A company's balance sheets show a total of $ million long-term debt with a coupon rate of 0. 1000 dollars face value that matures in 22 yer and market price of 1090 dollar The . The bal sheets also show that the company has 2 milli shares of stock. The current stock price is $8 share.,and it will pay 2 as dividends and it will rate is 0.05. The company has 200,000 share

A company's balance sheets show a total of $ million long-term debt with a coupon rate of 0. 1000 dollars face value that matures in 22 yer and market price of 1090 dollar The . The bal sheets also show that the company has 2 milli shares of stock. The current stock price is $8 share.,and it will pay 2 as dividends and it will rate is 0.05. The company has 200,000 share

Chapter7: Stocks (equity) - Characterstics And Valuation

Section: Chapter Questions

Problem 8PROB

Related questions

Question

4

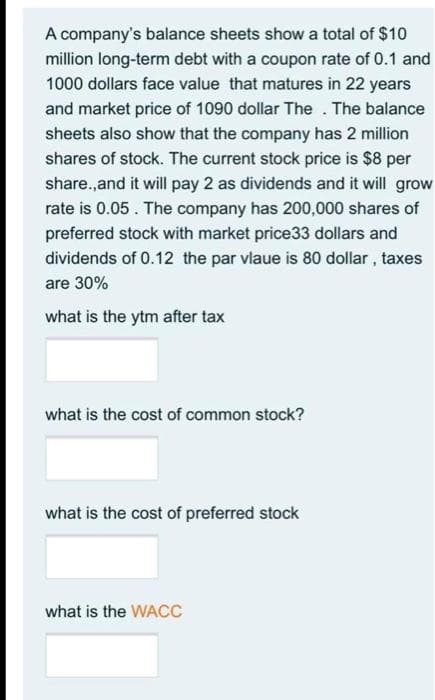

Transcribed Image Text:A company's balance sheets show a total of $10

million long-term debt with a coupon rate of 0.1 and

1000 dollars face value that matures in 22 years

and market price of 1090 dollar The . The balance

sheets also show that the company has 2 million

shares of stock. The current stock price is $8 per

share.,and it will pay 2 as dividends and it will grow

rate is 0.05. The company has 200,000 shares of

preferred stock with market price33 dollars and

dividends of 0.12 the par vlaue is 80 dollar, taxes

are 30%

what is the ytm after tax

what is the cost of common stock?

what is the cost of preferred stock

what is the WACC

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning