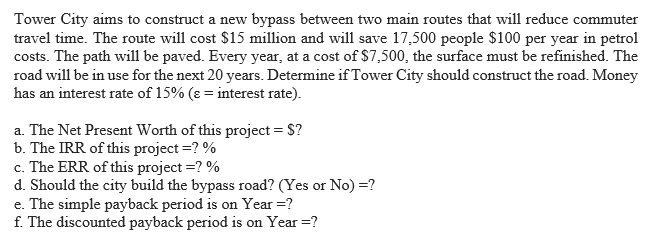

Tower City aims to construct a new bypass between two main routes that will reduce commuter travel time. The route will cost $15 million and will save 17,500 people $100 per year in petrol costs. The path will be paved. Every year, at a cost of $7,500, the surface must be refinished. The road will be in use for the next 20 years. Determine if Tower City should construct the road. Money has an interest rate of 15% (ɛ = interest rate). a. The Net Present Worth of this project = $? b. The IRR of this project =? % c. The ERR of this project =? % d. Should the city build the bypass road? (Yes or No) =? e. The simple payback period is on Year =? f. The discounted payback period is on Year =?

Tower City aims to construct a new bypass between two main routes that will reduce commuter travel time. The route will cost $15 million and will save 17,500 people $100 per year in petrol costs. The path will be paved. Every year, at a cost of $7,500, the surface must be refinished. The road will be in use for the next 20 years. Determine if Tower City should construct the road. Money has an interest rate of 15% (ɛ = interest rate). a. The Net Present Worth of this project = $? b. The IRR of this project =? % c. The ERR of this project =? % d. Should the city build the bypass road? (Yes or No) =? e. The simple payback period is on Year =? f. The discounted payback period is on Year =?

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 2E

Related questions

Question

please answer all with complete solution, draw the cash flow diagram. thank you...

note: do not use excel please. thank youu

Transcribed Image Text:Tower City aims to construct a new bypass between two main routes that will reduce commuter

travel time. The route will cost $15 million and will save 17,500 people $100 per year in petrol

costs. The path will be paved. Every year, at a cost of $7,500, the surface must be refinished. The

road will be in use for the next 20 years. Determine if Tower City should construct the road. Money

has an interest rate of 15% (ɛ = interest rate).

a. The Net Present Worth of this project = $?

b. The IRR of this project =? %

c. The ERR of this project =? %

d. Should the city build the bypass road? (Yes or No) =?

e. The simple payback period is on Year =?

f. The discounted payback period is on Year =?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning