HB Harvard Business Publi b My Questions bartleb B Chapter 7 - MBAD-503 Lauren Stoney | Net Im + HB MindTap - CengagX Ahttps://ng.cengage.com/static/nb/ui/evo/index.html?elSBN=9781337900010&id- 5432476578snapshotld=1286803& CENGAGE MINDTAP Q Search this course X Ch 08: Assignment - Risk and Rates of Return మా Five years of realized returns for CCC are given in the following table. Remember: 1. While CCC was started 40 years ago, its common stock has been publicly traded for the past 25 A-Z years. 2. The returns on its equity are calculated as arithmetic returns. Office 3. The historical returns for CCC for 2012 to 2015 are: 2013 2012 2014 2015 2016 Stock return 13.75% 9.35% 16.50% 23.10% 7.15% Given the preceding data, the average realized return on CCC's stock is of CCC's historical returns. Based on this conclusion, the The preceding data series represents standard deviation of CCC's historical returns is If investors expect the average realized return from 2012 to 2016 on CCC's stock to continue into the future, its coefficient of variation (CV) will be X

HB Harvard Business Publi b My Questions bartleb B Chapter 7 - MBAD-503 Lauren Stoney | Net Im + HB MindTap - CengagX Ahttps://ng.cengage.com/static/nb/ui/evo/index.html?elSBN=9781337900010&id- 5432476578snapshotld=1286803& CENGAGE MINDTAP Q Search this course X Ch 08: Assignment - Risk and Rates of Return మా Five years of realized returns for CCC are given in the following table. Remember: 1. While CCC was started 40 years ago, its common stock has been publicly traded for the past 25 A-Z years. 2. The returns on its equity are calculated as arithmetic returns. Office 3. The historical returns for CCC for 2012 to 2015 are: 2013 2012 2014 2015 2016 Stock return 13.75% 9.35% 16.50% 23.10% 7.15% Given the preceding data, the average realized return on CCC's stock is of CCC's historical returns. Based on this conclusion, the The preceding data series represents standard deviation of CCC's historical returns is If investors expect the average realized return from 2012 to 2016 on CCC's stock to continue into the future, its coefficient of variation (CV) will be X

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter2: Working With The Tax Law

Section: Chapter Questions

Problem 3RP

Related questions

Question

Transcribed Image Text:HB Harvard Business Publi

b My Questions bartleb

B Chapter 7 - MBAD-503

Lauren Stoney | Net Im

+

HB

MindTap - CengagX

Ahttps://ng.cengage.com/static/nb/ui/evo/index.html?elSBN=9781337900010&id- 5432476578snapshotld=1286803&

CENGAGE MINDTAP

Q Search this course

X

Ch 08: Assignment - Risk and Rates of Return

మా

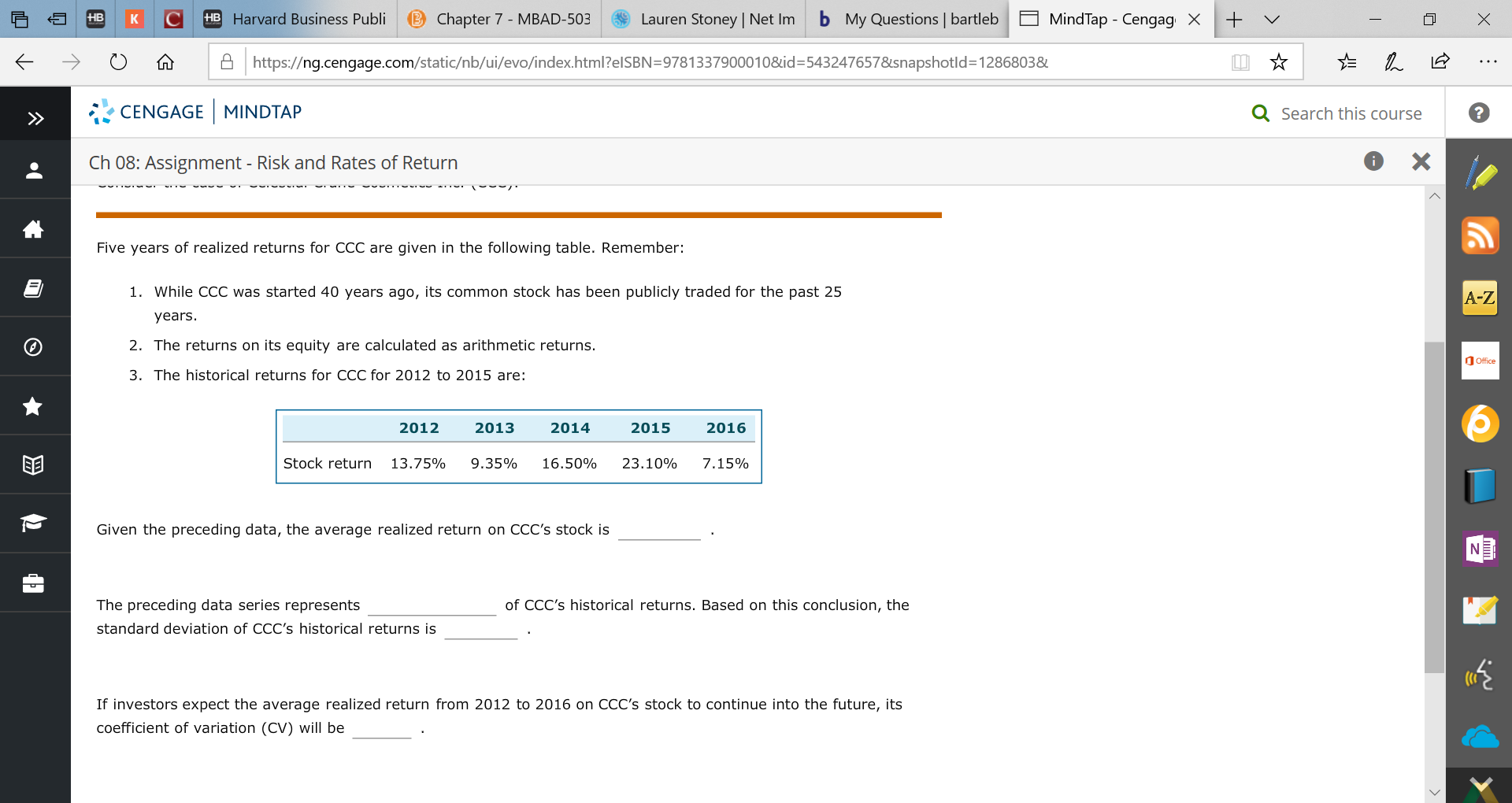

Five years of realized returns for CCC are given in the following table. Remember:

1. While CCC was started 40 years ago, its common stock has been publicly traded for the past 25

A-Z

years.

2. The returns on its equity are calculated as arithmetic returns.

Office

3. The historical returns for CCC for 2012 to 2015 are:

2013

2012

2014

2015

2016

Stock return

13.75%

9.35%

16.50%

23.10%

7.15%

Given the preceding data, the average realized return on CCC's stock is

of CCC's historical returns. Based on this conclusion, the

The preceding data series represents

standard deviation of CCC's historical returns is

If investors expect the average realized return from 2012 to 2016 on CCC's stock to continue into the future, its

coefficient of variation (CV) will be

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you