A) Should Coronation make or buy the tubes? If they should buy then w maximum acceptable purchase price? B) Instead of sales of 100,000 boxes, revised estimates show sales of 1: boxes. This new volume requires the company to rent additional equ an annual rate of $10,600 to manufacture the tubes. This is the only a fixed cost even if sales increase to 300,000 boxes (300,000 productio goal for the third year). With this, should Coronation make or buy the C) The company has the option of making and buying at the same time. would be your answer to part (c) if this alternative is considered?

A) Should Coronation make or buy the tubes? If they should buy then w maximum acceptable purchase price? B) Instead of sales of 100,000 boxes, revised estimates show sales of 1: boxes. This new volume requires the company to rent additional equ an annual rate of $10,600 to manufacture the tubes. This is the only a fixed cost even if sales increase to 300,000 boxes (300,000 productio goal for the third year). With this, should Coronation make or buy the C) The company has the option of making and buying at the same time. would be your answer to part (c) if this alternative is considered?

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter10: Cost Analysis For Management Decision Making

Section: Chapter Questions

Problem 14P

Related questions

Question

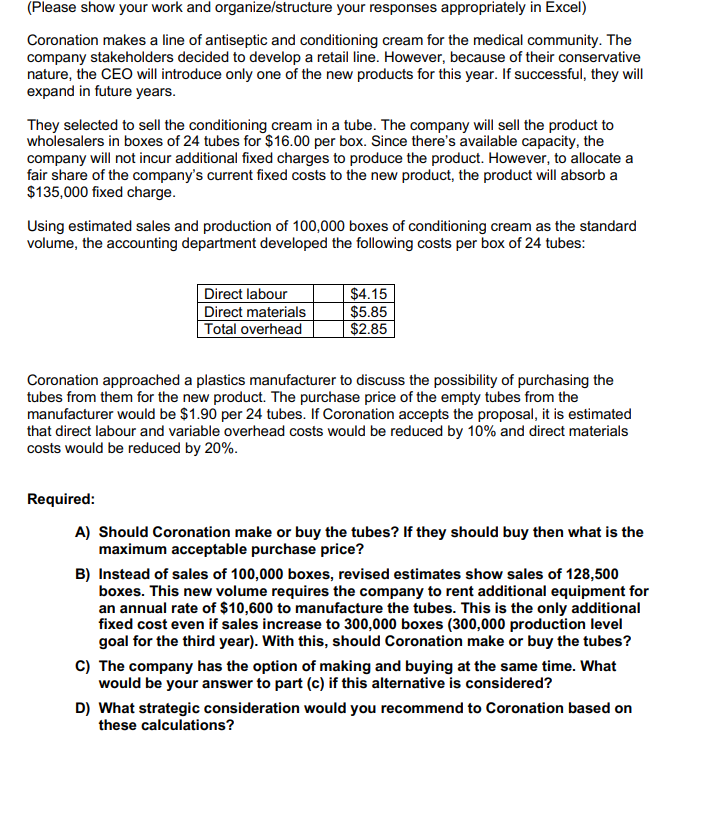

Transcribed Image Text:(Please show your work and organize/structure your responses appropriately in Excel)

Coronation makes a line of antiseptic and conditioning cream for the medical community. The

company stakeholders decided to develop a retail line. However, because of their conservative

nature, the CEO will introduce only one of the new products for this year. If successful, they will

expand in future years.

They selected to sell the conditioning cream in a tube. The company will sell the product to

wholesalers in boxes of 24 tubes for $16.00 per box. Since there's available capacity, the

company will not incur additional fixed charges to produce the product. However, to allocate a

fair share of the company's current fixed costs to the new product, the product will absorb a

$135,000 fixed charge.

Using estimated sales and production of 100,000 boxes of conditioning cream as the standard

volume, the accounting department developed the following costs per box of 24 tubes:

Direct labour

Direct materials

Total overhead

$4.15

$5.85

$2.85

Coronation approached a plastics manufacturer to discuss the possibility of purchasing the

tubes from them for the new product. The purchase price of the empty tubes from the

manufacturer would be $1.90 per 24 tubes. If Coronation accepts the proposal, it is estimated

that direct labour and variable overhead costs would be reduced by 10% and direct materials

costs would be reduced by 20%.

Required:

A) Should Coronation make or buy the tubes? If they should buy then what is the

maximum acceptable purchase price?

B) Instead of sales of 100,000 boxes, revised estimates show sales of 128,500

boxes. This new volume requires the company to rent additional equipment for

an annual rate of $10,600 to manufacture the tubes. This is the only additional

fixed cost even if sales increase to 300,000 boxes (300,000 production level

goal for the third year). With this, should Coronation make or buy the tubes?

C) The company has the option of making and buying at the same time. What

would be your answer to part (c) if this alternative is considered?

D) What strategic consideration would you recommend to Coronation based on

these calculations?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning