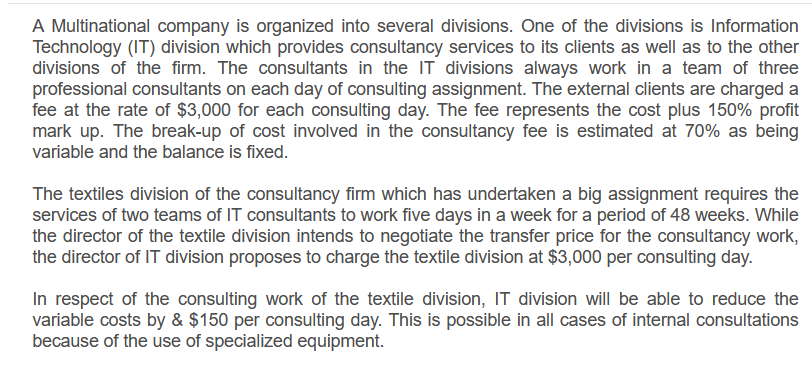

A Multinational company is organized into several divisions. One of the divisions is Information Technology (IT) division which provides consultancy services to its clients as well as to the other divisions of the firm. The consultants in the IT divisions always work in a team of three professional consultants on each day of consulting assignment. The external clients are charged a fee at the rate of $3,000 for each consulting day. The fee represents the cost plus 150% profit mark up. The break-up of cost involved in the consultancy fee is estimated at 70% as being variable and the balance is fixed. The textiles division of the consultancy firm which has undertaken a big assignment requires the services of two teams of IT consultants to work five days in a week for a period of 48 weeks. While the director of the textile division intends to negotiate the transfer price for the consultancy work, the director of IT division proposes to charge the textile division at $3,000 per consulting day. In respect of the consulting work of the textile division, IT division will be able to reduce the variable costs by & $150 per consulting day. This is possible in all cases of internal consultations because of the use of specialized equipment.

A Multinational company is organized into several divisions. One of the divisions is Information Technology (IT) division which provides consultancy services to its clients as well as to the other divisions of the firm. The consultants in the IT divisions always work in a team of three professional consultants on each day of consulting assignment. The external clients are charged a fee at the rate of $3,000 for each consulting day. The fee represents the cost plus 150% profit mark up. The break-up of cost involved in the consultancy fee is estimated at 70% as being variable and the balance is fixed. The textiles division of the consultancy firm which has undertaken a big assignment requires the services of two teams of IT consultants to work five days in a week for a period of 48 weeks. While the director of the textile division intends to negotiate the transfer price for the consultancy work, the director of IT division proposes to charge the textile division at $3,000 per consulting day. In respect of the consulting work of the textile division, IT division will be able to reduce the variable costs by & $150 per consulting day. This is possible in all cases of internal consultations because of the use of specialized equipment.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter10: Decentralization: Responsibility Accounting, Performance Evaluation, And Transfer Pricing

Section: Chapter Questions

Problem 4CE

Related questions

Question

Transcribed Image Text:A Multinational company is organized into several divisions. One of the divisions is Information

Technology (IT) division which provides consultancy services to its clients as well as to the other

divisions of the firm. The consultants in the IT divisions always work in a team of three

professional consultants on each day of consulting assignment. The external clients are charged a

fee at the rate of $3,000 for each consulting day. The fee represents the cost plus 150% profit

mark up. The break-up of cost involved in the consultancy fee is estimated at 70% as being

variable and the balance is fixed.

The textiles division of the consultancy firm which has undertaken a big assignment requires the

services of two teams of IT consultants to work five days in a week for a period of 48 weeks. While

the director of the textile division intends to negotiate the transfer price for the consultancy work,

the director of IT division proposes to charge the textile division at $3,000 per consulting day.

In respect of the consulting work of the textile division, IT division will be able to reduce the

variable costs by & $150 per consulting day. This is possible in all cases of internal consultations

because of the use of specialized equipment.

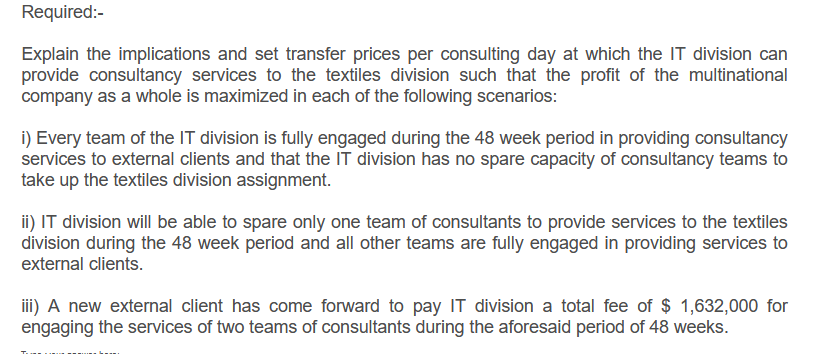

Transcribed Image Text:Required:-

Explain the implications and set transfer prices per consulting day at which the IT division can

provide consultancy services to the textiles division such that the profit of the multinational

company as a whole is maximized in each of the following scenarios:

i) Every team of the IT division is fully engaged during the 48 week period in providing consultancy

services to external clients and that the IT division has no spare capacity of consultancy teams to

take up the textiles division assignment.

ii) IT division will be able to spare only one team of consultants to provide services to the textiles

division during the 48 week period and all other teams are fully engaged in providing services to

external clients.

iii) A new external client has come forward to pay IT division a total fee of $ 1,632,000 for

engaging the services of two teams of consultants during the aforesaid period of 48 weeks.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning