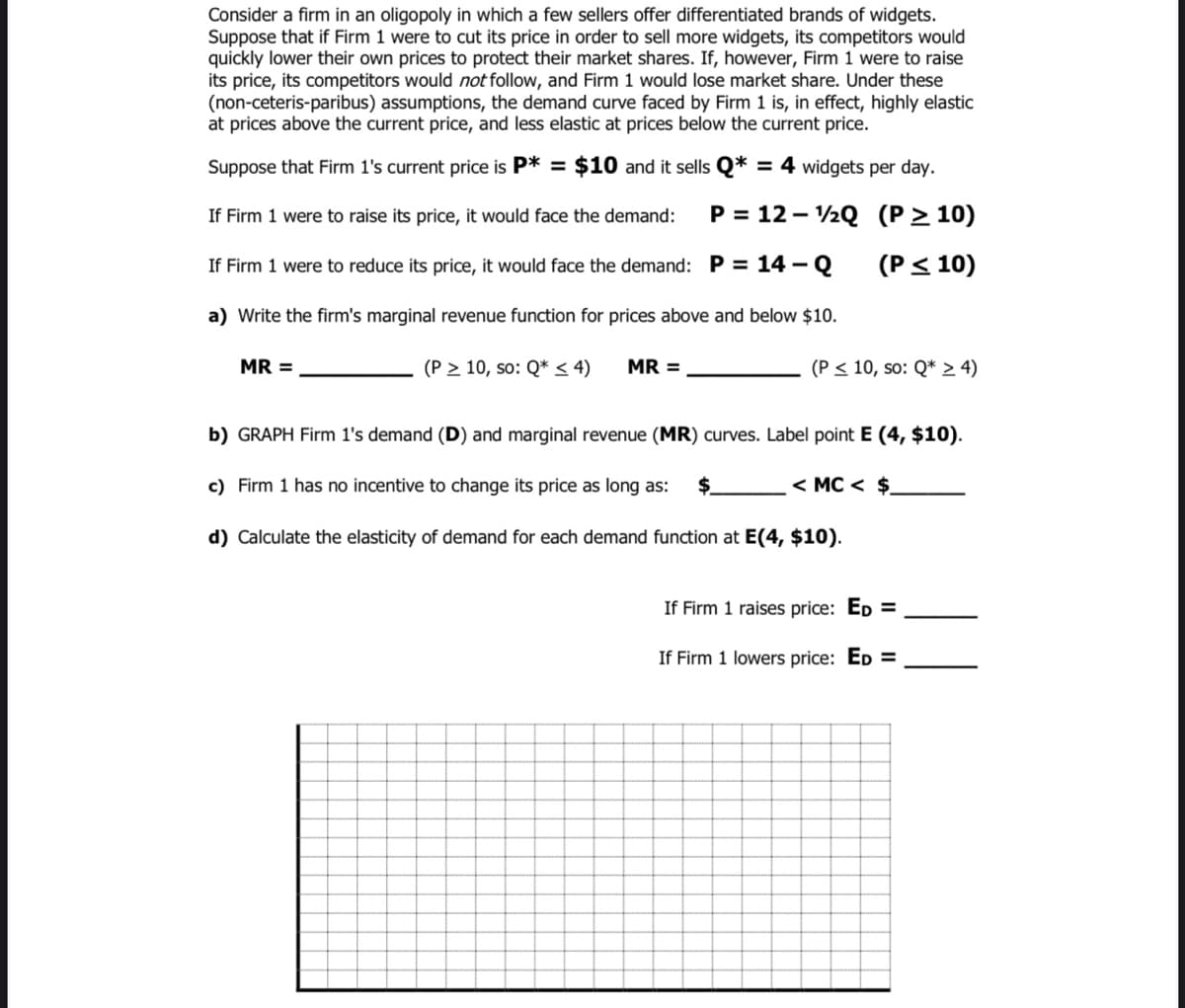

Consider a firm in an oligopoly in which a few sellers offer differentiated brands of widgets. Suppose that if Firm 1 were to cut its price in order to sell more widgets, its competitors would quickly lower their own prices to protect their market shares. If, however, Firm 1 were to raise its price, its competitors would not follow, and Firm 1 would lose market share. Under these (non-ceteris-paribus) assumptions, the demand curve faced by Firm 1 is, in effect, highly elastic at prices above the current price, and less elastic at prices below the current price. Suppose that Firm 1's current price is P* = $10 and it sells Q* = 4 widgets per day. If Firm 1 were to raise its price, it would face the demand: P = 12 – 2Q (P > 10) If Firm 1 were to reduce its price, it would face the demand: P = 14 - Q (P< 10) a) Write the firm's marginal revenue function for prices above and below $10. MR = (P > 10, so: Q* < 4) MR = (P < 10, so: Q* > 4) b) GRAPH Firm 1's demand (D) and marginal revenue (MR) curves. Label point E (4, $10). c) Firm 1 has no incentive to change its price as long as: $. < MC < $ d) Calculate the elasticity of demand for each demand function at E(4, $10). If Firm 1 raises price: ED = If Firm 1 lowers price: ED =

Consider a firm in an oligopoly in which a few sellers offer differentiated brands of widgets. Suppose that if Firm 1 were to cut its price in order to sell more widgets, its competitors would quickly lower their own prices to protect their market shares. If, however, Firm 1 were to raise its price, its competitors would not follow, and Firm 1 would lose market share. Under these (non-ceteris-paribus) assumptions, the demand curve faced by Firm 1 is, in effect, highly elastic at prices above the current price, and less elastic at prices below the current price. Suppose that Firm 1's current price is P* = $10 and it sells Q* = 4 widgets per day. If Firm 1 were to raise its price, it would face the demand: P = 12 – 2Q (P > 10) If Firm 1 were to reduce its price, it would face the demand: P = 14 - Q (P< 10) a) Write the firm's marginal revenue function for prices above and below $10. MR = (P > 10, so: Q* < 4) MR = (P < 10, so: Q* > 4) b) GRAPH Firm 1's demand (D) and marginal revenue (MR) curves. Label point E (4, $10). c) Firm 1 has no incentive to change its price as long as: $. < MC < $ d) Calculate the elasticity of demand for each demand function at E(4, $10). If Firm 1 raises price: ED = If Firm 1 lowers price: ED =

Chapter15: Imperfect Competition

Section: Chapter Questions

Problem 15.5P

Related questions

Question

Could I have help with parts c and d of problem I’m a bit confused.

Transcribed Image Text:Consider a firm in an oligopoly in which a few sellers offer differentiated brands of widgets.

Suppose that if Firm 1 were to cut its price in order to sell more widgets, its competitors would

quickly lower their own prices to protect their market shares. If, however, Firm 1 were to raise

its price, its competitors would not follow, and Firm 1 would lose market share. Under these

(non-ceteris-paribus) assumptions, the demand curve faced by Firm 1 is, in effect, highly elastic

at prices above the current price, and less elastic at prices below the current price.

Suppose that Firm 1's current price is P* = $10 and it sells Q* = 4 widgets per day.

If Firm 1 were to raise its price, it would face the demand:

P = 12 - 2Q (P> 10)

If Firm 1 were to reduce its price, it would face the demand: P = 14 – Q

(P< 10)

a) Write the firm's marginal revenue function for prices above and below $10.

MR =

(P > 10, so: Q* < 4)

MR =

(P < 10, so: Q* 2 4)

b) GRAPH Firm 1's demand (D) and marginal revenue (MR) curves. Label point E (4, $10).

c) Firm 1 has no incentive to change its price as long as:

$.

< MC < $.

d) Calculate the elasticity of demand for each demand function at E(4, $10).

If Firm 1 raises price: ED

If Firm 1 lowers price: ED =

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc