A company is planning the financing of a major expansion. It will use common stock to fund this expansion. The company currently has 300,000 shares outstanding selling at an average of $130 per share. It would sell an additional 50,000 shares to bring in an estimated $5 million. The new project is expected to raise EBIT by 18% when implemented. The company’s capital structure contains long-term debt of $10 million which pays interest of 11%. Current Income Statement Net Sales 66,000,000 COGS 42,000,000 Gross Profits 24,000,000 S and A Expenses 9,300,000 Operating Profits 14,700,000 Interest on Debt 1,100,000 EBT 13,600,000 Taxes at 34% 4,600,000 EAT 9,000,000 Develop an analysis of EPS and show the effect of any dilution of earnings. Develop the same analysis for an alternative issue of $5 million of 10% preferred stock, and an alternative issue of $5 million of 9% debt. Develop specific comparative costs of all three methods and discuss your findings.

A company is planning the financing of a major expansion. It will use common stock to fund this expansion. The company currently has 300,000 shares outstanding selling at an average of $130 per share. It would sell an additional 50,000 shares to bring in an estimated $5 million. The new project is expected to raise EBIT by 18% when implemented. The company’s capital structure contains long-term debt of $10 million which pays interest of 11%. Current Income Statement Net Sales 66,000,000 COGS 42,000,000 Gross Profits 24,000,000 S and A Expenses 9,300,000 Operating Profits 14,700,000 Interest on Debt 1,100,000 EBT 13,600,000 Taxes at 34% 4,600,000 EAT 9,000,000 Develop an analysis of EPS and show the effect of any dilution of earnings. Develop the same analysis for an alternative issue of $5 million of 10% preferred stock, and an alternative issue of $5 million of 9% debt. Develop specific comparative costs of all three methods and discuss your findings.

Chapter4: Financial Planning And Forecasting

Section: Chapter Questions

Problem 6P

Related questions

Question

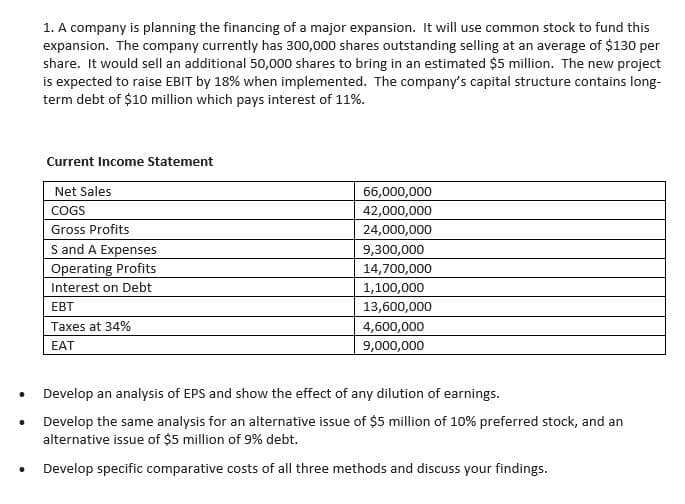

A company is planning the financing of a major expansion. It will use common stock to fund this expansion. The company currently has 300,000 shares outstanding selling at an average of $130 per share. It would sell an additional 50,000 shares to bring in an estimated $5 million. The new project is expected to raise EBIT by 18% when implemented. The company’s capital structure contains long-term debt of $10 million which pays interest of 11%.

Current Income Statement

|

Net Sales |

66,000,000 |

|

COGS |

42,000,000 |

|

Gross Profits |

24,000,000 |

|

S and A Expenses |

9,300,000 |

|

Operating Profits |

14,700,000 |

|

Interest on Debt |

1,100,000 |

|

EBT |

13,600,000 |

|

Taxes at 34% |

4,600,000 |

|

EAT |

9,000,000 |

- Develop an analysis of EPS and show the effect of any dilution of earnings.

- Develop the same analysis for an alternative issue of $5 million of 10% preferred stock, and an alternative issue of $5 million of 9% debt.

- Develop specific comparative costs of all three methods and discuss your findings.

Transcribed Image Text:.

1. A company is planning the financing of a major expansion. It will use common stock to fund this

expansion. The company currently has 300,000 shares outstanding selling at an average of $130 per

share. It would sell an additional 50,000 shares to bring in an estimated $5 million. The new project

is expected to raise EBIT by 18% when implemented. The company's capital structure contains long-

term debt of $10 million which pays interest of 11%.

Current Income Statement

Net Sales

COGS

Gross Profits

S and A Expenses

Operating Profits

Interest on Debt

EBT

Taxes at 34%

EAT

66,000,000

42,000,000

24,000,000

9,300,000

14,700,000

1,100,000

13,600,000

4,600,000

9,000,000

Develop an analysis of EPS and show the effect of any dilution of earnings.

Develop the same analysis for an alternative issue of $5 million of 10% preferred stock, and an

alternative issue of $5 million of 9% debt.

Develop specific comparative costs of all three methods and discuss your findings.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning