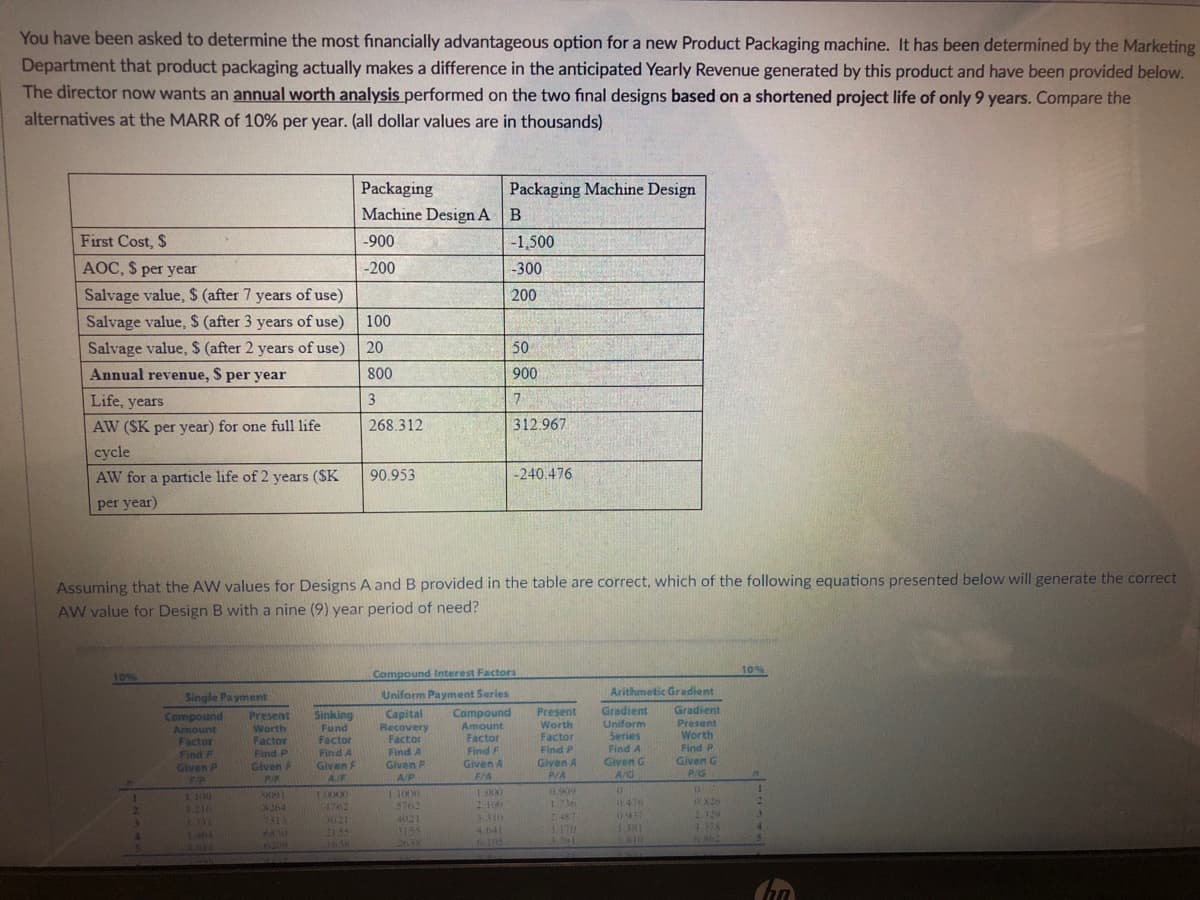

You have been asked to determine the most fınancially advantageous option for a new Product Packaging machine. It has been determined by the Market Department that product packaging actually makes a difference in the anticipated Yearly Revenue generated by this product and have been provided below The director now wants an annual worth analysis performed on the two final designs based on a shortened project life of only 9 years. Compare the alternatives at the MARR of 10% per year. (all dollar values are in thousands) Packaging Packaging Machine Design Machine Design A B First Cost, $ -900 -1,500 AOC, $ per year -200 -300 Salvage value, S$ (after 7 years of use) Salvage value, S (after 3 years of use) 200 100 Salvage value, $ (after 2 years of use) 20 50 Annual revenue, S per year 800 900 Life, years 3 AW (ŠK per year) for one full life 268.312 312.967 cycle AW for a particle life of 2 years ($K 90.953 -240.476 per year) Assuming that the AW values for Designs A and B provided in the table are correct, which of the following equations presented below will generate the correc AW value for Design B with a nine (9) year period of need?

You have been asked to determine the most fınancially advantageous option for a new Product Packaging machine. It has been determined by the Market Department that product packaging actually makes a difference in the anticipated Yearly Revenue generated by this product and have been provided below The director now wants an annual worth analysis performed on the two final designs based on a shortened project life of only 9 years. Compare the alternatives at the MARR of 10% per year. (all dollar values are in thousands) Packaging Packaging Machine Design Machine Design A B First Cost, $ -900 -1,500 AOC, $ per year -200 -300 Salvage value, S$ (after 7 years of use) Salvage value, S (after 3 years of use) 200 100 Salvage value, $ (after 2 years of use) 20 50 Annual revenue, S per year 800 900 Life, years 3 AW (ŠK per year) for one full life 268.312 312.967 cycle AW for a particle life of 2 years ($K 90.953 -240.476 per year) Assuming that the AW values for Designs A and B provided in the table are correct, which of the following equations presented below will generate the correc AW value for Design B with a nine (9) year period of need?

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 1nM

Related questions

Question

[(312.967)(P/A 10,7) + (-240.476)(P/A 10,2)(F/P 10,7)

O[312.967)(P/A 10,7) + (-240.476)(P/A 10,2)XF/P 10,7)(A/P 10,9)

[(312.967)(P/A 10,7) + (-240.476)(P/A 10.2)(A/P 10.9)

[(312.967 7) + (-240.476 2)(A/P 10.9)

None of the equations presented will provide the correct value of AW for Design B over a 9 year Period of Need.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F9c2958c2-088a-4c9f-b425-667be7458fd5%2Faa5b9be0-9fef-4e18-84ef-96173b6b3286%2Feg5i0eg_processed.jpeg&w=3840&q=75)

Transcribed Image Text:10.835

.0923

98.347

9.077

7.458

67.696

25

26

27

11.918

13.110

14.421

15.863

17.449

.00916

00826

.00745

00673

00608

1092

1083

1075

.1067

1061

0839

0763

109.182

121,100

134.210

148.631

164.494

9.161

7.619

7.770

7.914

69.794

71.777

73.650

75.415

77.077

26

9.237

9.307

9.370

9.427

27

28

29

30

0693

0630

0573

28

8.049

8.176

29

30

31

32

33

19.194

21.114

23.225

25.548

28.102

0521

0474

0431

0391

0356

.00550

.00497

.00450

.00407

00369

1055

1050

1045

1041

1037

181.944

201.138

222.252

245.477

271.025

9.479

9.526

9.569

9.609

8.296

8.409

8.515

8615

8.709

78.640

80.108

81.486

2.777

83.987

31

32

33

34

35

34

35

9.644

40

45

45.259

72.891

10221

0137

00226

00 139

00O86

1023

1014

442 593

718.905

9.779

9.863

9.096

9.374

88.953

92.454

94.889

96.562

97.701

40

45

50

117.391

189.059

304 482

00852

00529

00328

00204

1009

.1005

1003

1 163.9

1 880.6

3034.8

9.915

9.947

9 967

9570

9.708

9 802

55

60

.00053

55

00033

00020

00013

00008

00005

00003

65

490.371

789.748

1002

1001

1001

1000

4 893 7

9.867

9.980

9.987

98.471

98.987

65

70

00127

7887.5

9.911

70

75

s0

85

1271.9

2048.4

3299.0

00079

99 332

99 561

99.712

12709.0

9.992

9.995

9.941

9.961

9.974

75

100049

00030

20474.0

32979.7

30

1000

9.997

90

5313.0

95

8556.7

137806

00019

00012

00007

00002

.00001

00001

1000

1000

53120.3

85 556.9

137 796 3

99 812

99.877

99 920

9.998

9.983

9.989

9.993

90

95

100

9.999

100

1000

9.999

[312.967)(P/A 10,7) + (-240.476)(P/A 10,2)(P/F 10,7)](A/P 10,9)

[(312.967)(P/A 10,7) + (-240.476)(P/A 10,2)(F/P 10,7)

O[312.967)(P/A 10,7) + (-240.476)(P/A 10,2)XF/P 10,7)(A/P 10,9)

[(312.967)(P/A 10,7) + (-240.476)(P/A 10.2)(A/P 10.9)

[(312.967 7) + (-240.476 2)(A/P 10.9)

None of the equations presented will provide the correct value of AW for Design B over a 9 year Period of Need.

Transcribed Image Text:You have been asked to determine the most financially advantageous option for a new Product Packaging machine. It has been determined by the Marketing

Department that product packaging actually makes a difference in the anticipated Yearly Revenue generated by this product and have been provided below.

The director now wants an annual worth analysis performed on the two final designs based on a shortened project life of only 9 years. Compare the

alternatives at the MARR of 10% per year. (all dollar values are in thousands)

Packaging

Packaging Machine Design

Machine Design A B

First Cost, $

-900

-1,500

AOC, $ per year

-200

-300

Salvage value, $ (after 7 years of use)

200

Salvage value, $ (after 3 years of use)

100

Salvage value, $ (after 2 years of use)

20

50

Annual revenue, $ per year

800

900

Life, years

3

7

AW ($K per year) for one full life

268.312

312.967

cycle

AW for a particle life of 2 years ($K

90.953

-240.476

per year)

Assuming that the AW values for Designs A and B provided in the table are correct, which of the following equations presented below will generate the correct

AW value for Design B with a nine (9) year period of need?

10%

10%

Compound Interest Factors

Uniform Payment Series

Arithmetic Gradient

Single Payment

Compound

Amount

Factor

Find F

Given P

FIP

Compound

Amount

Factor

Find F

Given A

Gradient

Uniform

Series

Gradient

Present

Worth

Present

Sinking

Fund

Factor

Capital

Recovery

Factor

Present

Worth

Factor

Find P

Given

Worth

Factor

Find P

Given A

P/A

Find A

Find A

Find A

Find P

Given G

A/G

Given G

P/G

Given F

Given P

P/F

A/F

A/P

F/A

1000

0.909

L0000

4762

3021

2135

11000

5762

20001

0.476

826

1.736

2487

1210

N264

2-100

0917

1.329

4121

3155

3.310

4 641

1.404

3.291

6962

501-9

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College