Required: 1. Using the data provided in the accompanying financial statements, calculate the following ratios for Alpine Chemical for 20X6: a. EBIT/Interest expense b. Long-term debt/Total capitalization at December 31 c. Funds from operations/Total debt d. Operating income/Sales Use the following conventions: EBIT is earnings before interest and taxes; Total capitalization is interest-bearing long-term debt plus net worth; Funds from operations means net income plus depreciation expense; and Total debt includes interest-bearing short-term and long-term debt.

Required: 1. Using the data provided in the accompanying financial statements, calculate the following ratios for Alpine Chemical for 20X6: a. EBIT/Interest expense b. Long-term debt/Total capitalization at December 31 c. Funds from operations/Total debt d. Operating income/Sales Use the following conventions: EBIT is earnings before interest and taxes; Total capitalization is interest-bearing long-term debt plus net worth; Funds from operations means net income plus depreciation expense; and Total debt includes interest-bearing short-term and long-term debt.

Chapter2: The Domestic And International Financial Marketplace

Section: Chapter Questions

Problem 5P

Related questions

Question

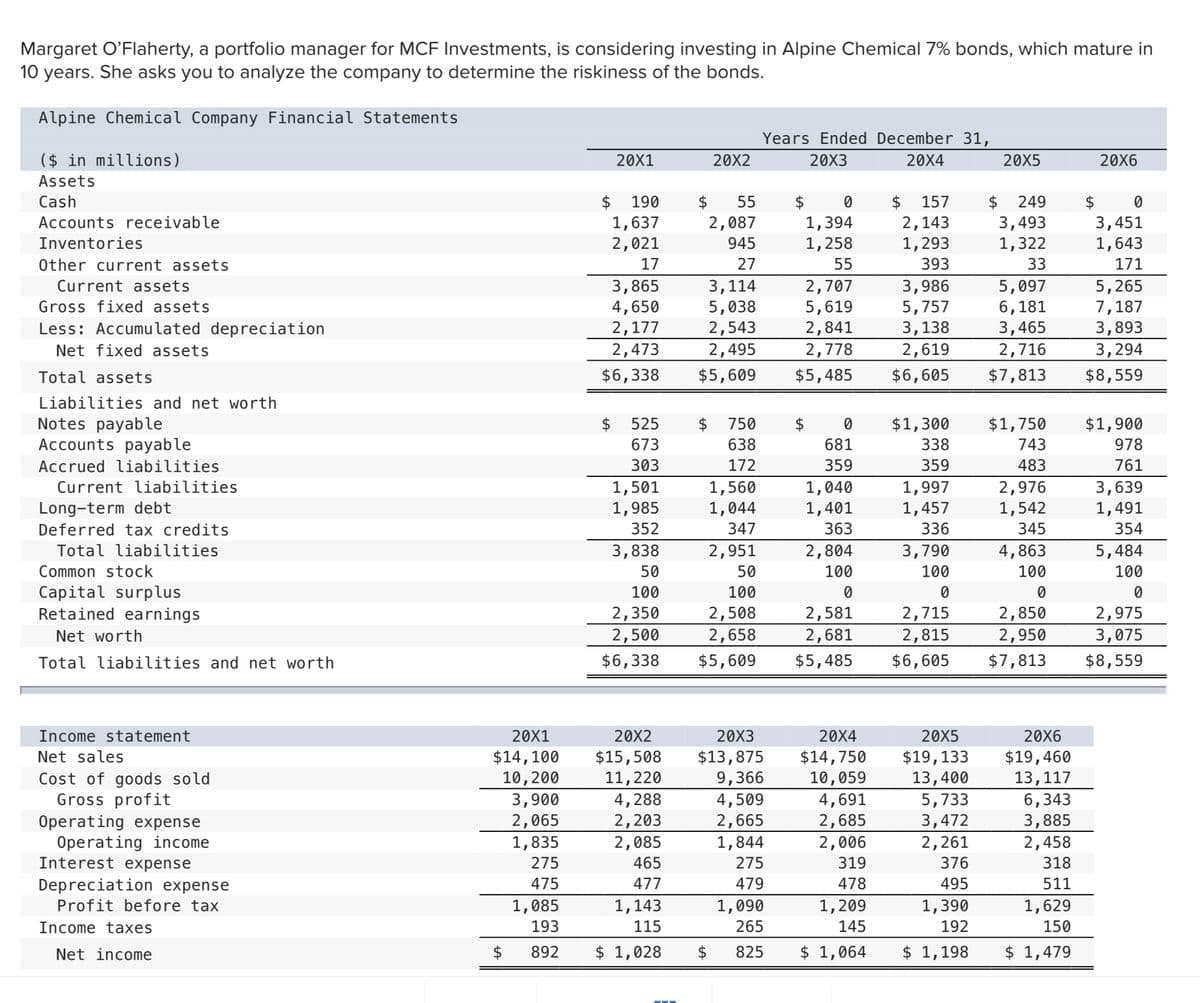

Transcribed Image Text:Margaret O'Flaherty, a portfolio manager for MCF Investments, is considering investing in Alpine Chemical 7% bonds, which mature in

10 years. She asks you to analyze the company to determine the riskiness of the bonds.

Alpine Chemical Company Financial Statements

Years Ended December 31,

($ in millions)

20X1

20X2

20X3

20X4

20X5

20X6

Assets

$ 249

3,493

1,322

Cash

$ 157

2$

1,637

2,021

190

$

2,087

2$

1,394

1,258

$

3,451

1,643

55

2,143

1,293

Accounts receivable

Inventories

945

Other current assets

17

27

55

393

33

171

3,986

5,757

3,865

4,650

2,177

2,473

3,114

5,038

Current asssets

2,707

5,619

2,841

5,265

7,187

3,893

5,097

Gross fixed assets

6,181

2,543

2,495

3,138

2,619

3,465

2,716

Less: Accumulated depreciation

Net fixed assets

2,778

3,294

Total assets

$6,338

$5,609

$5,485

$6,605

$7,813

$8,559

Liabilities and net worth

Notes payable

Accounts payable

$1,300

338

$

525

$ 750

$

$1,750

$1,900

673

638

681

743

978

Accrued liabilities

303

172

359

359

483

761

3,639

1,491

Current liabilities

1,501

1,985

1,560

1,044

1,040

1,401

1,997

1,457

336

2,976

Long-term debt

1,542

Deferred tax credits

352

347

363

345

354

Total liabilities

3,838

2,951

2,804

3,790

4,863

5,484

Common stock

50

50

100

100

100

100

Capital surplus

Retained earnings

100

100

2,350

2,500

2,508

2,581

2,715

2,850

2,950

2,975

3,075

Net worth

2,658

2,681

2,815

Total liabilities and net worth

$6,338

$5,609

$5,485

$6,605

$7,813

$8,559

Income statement

20X1

20X2

20X3

20X4

20X5

20X6

$14,100

10,200

3,900

$15,508

11,220

4,288

$13,875

9,366

4,509

2,665

1,844

$14,750

10,059

4,691

2,685

2,006

$19,133

13,400

5,733

3,472

$19,460

13,117

6,343

Net sales

Cost of goods sold

Gross profit

Operating expense

Operating income

Interest expense

2,065

1,835

2,203

2,085

3,885

2,458

2,261

376

275

465

275

319

318

Depreciation expense

475

477

479

478

495

511

Profit before tax

1,085

1,143

1,090

1,209

1,390

1,629

Income taxes

193

115

265

145

192

150

Net income

$

892

$ 1,028

$

825

$ 1,064

$ 1,198

$ 1,479

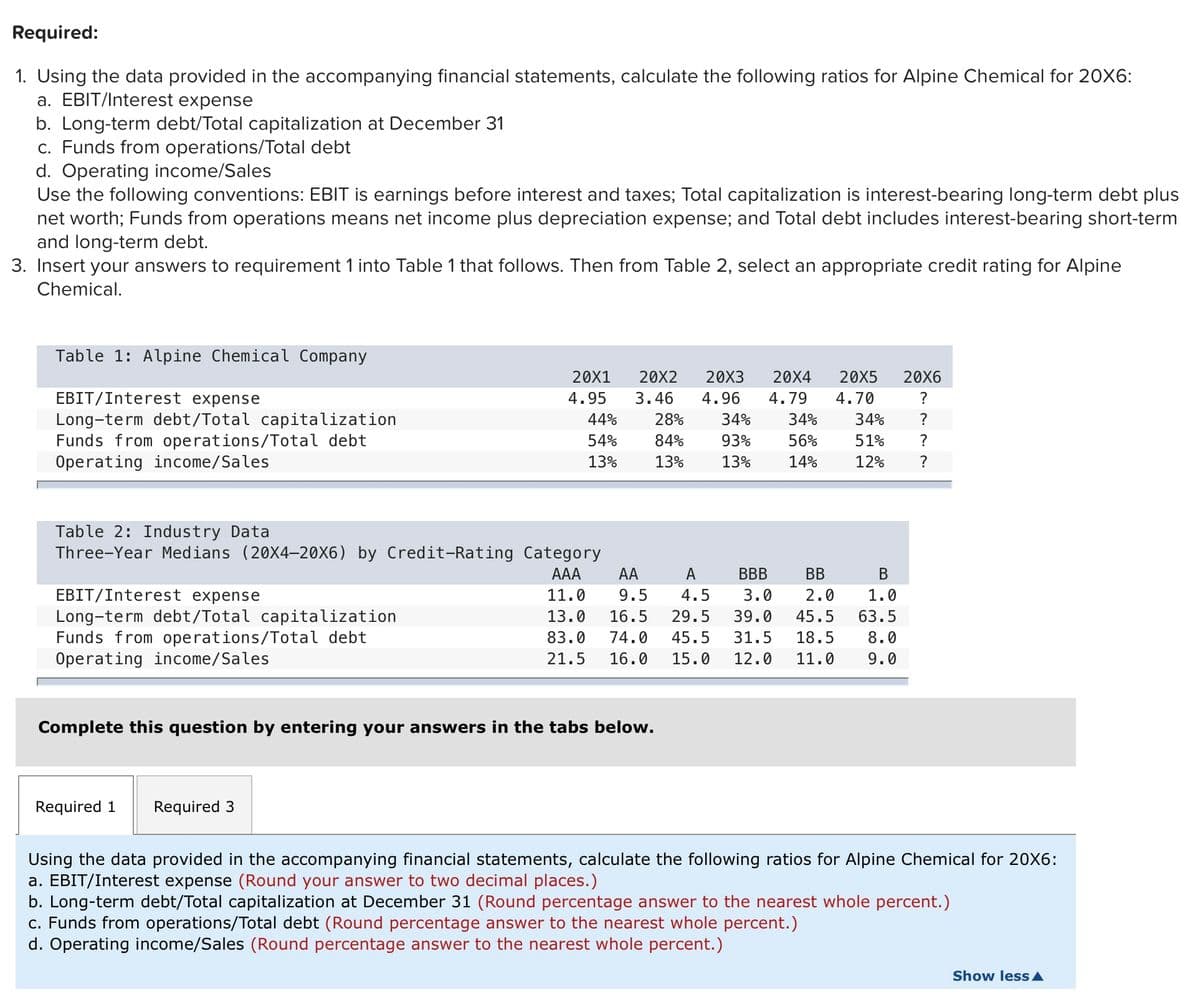

Transcribed Image Text:Required:

1. Using the data provided in the accompanying financial statements, calculate the following ratios for Alpine Chemical for 20X6:

a. EBIT/Interest expense

b. Long-term debt/Total capitalization at December 31

c. Funds from operations/Total debt

d. Operating income/Sales

Use the following conventions: EBIT is earnings before interest and taxes; Total capitalization is interest-bearing long-term debt plus

net worth; Funds from operations means net income plus depreciation expense; and Total debt includes interest-bearing short-term

and long-term debt.

3. Insert your answers to requirement 1 into Table 1 that follows. Then from Table 2, select an appropriate credit rating for Alpine

Chemical.

Table 1: Alpine Chemical Company

20X1

20X2

20X3

20X4

20X5

20X6

EBIT/Interest expense

4.95

3.46

4.96

4.79

4.70

?

Long-term debt/Total capitalization

Funds from operations/Total debt

Operating income/Sales

44%

28%

34%

34%

34%

?

54%

84%

93%

56%

51%

?

13%

13%

13%

14%

12%

Table 2: Industry Data

Three-Year Medians (20X4–20X6) by Credit-Rating Category

AAA

AA

A

BBB

ВВ

В

EBIT/Interest expense

11.0

9.5

4.5

3.0

2.0

1.0

Long-term debt/Total capitalization

Funds from operations/Total debt

Operating income/Sales

13.0

16.5

29.5

39.0

45.5

63.5

83.0

74.0

45.5

31.5

18.5

8.0

21.5

16.0

15.0

12.0

11.0

9.0

Complete this question by entering your answers in the tabs below.

Required 1

Required 3

Using the data provided in the accompanying financial statements, calculate the following ratios for Alpine Chemical for 20X6:

a. EBIT/Interest expense (Round your answer to two decimal places.)

b. Long-term debt/Total capitalization at December 31 (Round percentage answer to the nearest whole percent.)

c. Funds from operations/Total debt (Round percentage answer to the nearest whole percent.)

d. Operating income/Sales (Round percentage answer to the nearest whole percent.)

Show less A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning