Financial Ratios for 2018 Current Ratio Quick ratio Receivable Turnover Inventory Turnover Debt Ratio Competitor C 4.5:1 3.625:1 7 times 5.3 times 0.075:1 0.825:1 2.6 times 38.5% Competitor B 6:1 4.25:1 P&P Mfg. Co. 9.31:1 6.9:1 18.9 times 7.8 times 0.15:1 0.17:1 3.4 times 49.4% 20 times 8.6 times 0.2:1 Debt-equity Ratio Times Interest Earned Ratio Gross Profit Margin Ratio Net Profit Margin Ratio Return on Assets Return on Equity 1.75:1 4.5 times 51.2% 22.5% 24% 22% 17.6% 26.9% 31.5% 14.5% 16% 12%

Financial Ratios for 2018 Current Ratio Quick ratio Receivable Turnover Inventory Turnover Debt Ratio Competitor C 4.5:1 3.625:1 7 times 5.3 times 0.075:1 0.825:1 2.6 times 38.5% Competitor B 6:1 4.25:1 P&P Mfg. Co. 9.31:1 6.9:1 18.9 times 7.8 times 0.15:1 0.17:1 3.4 times 49.4% 20 times 8.6 times 0.2:1 Debt-equity Ratio Times Interest Earned Ratio Gross Profit Margin Ratio Net Profit Margin Ratio Return on Assets Return on Equity 1.75:1 4.5 times 51.2% 22.5% 24% 22% 17.6% 26.9% 31.5% 14.5% 16% 12%

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 6MCQ

Related questions

Question

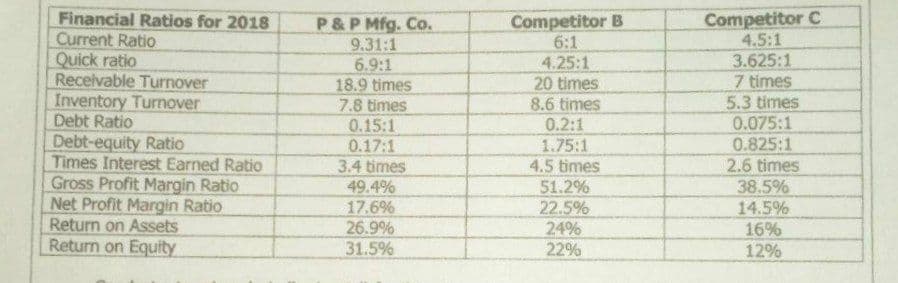

Give your insights into the relative solvency or stability of the company (as benchmarked with the competitors) using the following ratios:

debt ratio

times interest earned ratio

debt - equity ratio

Transcribed Image Text:Competitor C

4.5:1

3.625:1

7 times

5.3 times

0.075:1

Financial Ratios for 2018

Current Ratio

Quick ratio

Receivable Turnover

Inventory Turnover

Debt Ratio

Debt-equity Ratio

Times Interest Earned Ratio

Gross Profit Margin Ratio

Net Profit Margin Ratio

Return on Assets

Return on Equity

P&P Mfg. Co.

9.31:1

6.9:1

18.9 times

7.8 times

0.15:1

0.17:1

Competitor B

6:1

4.25:1

20 times

8.6 times

0.2:1

1.75:1

4.5 times

0.825:1

2.6 times

3.4 times

49.4%

17.6%

26.9%

31.5%

51.2%

22.5%

24%

22%

38.5%

14.5%

16%

12%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning