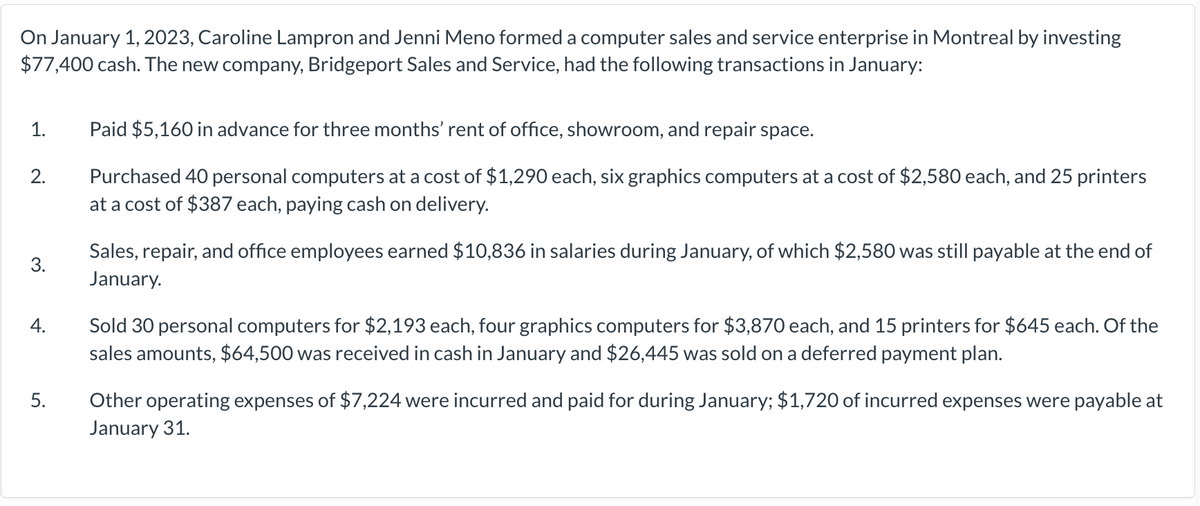

On January 1, 2023, Caroline Lampron and Jenni Meno formed a computer sales and service enterprise in Montreal by investing $77,400 cash. The new company, Bridgeport Sales and Service, had the following transactions in January: 1. 2. 3. 4. 5. Paid $5,160 in advance for three months' rent of office, showroom, and repair space. Purchased 40 personal computers at a cost of $1,290 each, six graphics computers at a cost of $2,580 each, and 25 printers at a cost of $387 each, paying cash on delivery. Sales, repair, and office employees earned $10,836 in salaries during January, of which $2,580 was still payable at the end of January. Sold 30 personal computers for $2,193 each, four graphics computers for $3,870 each, and 15 printers for $645 each. Of the sales amounts, $64,500 was received in cash in January and $26,445 was sold on a deferred payment plan. Other operating expenses of $7,224 were incurred and paid for during January; $1,720 of incurred expenses were payable at January 31.

On January 1, 2023, Caroline Lampron and Jenni Meno formed a computer sales and service enterprise in Montreal by investing $77,400 cash. The new company, Bridgeport Sales and Service, had the following transactions in January: 1. 2. 3. 4. 5. Paid $5,160 in advance for three months' rent of office, showroom, and repair space. Purchased 40 personal computers at a cost of $1,290 each, six graphics computers at a cost of $2,580 each, and 25 printers at a cost of $387 each, paying cash on delivery. Sales, repair, and office employees earned $10,836 in salaries during January, of which $2,580 was still payable at the end of January. Sold 30 personal computers for $2,193 each, four graphics computers for $3,870 each, and 15 printers for $645 each. Of the sales amounts, $64,500 was received in cash in January and $26,445 was sold on a deferred payment plan. Other operating expenses of $7,224 were incurred and paid for during January; $1,720 of incurred expenses were payable at January 31.

Chapter3: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 60P

Related questions

Question

pls fill the gap thanks

Transcribed Image Text:On January 1, 2023, Caroline Lampron and Jenni Meno formed a computer sales and service enterprise in Montreal by investing

$77,400 cash. The new company, Bridgeport Sales and Service, had the following transactions in January:

1.

2.

3.

4.

5.

Paid $5,160 in advance for three months' rent of office, showroom, and repair space.

Purchased 40 personal computers at a cost of $1,290 each, six graphics computers at a cost of $2,580 each, and 25 printers

at a cost of $387 each, paying cash on delivery.

Sales, repair, and office employees earned $10,836 in salaries during January, of which $2,580 was still payable at the end of

January.

Sold 30 personal computers for $2,193 each, four graphics computers for $3,870 each, and 15 printers for $645 each. Of the

sales amounts, $64,500 was received in cash in January and $26,445 was sold on a deferred payment plan.

Other operating expenses of $7,224 were incurred and paid for during January; $1,720 of incurred expenses were payable at

January 31.

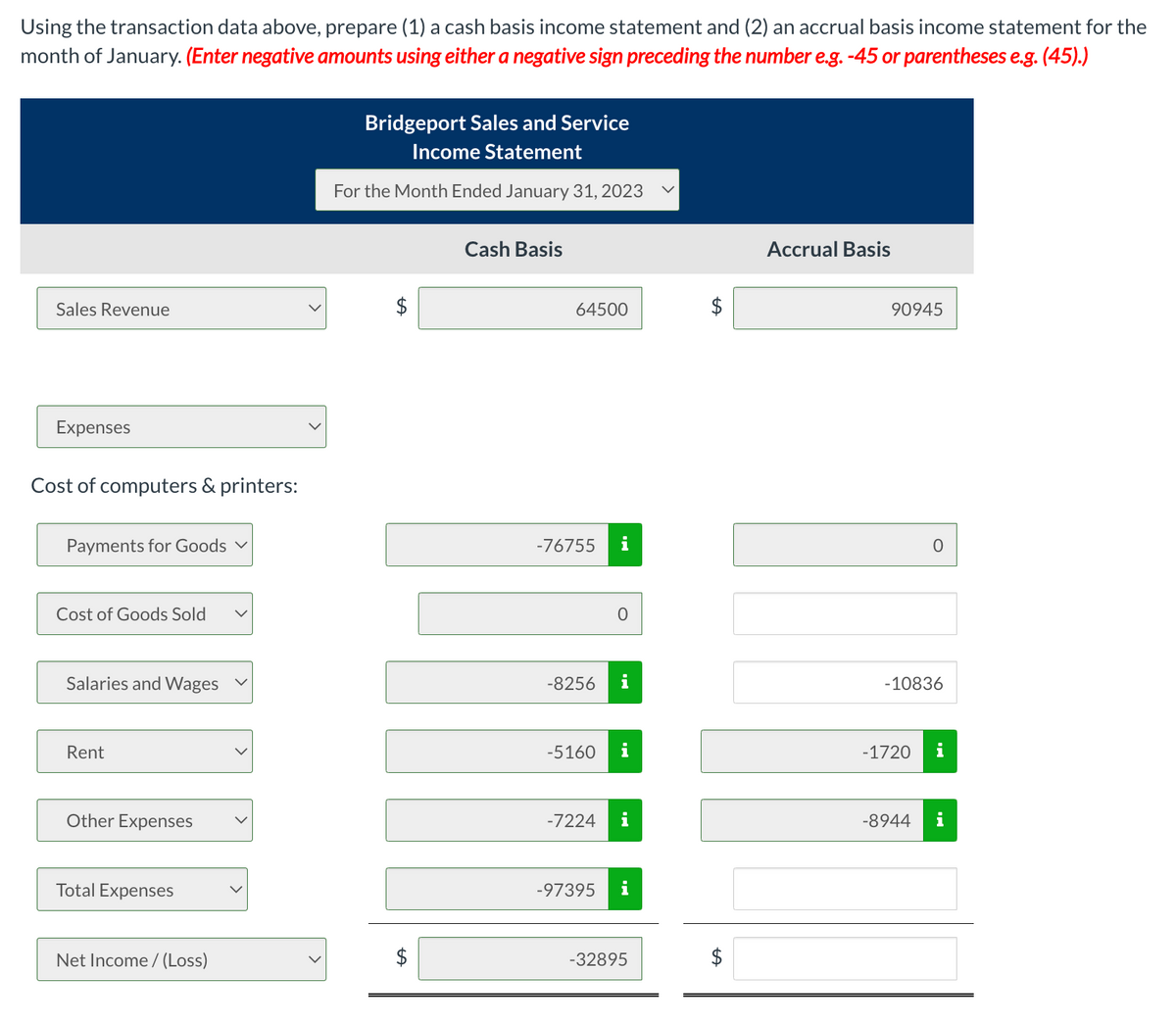

Transcribed Image Text:Using the transaction data above, prepare (1) a cash basis income statement and (2) an accrual basis income statement for the

month of January. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)

Sales Revenue

Expenses

Cost of computers & printers:

Payments for Goods ✓

Cost of Goods Sold

Salaries and Wages

Rent

Other Expenses

Total Expenses

Net Income /(Loss)

Bridgeport Sales and Service

Income Statement

For the Month Ended January 31, 2023

LA

Cash Basis

64500

-76755 i

-8256

-5160

-7224

-97395

0

i

i

i

-32895

Accrual Basis

90945

-10836

-1720

0

-8944

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub