years and has no appreciable salvage value (regardless of seating capacity). Assuming an 8% discount rate which of the following statements is incorrect? a. Select A1 because it has the largest B/C ratio. b. Select A1 because it has the most benefits per seating capacity. c. Select A1 because it has the largest PW. d. Select A1 because the incremental benefits generated from A2 are not large enough to offset the additional investment ($200,000 more than A1).

8s.3 Auburn Recreation and Parks Department is considering two mutually exclusive proposals for a new softball complex on a city-owned lot Seating Сараcity Annual Annual Required Investment Alternative Design Benefits Costs A1 3,000 $194,000 $87,500 $800,000 A2 4,000 $224,000 $105,000 $1,000,000 The complex will be useful for 30 years and has no appreciable salvage value (regardless of seating capacity). Assuming an 8% discount rate which of the following statements is incorrect? a. Select A1 because it has the largest B/C ratio. b. Select A1 because it has the most benefits per seating capacity. c. Select A1 because it has the largest PW. d. Select A1 because the incremental benefits generated from A2 are not large enough to offset the additional investment ($200,000 more than A1).

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter1: Introduction And Goals Of The Firm

Section: Chapter Questions

Problem 2.5CE: Energy entrepreneur T. Boone Pickens has proposed converting the trucking fleet in the United States...

Related questions

Question

Attached is question 3. PLEASE SHOW WORK IN EXCEL!

Transcribed Image Text:8s.3 Auburn Recreation and Parks Department is considering two mutually exclusive proposals for a new softball complex on a city-owned lot.

Seating

Сараcity

Annual

Annual

Required

Investment

Alternative

Design

Benefits

Costs

A1

3,000

$194,000

$87,500

$800,000

A2

4,000

$224,000

$105,000

$1,000,000

The complex will be useful for 30 years and has no appreciable salvage value (regardless of seating capacity). Assuming an 8% discount rate,

which of the following statements is incorrect?

a. Select A1 because it has the largest B/C ratio.

b. Select A1 because it has the most benefits per seating capacity.

c. Select A1 because it has the largest PW.

d. Select A1 because the incremental benefits generated from A2 are not large enough to offset the additional investment ($200,000 more

than A1).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 9 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning