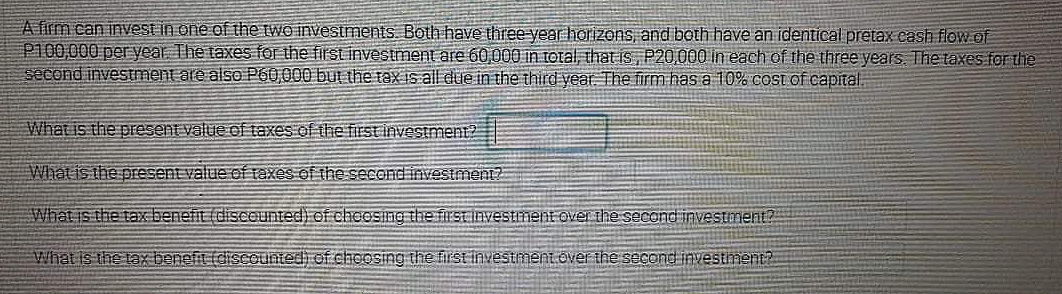

A firm can invest in one of the two investments. Both have three year horizons, and both have an identical pretax cash flow of P100,000 per year The taxes for the first investment are 60,000 in total, that is, P20.000 in each of the three years. The taxes for the second investment are also P60,000 but the tax is all due in the third vear. The firm has a 10% cost of capital. What is the present value of taxes of the first investment What is the present value of taxes of the second investment? What is the taxbenefit (disceunted) of chcosing the first investment over the second investment? What is the tax beneft fdiseounied of choosing the firstinvestment.over the second investment?

A firm can invest in one of the two investments. Both have three year horizons, and both have an identical pretax cash flow of P100,000 per year The taxes for the first investment are 60,000 in total, that is, P20.000 in each of the three years. The taxes for the second investment are also P60,000 but the tax is all due in the third vear. The firm has a 10% cost of capital. What is the present value of taxes of the first investment What is the present value of taxes of the second investment? What is the taxbenefit (disceunted) of chcosing the first investment over the second investment? What is the tax beneft fdiseounied of choosing the firstinvestment.over the second investment?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 13E: Buena Vision Clinic is considering an investment that requires an outlay of 600,000 and promises a...

Related questions

Question

100%

Transcribed Image Text:A firm can inVest in one of the two investments. Both have three year horizons, and both have an identical pretax cash flow of

P100,000 pe year The taxes for the first investment are 60,000 in toral, that is, P20000 in each of the three years The taxes for the

second investment are also P60,000 but the tax is all due in the third vear. The firm has a 10% cost of capital.

What is the present value of taxes of the first investment?

Whatis the present value of taxes of the second investment?

What is the tax-benefit (discounted) of cheeSilng the first investment over the second investment?

What is the tax benefit (discountedi of choosing the firstinvestment.over the second investnment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub