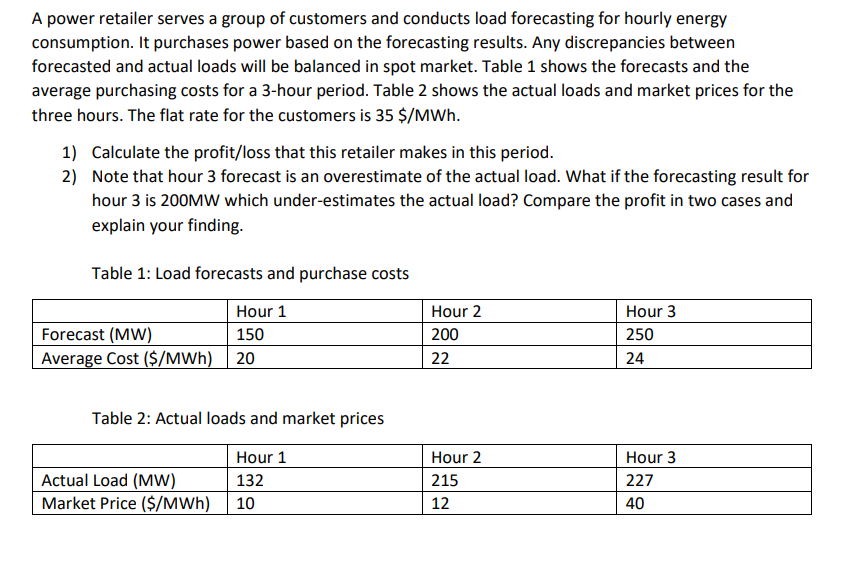

A power retailer serves a group of customers and conducts load forecasting for hourly energy consumption. It purchases power based on the forecasting results. Any discrepancies between forecasted and actual loads will be balanced in spot market. Table 1 shows the forecasts and the average purchasing costs for a 3-hour period. Table 2 shows the actual loads and market prices for the three hours. The flat rate for the customers is 35 $/MWh. 1) Calculate the profit/loss that this retailer makes in this period. 2) Note that hour 3 forecast is an overestimate of the actual load. What if the forecasting result for hour 3 is 200MW which under-estimates the actual load? Compare the profit in two cases and explain your finding. Table 1: Load forecasts and purchase costs Hour 1 Hour 2 Hour 3 Forecast (MW) 150 200 250 Average Cost ($/MWh) 20 22 24 Table 2: Actual loads and market prices Hour 1 Hour 2 Hour 3 Actual Load (MW) Market Price ($/MWh) 132 215 227 10 12 40

A power retailer serves a group of customers and conducts load forecasting for hourly energy consumption. It purchases power based on the forecasting results. Any discrepancies between forecasted and actual loads will be balanced in spot market. Table 1 shows the forecasts and the average purchasing costs for a 3-hour period. Table 2 shows the actual loads and market prices for the three hours. The flat rate for the customers is 35 $/MWh. 1) Calculate the profit/loss that this retailer makes in this period. 2) Note that hour 3 forecast is an overestimate of the actual load. What if the forecasting result for hour 3 is 200MW which under-estimates the actual load? Compare the profit in two cases and explain your finding. Table 1: Load forecasts and purchase costs Hour 1 Hour 2 Hour 3 Forecast (MW) 150 200 250 Average Cost ($/MWh) 20 22 24 Table 2: Actual loads and market prices Hour 1 Hour 2 Hour 3 Actual Load (MW) Market Price ($/MWh) 132 215 227 10 12 40

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 10E

Related questions

Question

Help with this problem

Transcribed Image Text:A power retailer serves a group of customers and conducts load forecasting for hourly energy

consumption. It purchases power based on the forecasting results. Any discrepancies between

forecasted and actual loads will be balanced in spot market. Table 1 shows the forecasts and the

average purchasing costs for a 3-hour period. Table 2 shows the actual loads and market prices for the

three hours. The flat rate for the customers is 35 $/MWh.

1) Calculate the profit/loss that this retailer makes in this period.

2) Note that hour 3 forecast is an overestimate of the actual load. What if the forecasting result for

hour 3 is 200MW which under-estimates the actual load? Compare the profit in two cases and

explain your finding.

Table 1: Load forecasts and purchase costs

Hour 1

Hour 2

Hour 3

Forecast (MW)

150

200

250

Average Cost ($/MWh)

22

24

Table 2: Actual loads and market prices

Hour 1

Hour 2

Hour 3

Actual Load (MW)

Market Price ($/MWh)

132

215

227

10

12

40

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning