A Colsen Communications is trying to estimate the first-year cash flow (at Year 1) for a proposed project. The assets required for the project were fully depreciated at the time of purchase. The financial staff has collected the following information on the project: eBook Sales revenues $10 million Operating costs 8 million Interest expense 3 million The company has a 25% tax rate, and its WACC is 12%. Write out your answers completely. For example, 13 million should be entered as 13,000,000. a. What is the project's operating cash flow for the first year (t 1)? Round your answer to the nearest dollar. b. If this project would cannibalize other projects by $1 million of cash flow before taxes per year, how would this change your answer to part a? Round your answer to the nearest dollar. The firm's OCF would now be $

A Colsen Communications is trying to estimate the first-year cash flow (at Year 1) for a proposed project. The assets required for the project were fully depreciated at the time of purchase. The financial staff has collected the following information on the project: eBook Sales revenues $10 million Operating costs 8 million Interest expense 3 million The company has a 25% tax rate, and its WACC is 12%. Write out your answers completely. For example, 13 million should be entered as 13,000,000. a. What is the project's operating cash flow for the first year (t 1)? Round your answer to the nearest dollar. b. If this project would cannibalize other projects by $1 million of cash flow before taxes per year, how would this change your answer to part a? Round your answer to the nearest dollar. The firm's OCF would now be $

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 17E: Postman Company is considering two independent projects. One project involves a new product line,...

Related questions

Question

Transcribed Image Text:A

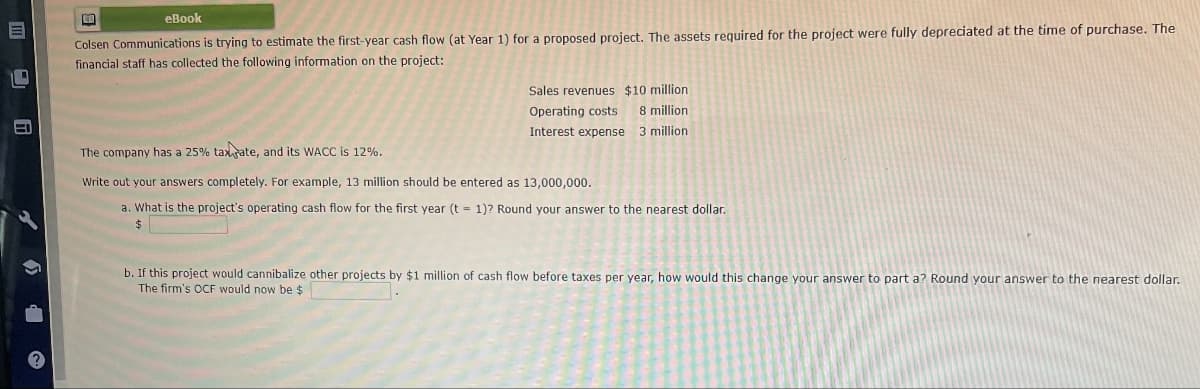

Colsen Communications is trying to estimate the first-year cash flow (at Year 1) for a proposed project. The assets required for the project were fully depreciated at the time of purchase. The

financial staff has collected the following information on the project:

eBook

Sales revenues $10 million

Operating costs 8 million

Interest expense 3 million

The company has a 25% tax rate, and its WACC is 12%.

Write out your answers completely. For example, 13 million should be entered as 13,000,000.

a. What is the project's operating cash flow for the first year (t 1)? Round your answer to the nearest dollar.

b. If this project would cannibalize other projects by $1 million of cash flow before taxes per year, how would this change your answer to part a? Round your answer to the nearest dollar.

The firm's OCF would now be $

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College