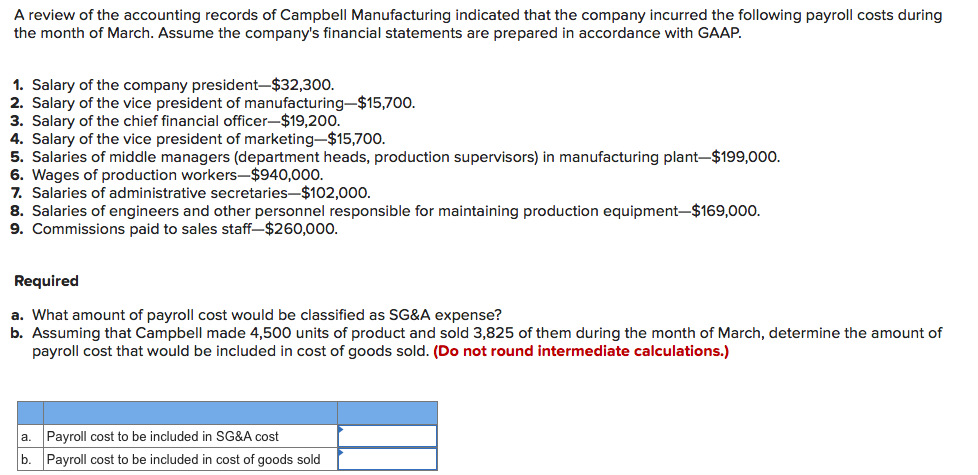

A review of the accounting records of Campbell Manufacturing indicated that the company incurred the following payroll costs during the month of March. Assume the company's financial statements are prepared in accordance with GAAP. 1. Salary of the company president-$32,300. 2. Salary of the vice president of manufacturing-$15,700. 3. Salary of the chief financial officer-$19,200. 4. Salary of the vice president of marketing-$15,700. 5. Salaries of middle managers (department heads, production supervisors) in manufacturing plant-$199,000. 6. Wages of production workers-$940,000. 7. Salaries of administrative secretaries-$102,00o. 8. Salaries of engineers and other personnel responsible for maintaining production equipment-$169,000. 9. Commissions paid to sales staff-$260,000. Required a. What amount of payroll cost would be classified as SG&A expense? b. Assuming that Campbell made 4,500 units of product and sold 3,825 of them during the month of March, determine the amount of payroll cost that would be included in cost of goods sold. (Do not round intermediate calculations.)

A review of the accounting records of Campbell Manufacturing indicated that the company incurred the following payroll costs during the month of March. Assume the company's financial statements are prepared in accordance with GAAP. 1. Salary of the company president-$32,300. 2. Salary of the vice president of manufacturing-$15,700. 3. Salary of the chief financial officer-$19,200. 4. Salary of the vice president of marketing-$15,700. 5. Salaries of middle managers (department heads, production supervisors) in manufacturing plant-$199,000. 6. Wages of production workers-$940,000. 7. Salaries of administrative secretaries-$102,00o. 8. Salaries of engineers and other personnel responsible for maintaining production equipment-$169,000. 9. Commissions paid to sales staff-$260,000. Required a. What amount of payroll cost would be classified as SG&A expense? b. Assuming that Campbell made 4,500 units of product and sold 3,825 of them during the month of March, determine the amount of payroll cost that would be included in cost of goods sold. (Do not round intermediate calculations.)

College Accounting (Book Only): A Career Approach

12th Edition

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cathy J. Scott

Chapter7: Employee Earnings And Deductions

Section: Chapter Questions

Problem 6E: On January 21, the column totals of the payroll register for Great Products Company showed that its...

Related questions

Question

Transcribed Image Text:A review of the accounting records of Campbell Manufacturing indicated that the company incurred the following payroll costs during

the month of March. Assume the company's financial statements are prepared in accordance with GAAP.

1. Salary of the company president-$32,300.

2. Salary of the vice president of manufacturing-$15,700.

3. Salary of the chief financial officer-$19,200.

4. Salary of the vice president of marketing-$15,700.

5. Salaries of middle managers (department heads, production supervisors) in manufacturing plant-$199,000.

6. Wages of production workers-$940,000.

7. Salaries of administrative secretaries-$102,000.

8. Salaries of engineers and other personnel responsible for maintaining production equipment-$169,000.

9. Commissions paid to sales staff-$260,000.

Required

a. What amount of payroll cost would be classified as SG&A expense?

b. Assuming that Campbell made 4,500 units of product and sold 3,825 of them during the month of March, determine the amount of

payroll cost that would be included in cost of goods sold. (Do not round intermediate calculations.)

a. Payroll cost to be included in SG&A cost

Payroll cost to be included in cost of goods sold

b

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College