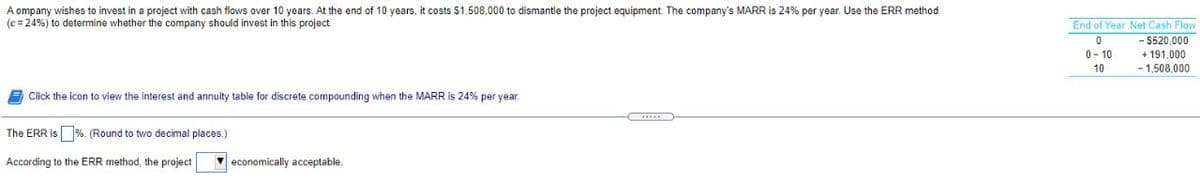

A ompany wishes to invest in a project with cash flows over 10 years. At the end of 10 years, it costs $1.508,000 to dismantle the project equipment. The company's MARR is 24% per year. Use the ERR method (e = 24%) to determine whether the company should invest in this project End of Year Net Cash Flow - $520,000 + 191,000 -1,508.000 0- 10 10 A Click the icon to view the interest and annuity table for discrete compounding when the MARR is 24% per year. The ERR is%. (Round to two decimal places.) According to the ERR method, the project V economically acceptable.

A ompany wishes to invest in a project with cash flows over 10 years. At the end of 10 years, it costs $1.508,000 to dismantle the project equipment. The company's MARR is 24% per year. Use the ERR method (e = 24%) to determine whether the company should invest in this project End of Year Net Cash Flow - $520,000 + 191,000 -1,508.000 0- 10 10 A Click the icon to view the interest and annuity table for discrete compounding when the MARR is 24% per year. The ERR is%. (Round to two decimal places.) According to the ERR method, the project V economically acceptable.

Chapter1: Making Economics Decisions

Section: Chapter Questions

Problem 1QTC

Related questions

Question

Solve it correctly please. I will rate accordingly.

Transcribed Image Text:A ompany wishes to invest in a project with cash flows over 10 years. At the end of 10 years, it costs $1,508,000 to dismantle the project equipment. The company's MARR is 24% per year. Use the ERR method

(e = 24%) to determine whether the company should invest in this project.

End of Year Net Cash Flow

-$520,000

+ 191,000

- 1,508.000

0- 10

10

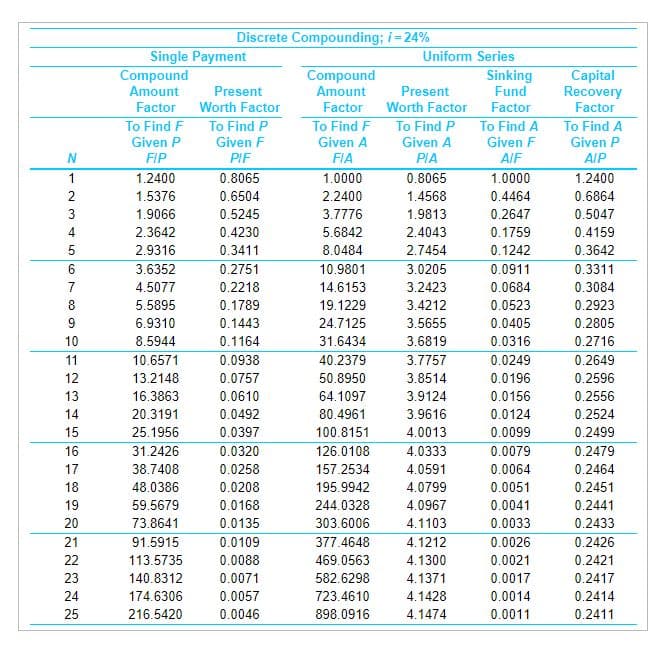

Click the icon to view the interest and annuity table for discrete compounding when the MARR is 24% per year.

The ERR is %. (Round to two decimal places.)

According to the ERR method, the project

V economically acceptable.

Transcribed Image Text:Discrete Compounding; i= 24%

Single Payment

Compound

Amount

Factor

Uniform Series

Present

Worth Factor

Compound

Amount

Factor

Sinking

Fund

Capital

Recovery

Factor

Present

Worth Factor

Factor

To Find F

To Find P

To Find F

Given A

To Find P

Given A

To Find A

To Find A

Given P

Given F

Given F

Given P

FIP

PIF

FIA

PIA

AIF

AIP

1

1.2400

0.8065

1.0000

0.8065

1.0000

1.2400

2

1.5376

0.6504

2.2400

1.4568

0.4464

0.6864

3

1.9066

0.5245

3.7776

1.9813

0.2647

0.5047

4

2.3642

0.4230

5.6842

2.4043

0.1759

0.4159

5

2.9316

0.3411

8.0484

2.7454

0.1242

0.3642

3.6352

0.2751

10.9801

3.0205

0.0911

0.3311

7

4.5077

0.2218

14.6153

3.2423

0.0684

0.3084

19.1229

24.7125

8

5.5895

0.1789

3.4212

0.0523

0.2923

9

6.9310

0.1443

3.5655

0.0405

0.2805

10

8.5944

0.1164

31.6434

3.6819

0.0316

0.2716

11

10.6571

0.0938

40.2379

3.7757

0.0249

0.2649

12

13.2148

0.0757

50.8950

3.8514

0.0196

0.2596

13

16.3863

0.0610

64.1097

3.9124

0.0156

0.2556

14

20.3191

0.0492

80.4961

3.9616

0.0124

0.2524

15

25.1956

0.0397

100.8151

4.0013

0.0099

0.2499

16

31.2426

0.0320

126.0108

4.0333

0.0079

0.2479

17

38.7408

0.0258

157.2534

4.0591

0.0064

0.2464

18

48.0386

0.0208

195.9942

4.0799

0.0051

0.2451

19

59.5679

0.0168

244.0328

4.0967

0.0041

0.2441

20

73.8641

0.0135

303.6006

4.1103

0.0033

0.2433

21

91.5915

0.0109

377.4648

4.1212

0.0026

0.2426

22

113.5735

0.0088

469.0563

4.1300

0.0021

0.2421

23

140.8312

0.0071

582.6298

4.1371

0.0017

0.2417

24

174.6306

0.0057

723.4610

4.1428

0.0014

0.2414

25

216.5420

0.0046

898.0916

4.1474

0.0011

0.2411

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-…

Economics

ISBN:

9781259290619

Author:

Michael Baye, Jeff Prince

Publisher:

McGraw-Hill Education