A plant engineer wishes to know which of two types of lightbulbs should be used to light a warehouse. The bulbs that are currently used cost $43.00 per bulb and last 14,800 hours before burning out. The new bulb (at $82.9 per bulb) provides the same amount of light and consumes the same amount of energy, but it lasts twice as long. The labor cost to change a bulb is $17.00. The lights are on 19 hours a day, 365 days a year. (Assume that the firm's marginal tax rate is 25%) If the firm's MARR is 18%, what is the maximum price (per bulb) the engineer should be willing to pay to switch to the new bulb? Round the service life of the old bulb to the nearest whole number. Click the icon to view the interest factors for discrete compounding when i=18% per year. The maximum price per new bulb the engineer should be willing to pay is $- (Round to one decimal place.) X More Info Single Payment Equal Payment Series Present Compound Amount Factor Sinking Fund Factor Worth Factor Capital Recovery Factor (A/P, i, N) (F/A, i, N) (A/F, i, N) (P/A, i, N) 1.0000 1.0000 0.8475 1.1800 2.1800 0.4587 1.5658 0.6387 212 N 2 Compound Amount Factor (FP, i, N) 1.1800 1.3924 Present Worth Factor (P/F, i, N) 0.8475 0.7182

A plant engineer wishes to know which of two types of lightbulbs should be used to light a warehouse. The bulbs that are currently used cost $43.00 per bulb and last 14,800 hours before burning out. The new bulb (at $82.9 per bulb) provides the same amount of light and consumes the same amount of energy, but it lasts twice as long. The labor cost to change a bulb is $17.00. The lights are on 19 hours a day, 365 days a year. (Assume that the firm's marginal tax rate is 25%) If the firm's MARR is 18%, what is the maximum price (per bulb) the engineer should be willing to pay to switch to the new bulb? Round the service life of the old bulb to the nearest whole number. Click the icon to view the interest factors for discrete compounding when i=18% per year. The maximum price per new bulb the engineer should be willing to pay is $- (Round to one decimal place.) X More Info Single Payment Equal Payment Series Present Compound Amount Factor Sinking Fund Factor Worth Factor Capital Recovery Factor (A/P, i, N) (F/A, i, N) (A/F, i, N) (P/A, i, N) 1.0000 1.0000 0.8475 1.1800 2.1800 0.4587 1.5658 0.6387 212 N 2 Compound Amount Factor (FP, i, N) 1.1800 1.3924 Present Worth Factor (P/F, i, N) 0.8475 0.7182

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter8: Cost Analysis

Section: Chapter Questions

Problem 8E

Related questions

Question

15

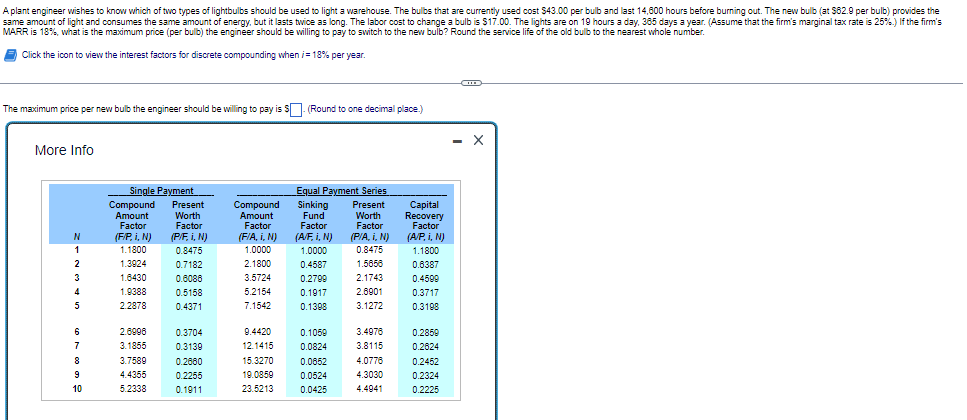

Transcribed Image Text:A plant engineer wishes to know which of two types of lightbulbs should be used to light a warehouse. The bulbs that are currently used cost $43.00 per bulb and last 14,800 hours before burning out. The new bulb (at $82.9 per bulb) provides the

same amount of light and consumes the same amount of energy, but it lasts twice as long. The labor cost to change a bulb is $17.00. The lights are on 19 hours a day, 365 days a year. (Assume that the firm's marginal tax rate is 25%.) If the firm's

MARR is 18%, what is the maximum price (per bulb) the engineer should be willing to pay to switch to the new bulb? Round the service life of the old bulb to the nearest whole number.

Click the icon to view the interest factors for discrete compounding when i = 18% per year.

COO

The maximum price per new bulb the engineer should be willing to pay is S. (Round to one decimal place.)

More Info

Single Payment

Equal Payment Series

Compound

Amount

Factor

(F/A, i, N)

Sinking

Fund

Factor

Present

Worth

Factor

Capital

Recovery

Factor

(A/P, i, N)

(A/F, i, N)

(P/A, i, N)

1.0000

1.0000

0.8475

1.1800

2.1800

0.4587

1.5658

0.6387

3.5724

0.2799

2.1743

0.4599

5.2154

0.1917

2.8901

0.3717

7.1542

0.1398

3.1272

0.3198

9.4420

0.1059

3.4978

0.2859

12.1415

0.0824

3.8115

0.2624

15.3270

0.0652

4.0776

0.2452

19.0859

0.0524

4.3030

0.2324

23.5213

0.0425

4.4941

0.2225

N

1

2

3

4

5

6

7

8

9

10

Compound

Amount

Factor

(F/P, i, N)

1.1800

1.3924

1.6430

1.9388

2.2878

2.6996

3.1855

3.7589

4.4355

5.2338

Present

Worth

Factor

(P/F, i, N)

0.8475

0.7182

0.6086

0.5158

0.4371

0.3704

0.3139

0.2680

0.2255

0.1911

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning