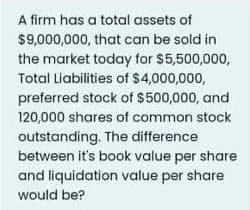

A firm has a total assets of 59,000,000, that can be sold in he market today for $5,500,000, otal Liabilities of S4,000,000, preferred stock of $500,000, and 20,000 shares of common stock putstanding. The difference petween it's book value per share and liquidation value per share vould be?

Q: You are modeling a qualitative variable that takes on two classes (classes 1 and 2). In trying to cl...

A: The answer is given below

Q: er to the process of adding up the individual demand curves to find the market demand curve as aggre...

A: The demand curve shows the inverse relationship between demand and price. Rise in the price leads to...

Q: Troy wins a prize of a McDonald's Restaurant $10 gift certificate. He can trade the prize in for a m...

A: Opportunity cost is the cost that a person sacrifices when they choose one option over another. This...

Q: would the equity and efficiency effects of raising the minimum wage to $20/

A: Raising the legal minimum wage should, in theory, benefit both the representative and the loser. Ent...

Q: 19- The firm's marginal rate of technical substitution is diminishing. 18 17 16 15 14 A firm finds t...

A: A firm finds that it can always trade five units of labor for one unit of capital and still keep out...

Q: 5. demand *Refer to the above figure. What happens to total revenue if price rises along part A of t...

A: Introduction: The demand curve is a graphical representation of the relationship between a good's or...

Q: Hebrews, the Greeks, and the Scholastics with regard to what constitutes a “just price.”

A: Just price is defined as a price that is set by a standard or is structured under some principles or...

Q: Q2) Case-control studies tend to: Group of answer choices a)Require less time to conduct b)Cost more...

A: Case control study: For a situation control concentrate on patients who have fostered an illness are...

Q: Suppose the market for refrigerators is illustrated in the figure to the right. Assume refrigerators...

A: Given is the market for refrigerator. There are two demand curves.

Q: Please answer the question using the following table Year Cauliflower Broccoli Carrots Price Quantit...

A: Year 2008: Nominal GDP = Quantity of 2008 * Price of 2008 => Nominal GDP = (100 *$3) + (50 *$1.50...

Q: Economic Flows Give 3 different examples of Other Flows

A: To understand the cyclic or periodic nature of business booms and busts better, economists use the '...

Q: Give 5 examples that explain different types of Transactions

A: A finalized agreement between a buyer and a seller to trade goods, services, or financial assets in ...

Q: An investment on a machinery can yield following cash flow for 8 years and in the end of the 8th yea...

A: Cash flow is the movement of money in and out of a company. Cash received signifies inflows, and cas...

Q: A chemical manufacturer uses chemicals 1 and 2 to produce two drugs. Drug 1 must be at least 80% che...

A: Let the chemical 1 and 2 used for drug 1 be x and y respectively and chemical 1 and 2 used for drug ...

Q: Jagmit owns a 2009 sedan (auto). The last time Jagmit renewed his auto insurance, he decided to drop...

A: A policy where an entity or individual tends to receive reimbursement against losses from an insuran...

Q: 3. If certain apple growers are using a cancer-causing pesticide on apple trees, explain how the har...

A: 3) The above question refers to the issue of externalities. Externalities are the costs or benefits ...

Q: China is playing a growing role in the world economy. It is one of the world's fastest growing count...

A: China is the world's second most powerful country in the world after the USA. China's growth and dev...

Q: During the first 10 years of the life of a certain machine, the following were spent for its mainten...

A: Step 1 Answer is $ 29,000. Explanation: 10000 each year for the the first five years = 10000*4 = 40,...

Q: Maldonia has a comparative advantage in the production of while Lamponia has a comparative advantage...

A: Introduction: The potential benefits that an individual, investor, or organization loses out on by c...

Q: Consider the following data about U.S. real GDP for the George W. H. Bush (1989-1993) and Bill Clint...

A: In the given table, real GDP in two different adminstration is given from year 1989 to 2001, in whic...

Q: Question 3 Suppose that a representative consumer has the following utility function for leisure l a...

A: The answer is given below

Q: Suppose the unemployment rate in the United States goes from 6.4% in one year to 5.6% in the next. (...

A: Unemployment occurs in economics when people are out of work while actively looking for work. The un...

Q: Who formed the first unions? a employers who wanted to solve grievances among their employees ...

A: A labour or trade union is a group of workers dedicated to safeguarding the interests of their membe...

Q: a) Suppose the two countries engage in international trade, and that the international relative pric...

A: Answer a).

Q: A union leader states that: "The government should provide subsidies to unemployed workers throughou...

A: The statement which is subjective and based on value judgements and assumptions. Providing any view,...

Q: A Consumier s utility is given With marginal utiities being M 0X Prices are Px = 4 and Py = 8. Consu...

A: The utility function is quasi-linear. Given the prices we solve the following, MUXMUY=12X=PXPY=48⇒14...

Q: Find the uniform annual amount that is equivalent to a uniform gradient series in which first year's...

A: GIVEN First year payment (AL) = 500 Greadient (G) = 1000 Annual Rate of interest = 8%. (i) Numbe...

Q: Q.1.2 Should a measure of wealth be included in the consumption function and, if so, what should tha...

A: Consumption is process of using the resources available to you . It gives you some amount of utility...

Q: Explain the concept of Centre of Economic Interest.

A: In an economy, there are different economic concept to explain pr describe a specific market situati...

Q: QUESTION 28 Figure 6-13 16 12 8 Demand 40 80 105 120 160 QUANTITY Refer to Figure 6-13. What is the ...

A: Answer to the question is as follows:

Q: 8. Shifts in supply or demand I The following graph shows the market for peanut butter in Philadelph...

A: Answer: There is a positive relationship between the price of a good and the demand for its substitu...

Q: There will be a downward movement along the supply curve. There will be an upward movement along the...

A: There is positive relationship between supply curve and the price of the good. As the the price of t...

Q: Mary is a gardener. The graph shows Mary's preferences for roses and silver bells (two types of flow...

A: Answer: If the price of silver bells (shown on the x-axis) increases to $60 then the budget line wil...

Q: The cost function for Acme Laundry is: TC(q)=10+10q+q^2 so its marginal cost function is:...

A: please find the answer below.

Q: 16. Only one of these companies is affected by law of diminishing returns. Identify the company and ...

A: Since you have asked multiple question, we will solve the first question for you. If you want any sp...

Q: 1. Show on a single diagram, given a competitive market, how an increase in demand will provide the ...

A: A competitive market is one in which there are many customers and sellers selling similar goods and ...

Q: Measuring GDP - Income approach Assume an economy with a coal producer and a steel producer. In a gi...

A: Answer -

Q: The 1-year bond yield is currently at 0.5% and the 2-year bond yield is 1%. Inflation is expected to...

A: Here, information about bond yield for one year and 2 year is given with the inflation rate of 2% in...

Q: Define (1) Economic Stocks and (2) Economic Flows.

A: Answer: (1). Economic Stocks: The stock variable refers to the variable which is measured at a parti...

Q: se the Keynesian Cross model to show the effect of a decrease in government spending of ∆� on the ec...

A: A contract is a legally binding agreement that establishes, defines, and governs the parties' mutual...

Q: Microsoft Windows 8 Versions and U.S. Prices Version Price Full from Microsoft 249.99 Upgrade from M...

A: As we know that Microsoft Window is a popular operating system developed by Microsoft corporation. N...

Q: wo countries did not specialize, the total production of jeans was 18 million pairs per week, and th...

A: The opportunity cost is time spent contemplating and that cash to spend on something different. A fa...

Q: Suppose that you find $100 dollars and you deposit it into your bank account as a checkable deposit....

A: The required reserve ratio is the fraction of deposits that the Fed requires banks to hold as reserv...

Q: A woman arranges to repay a P10,000 bank loan in 10 equal payments at a 10% effective annual interes...

A:

Q: If some non-price level determinant causes total spending to decrease, what will the effect on aggre...

A: Answer:- Option(c) is correct .

Q: . What are the differences and/or similarities if there is between economic growth and economic deve...

A: Economic growth and Economic Development sound similar terms but there is a noticeable difference be...

Q: Global Media is a ________ type of globalization? Environmental Political Economic Social It is ...

A: Global Media is a ________ type of globalization.

Q: Use Fisher 's form find the price index number of the following table: Commodity Unit Base Year Curr...

A: To compute the price index through Fisher's approach, a specific formula is: ∑P1Q0∑P0Q0×∑P1Q1∑P0Q1××...

Q: According to ISO 17025:2017, an accredited organisation is required to inform HKAS Executive of any ...

A: This is a standard of measurement that examines the accuracy of any international document and also ...

Q: Discuss the role and function of any large financial institution in your country as well as THREE im...

A: Since you have asked multiple question, we will solve the first question for you. If you want any sp...

Step by step

Solved in 2 steps

- Sam, Inc. has current assets of $5,300, net fixed assets of $24,900, current liabilities of $4,600, and long-term debt of $10,300. What is the value of shareholder’s equity? Group of answer choices a. Cannot be determined without knowing the value of Common Stock b. $17,680 c. $60,030 d. $15,300 e. Cannot be determined without knowing the value of Retained EarningsA company has total revenue of $50,000,000, cost of sales of $40,000,000, operating expenses of $5,000,000, and financing costs of $2,000,000. What are earnings per share if the company has 100,000 shares outstanding and no preferred stockholders?Wu of Troy, New York, has $5,000 that he wants to invest in the stock market. Ji is in college on a scholarship and does not plan to use the $5,000 or any dividend income for another five years, when he plans to buy a home. He is currently considering a small company stock selling for $25 per share with an EPS of $1.25. Last year, the company earned $900,000, of which $250,000 was paid out in dividends. What classification of common stock would you recommend to Ji? Calculate the P/E ratio and the dividend payout ratio for this stock. Round your answers to the nearest whole number c3.Given this information and your recommendation, would this stock be an appropriate purchase for Ji? Why or why not?

- The following data regarding Atlas Construction Company are available:Current assets $300,000Current liabilities 200,000Long-term liabilities 500,000Total net worth 200,000What is the value of the company’s fixed assets?Window Help G Paraphrasing... aD ASSIgnment G how can you... lestion 8 of 20 rent Attempt in Progress Additional information for 2021: heridan Company has these comparative balance sheet data: Net income was $32, 000. Sales on account were $ 457,000. Sales returns and allowances amoun Cost of goods sold was $328, 600. Net cash provided by operating activities was $56, 000. Capital expenditures were $30, 000, and cash dividends were $25, 000. Compute the following ratios at December 31, 2021: (Use 365 days for calcu 52.7.) (a) Current ratio :1 (b) Accounts receivable turnover times (c) Average collection period days (d) Inventory turnover times (e) Days in inventory days SHERIDANCOMPANY Balance Sheets December 31 \table[[, 2021, 2020], [Cash, $32, 000, S30,0005. Kraft is a limited partner of Johnson Enterprises, a limited partnership. As provided in the limited partnershipagreement, Kraft decided to leave the partnership anddemanded that her capital contribution of $20,000 bereturned. At this time, the partnership assets were$150,000 and liabilities to all creditors totaled $140,000.The partnership returned to Kraft her capital contribution of$20,000.a. What liability, if any, does Kraft have to the creditorsof Johnson Enterprises?b. If Johnson Enterprises had been formed as a limitedliability company, what liability, if any, would Krafthave to the creditors of Johnson Enterprises?

- D&R A3 3 - 7 Question 3. FRA Pricing, Valuation, Payoff, and Hedging Today is June 1. Sustainable Corporation has an obligation of $25 million coming due on August 1. The company is planning to borrow this amount on August 1 to fulfill its obligation, and plans to pay back the loan on December 1. The company’s borrowing rate is LIBOR + 125 basis points. The company’s bank presents it with the following LIBOR term structure: # days LIBOR 30 0.90% 60 1.00% 90 1.05% 120 1.10% 150 1.15% 180 1.18% 210 1.20% 240 1.21% For the calculation of interest, the bank assumes 30 days in a month, and 360 days in a year. Ms. Devro, the VP Finance of Sustainable, is worried that LIBOR will increase between June and August, thus increasing the company’s borrowing cost. She advises that the company enters into a forward rate agreement (FRA) with its bank to hedge its interest rate risk. She has asked you, the treasurer of the company, to…13.3 Ganado’s Cost of Capital. Maria Gonzalez now estimates Ganado’s risk-free rate to be 3.60%, the company’s credit risk premium is 4.40%, the domestic beta is estimated at 1.05, the international beta is estimated at 0.85, and the company’s capital structure is now 30% debt. All other values remain the same as those presented in this chapter in the section “Sample Calculation: Ganado’s Cost of Capital.” For both the domestic CAPM and ICAPM, calculate the following: Sample Calculation: Ganado’s Cost of Capital Maria Gonzalez, Ganado’s chief financial officer, wants to calculate the company’s weighted average cost of capital in both forms, the traditional CAPM and also ICAPM. Maria assumes the risk-free rate of interest as 4%, using the U.S. government 10-year Treasury bond rate. The expected rate of return of the market portfolio is assumed to be 9%, the expected rate of return on the market portfolio held by a well-diversified domestic investor. Ganado’s estimate of…Calculate the equity of the Gravel Construction Company if it has $10 million worth of assets. Gravel has $1.3 million in current liabilities and $2.5 million in long-term liabilities.

- The most recent annual dividend of XYZ Ltd. was $1.80 per share and the required return is 11%. The management estimated that the dividends were expected to grow at a rate of 8% annually for three years, followed by a 5% constant annual growth rate in years 4 through infinity. The price of XYZ's stock should be about: a. $29 b. $43 c. $34 d. $5The board of directors of Divided Airlines has declared a dividend of $2.50 per share pay able on Tuesday, May 30, to shareholders of record as of TuesdayMay 9. Cal buys 100 shares of Divided on Tuesday, May 2, for $ 150 per share. What is the ex date? Describe the events that will occur with regard to the cash dividend and the stock price.[1] A manufacturer plans to introduce a new type of shirt based on the following information. The selling price is $35.00; variable cost per unit is $15.00; fixed costs are $8200.00; and capacity per period is 740 units. a) Calculate the break-even point (i) in units (ii) in dollars (iii) as a percent of capacity b) Draw a detailed break-even chart. c) Calculate the break-even point (in units) if fixed costs are reduced to $7000.00 d) Calculate the break-even point (in dollars) if the selling price is increased to $40.00 ANSWER WITH PROPER SOLUTIONS PLEASE