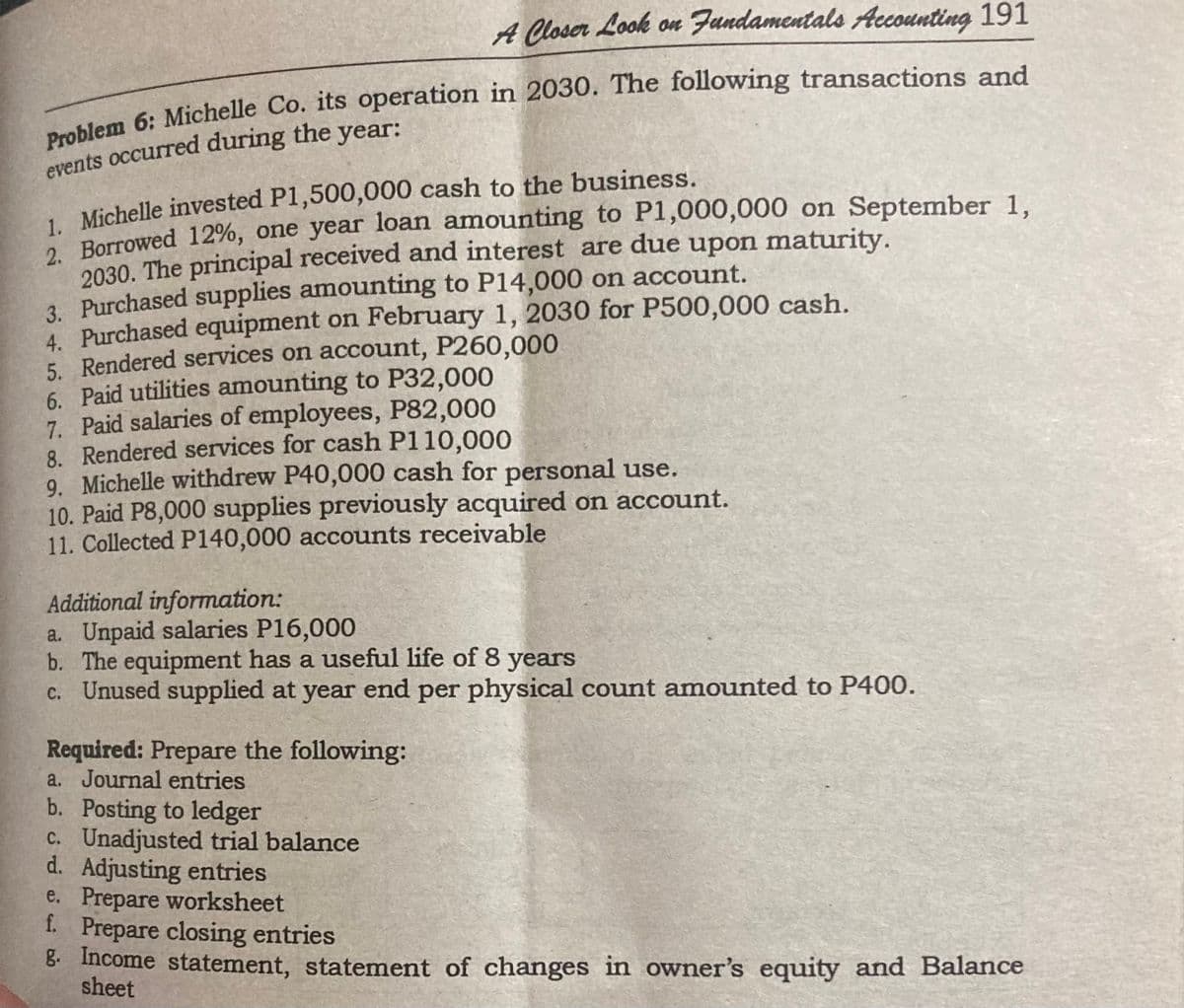

A Closer Look on Fundamentals Accounting 191 Problem 6: Michelle Co. its operation in 2030. The following transactions and events occurred during the year: 1. Michelle invested P1,500,000 cash to the business. 2. Borrowed 12%, one year loan amounting to P1,000,000 on September 1, 2030. The principal received and interest are due upon maturity. 3. Purchased supplies amounting to P14,000 on account. 4. Purchased equipment on February 1, 2030 for P500,000 cash. 5. Rendered services on account, P260,000 6. Paid utilities amounting to P32,000 7. Paid salaries of employees, P82,000 8. Rendered services for cash P110,000 9. Michelle withdrew P40,000 cash for personal use. 10. Paid P8,000 supplies previously acquired on account. 11. Collected P140,000 accounts receivable Additional information: a. Unpaid salaries P16,000 b. The equipment has a useful life of 8 years c. Unused supplied at year end per physical count amounted to P400. Required: Prepare the following: a. Journal entries b. Posting to ledger c. Unadjusted trial balance

A Closer Look on Fundamentals Accounting 191 Problem 6: Michelle Co. its operation in 2030. The following transactions and events occurred during the year: 1. Michelle invested P1,500,000 cash to the business. 2. Borrowed 12%, one year loan amounting to P1,000,000 on September 1, 2030. The principal received and interest are due upon maturity. 3. Purchased supplies amounting to P14,000 on account. 4. Purchased equipment on February 1, 2030 for P500,000 cash. 5. Rendered services on account, P260,000 6. Paid utilities amounting to P32,000 7. Paid salaries of employees, P82,000 8. Rendered services for cash P110,000 9. Michelle withdrew P40,000 cash for personal use. 10. Paid P8,000 supplies previously acquired on account. 11. Collected P140,000 accounts receivable Additional information: a. Unpaid salaries P16,000 b. The equipment has a useful life of 8 years c. Unused supplied at year end per physical count amounted to P400. Required: Prepare the following: a. Journal entries b. Posting to ledger c. Unadjusted trial balance

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter3: The Basics Of Record Keeping And Financial Statement Preparation: Income Statement

Section: Chapter Questions

Problem 29P

Related questions

Question

100%

Transcribed Image Text:A Closer Look on Fundamentals Accounting 191

Problem 6: Michelle Co. its operation in 2030. The following transactions and

events occurred during the year:

1. Michelle invested P1,500,000 cash to the business.

2. Borrowed 12%, one year loan amounting to P1,000,000 on September 1,

2030. The principal received and interest are due upon maturity.

3. Purchased supplies amounting to P14,000 on account.

4. Purchased equipment on February 1, 2030 for P500,000 cash.

5. Rendered services on account, P260,000

6. Paid utilities amounting to P32,000

7. Paid salaries of employees, P82,000

8. Rendered services for cash P110,000

9. Michelle withdrew P40,000 cash for personal use.

10. Paid P8,000 supplies previously acquired on account.

11. Collected P140,000 accounts receivable

Additional information:

a. Unpaid salaries P16,000

b. The equipment has a useful life of 8 years

c. Unused supplied at year end per physical count amounted to P400.

Required: Prepare the following:

a. Journal entries

b. Posting to ledger

c. Unadjusted trial balance

d. Adjusting entries

e. Prepare worksheet

f. Prepare closing entries

g. Income statement, statement of changes in owner's equity and Balance

sheet

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning