9- Which of the following statements about "Cash From Operations/Short Term Liabilities ratio is correct? a) If it is 20% or less, it is risky, an increase in the trend analysis is a positive indicator. b) 40% and above is safe, an decrease in trend analysis is a positive indicator c) O 25% and below is safe, an increase in trend analysis is a positive indicator d) 30% and below is safe, an decrease in trend analysis is a positive indicator

9- Which of the following statements about "Cash From Operations/Short Term Liabilities ratio is correct? a) If it is 20% or less, it is risky, an increase in the trend analysis is a positive indicator. b) 40% and above is safe, an decrease in trend analysis is a positive indicator c) O 25% and below is safe, an increase in trend analysis is a positive indicator d) 30% and below is safe, an decrease in trend analysis is a positive indicator

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter5: Risk Analysis

Section: Chapter Questions

Problem 14PC: Refer to the financial state-ment data for Abercrombie Fitch in Problem 4.25 in Chapter 4. Exhibit...

Related questions

Question

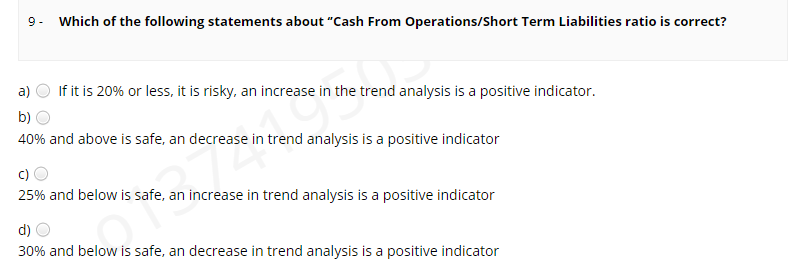

Transcribed Image Text:9. Which of the following statements about "Cash From Operations/Short Term Liabilities ratio is correct?

a)

If it is 20% or less, it is risky, an increase in the trend analysis is a positive indicator.

b)

40% and above is safe, an decrease in trend analysis is a positive indicator

c)

25% and below is safe, an increase in trend analysis is a positive indicator

d)

30% and below is safe, an decrease in trend analysis is a positive indicator

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning