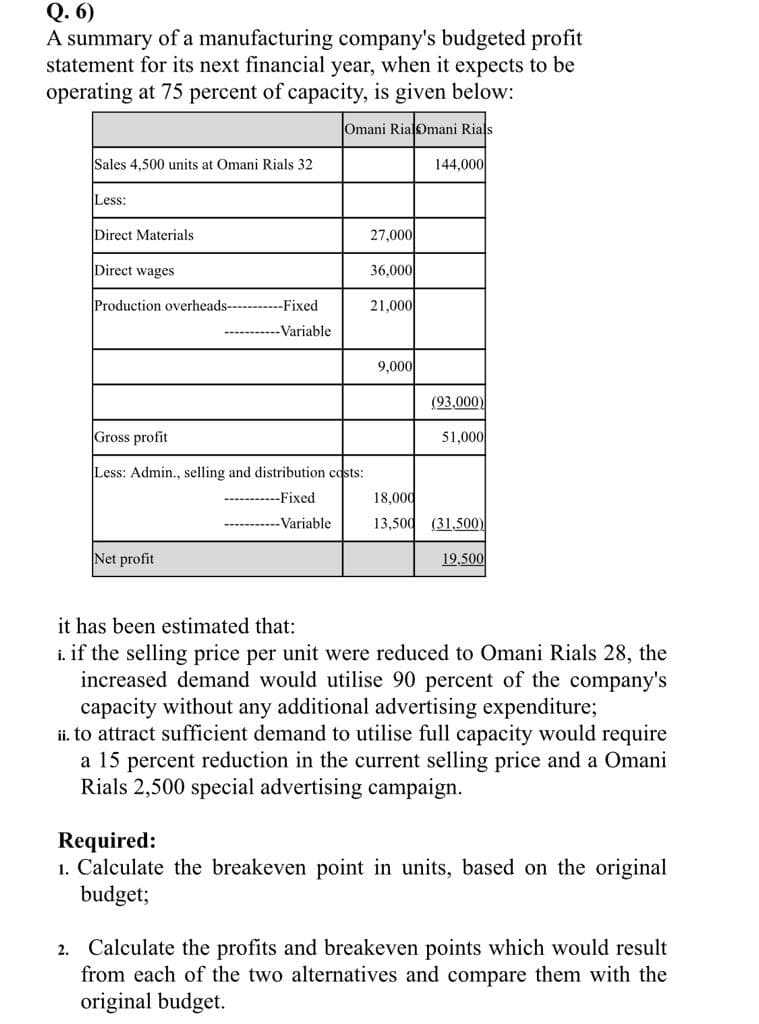

A summary of a manufacturing company's budgeted profit statement for its next financial year, when it expects to be operating at 75 percent of capacity, is given below: Omani RialOmani Rials Sales 4,500 units at Omani Rials 32 144,000 Less: Direct Materials 27,000 Direct wages 36,000 Production overheads- -Fixed 21,000 -Variable 9,000 (93,000) Gross profit 51,000 Less: Admin., selling and distribution costs: -Fixed 18,000 -Variable 13,500 (31.500) Net profit 19,500 it has been estimated that: i. if the selling price per unit were reduced to Omani Rials 28, the increased demand would utilise 90 percent of the company's capacity without any additional advertising expenditure; ii. to attract sufficient demand to utilise full capacity would require a 15 percent reduction in the current selling price and a Omani Rials 2,500 special advertising campaign. Required: 1. Calculate the breakeven point in units, based on the original budget; 2. Calculate the profits and breakeven points which would result from each of the two alternatives and compare them with the original budget.

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Step by step

Solved in 3 steps