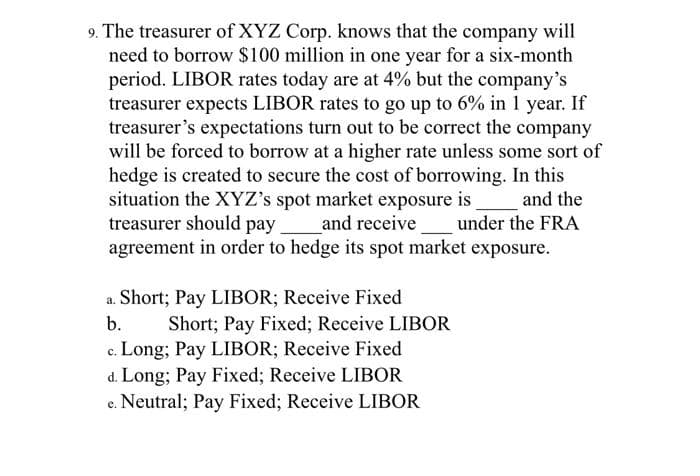

9. The treasurer of XYZ Corp. knows that the company will need to borrow $100 million in one year for a six-month period. LIBOR rates today are at 4% but the company's treasurer expects LIBOR rates to go up to 6% in 1 year. If treasurer's expectations turn out to be correct the company will be forced to borrow at a higher rate unless some sort of hedge is created to secure the cost of borrowing. In this situation the XYZ's spot market exposure is treasurer should pay agreement in order to hedge its spot market exposure. and the under the FRA and receive

9. The treasurer of XYZ Corp. knows that the company will need to borrow $100 million in one year for a six-month period. LIBOR rates today are at 4% but the company's treasurer expects LIBOR rates to go up to 6% in 1 year. If treasurer's expectations turn out to be correct the company will be forced to borrow at a higher rate unless some sort of hedge is created to secure the cost of borrowing. In this situation the XYZ's spot market exposure is treasurer should pay agreement in order to hedge its spot market exposure. and the under the FRA and receive

Principles of Macroeconomics (MindTap Course List)

7th Edition

ISBN:9781285165912

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter16: The Monetary System

Section: Chapter Questions

Problem 5PA

Related questions

Question

pls solve this MCQ type ques quickly needed urgently will give you many upvotes

Transcribed Image Text:9. The treasurer of XYZ Corp. knows that the company will

need to borrow $100 million in one year for a six-month

period. LIBOR rates today are at 4% but the company's

treasurer expects LIBOR rates to go up to 6% in 1 year. If

treasurer's expectations turn out to be correct the company

will be forced to borrow at a higher rate unless some sort of

hedge is created to secure the cost of borrowing. In this

situation the XYZ's spot market exposure is

treasurer should pay

agreement in order to hedge its spot market exposure.

and the

and receive under the FRA

a. Short; Pay LIBOR; Receive Fixed

Short; Pay Fixed; Receive LIBOR

c. Long; Pay LIBOR; Receive Fixed

d. Long; Pay Fixed; Receive LIBOR

e. Neutral; Pay Fixed; Receive LIBOR

b.

с.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning