a. A progressive tax is one in which the average tax rate is constant as income increases. O the average tax rate decreases as income increases. O the same amount of taxes are paid as income increases. O the average tax rate increases as income increases. b. A regressive tax is one in which O the average tax rate increases as income increases. O the average tax rate is constant as income increases. the average tax rate decreases as income increases. O the same amount of taxes are paid as income increases. C. A proportional tax is one in which O the same amount of taxes are paid as income increases. O the average tax rate decreases as income increases. O the average tax rate is constant as income increases. O the average tax rate increases as income increases.

a. A progressive tax is one in which the average tax rate is constant as income increases. O the average tax rate decreases as income increases. O the same amount of taxes are paid as income increases. O the average tax rate increases as income increases. b. A regressive tax is one in which O the average tax rate increases as income increases. O the average tax rate is constant as income increases. the average tax rate decreases as income increases. O the same amount of taxes are paid as income increases. C. A proportional tax is one in which O the same amount of taxes are paid as income increases. O the average tax rate decreases as income increases. O the average tax rate is constant as income increases. O the average tax rate increases as income increases.

Economics (MindTap Course List)

13th Edition

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Roger A. Arnold

Chapter11: Fiscal Policy And The Federal Budget

Section: Chapter Questions

Problem 5WNG

Related questions

Question

Q

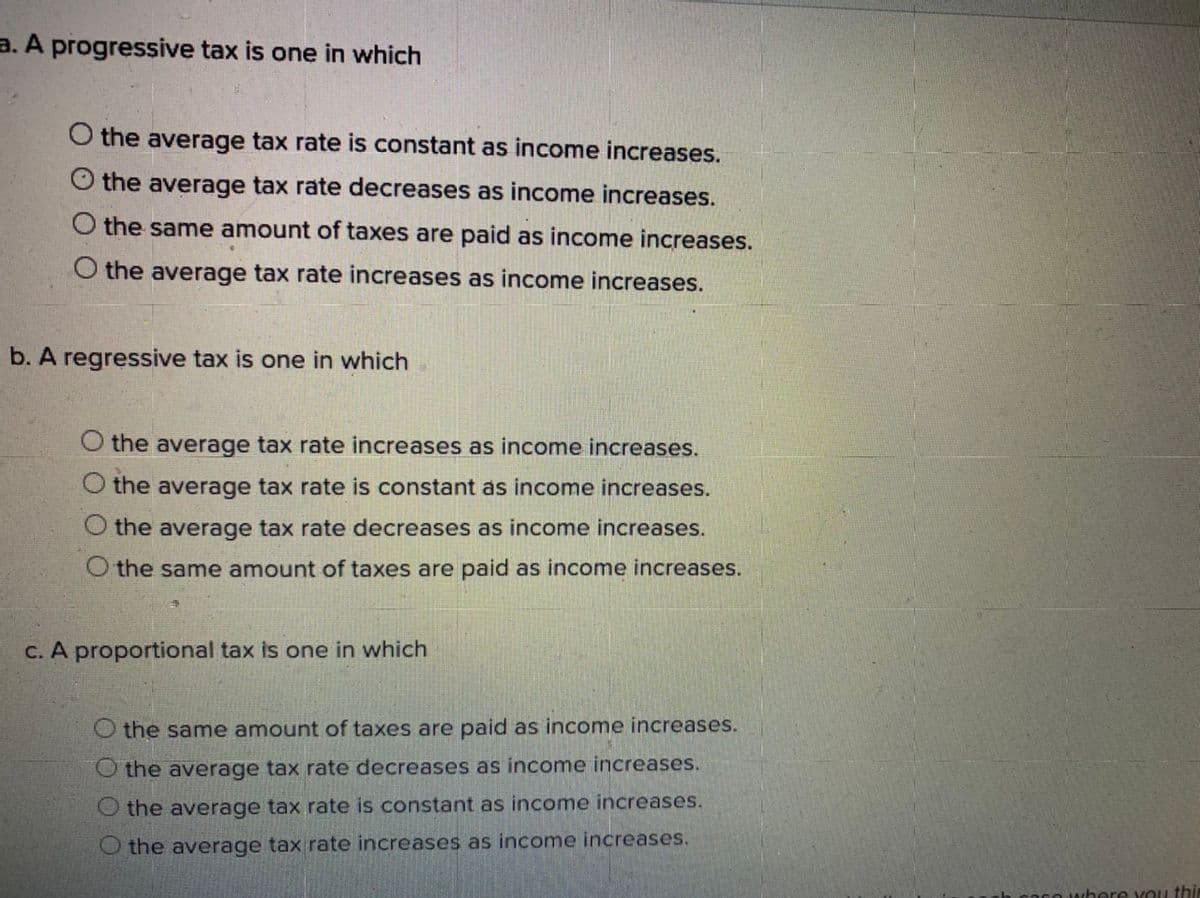

Transcribed Image Text:a. A progressive tax is one in which

O the average tax rate is constant as income increases.

O the average tax rate decreases as income increases.

O the same amount of taxes are paid as income increases.

O the average tax rate increases as income increases.

b. A regressive tax is one in which

O the average tax rate increases as income increases.

O the average tax rate is constant as income increases.

the average tax rate decreases as income increases.

the same amount of taxes are paid as income increases.

C. A proportional tax is one in which

O the same amount of taxes are paid as income increases.

O the average tax rate decreases as income increases.

the average tax rate is constant as income increases.

O the average tax rate increases as income increases.

cO where You thin

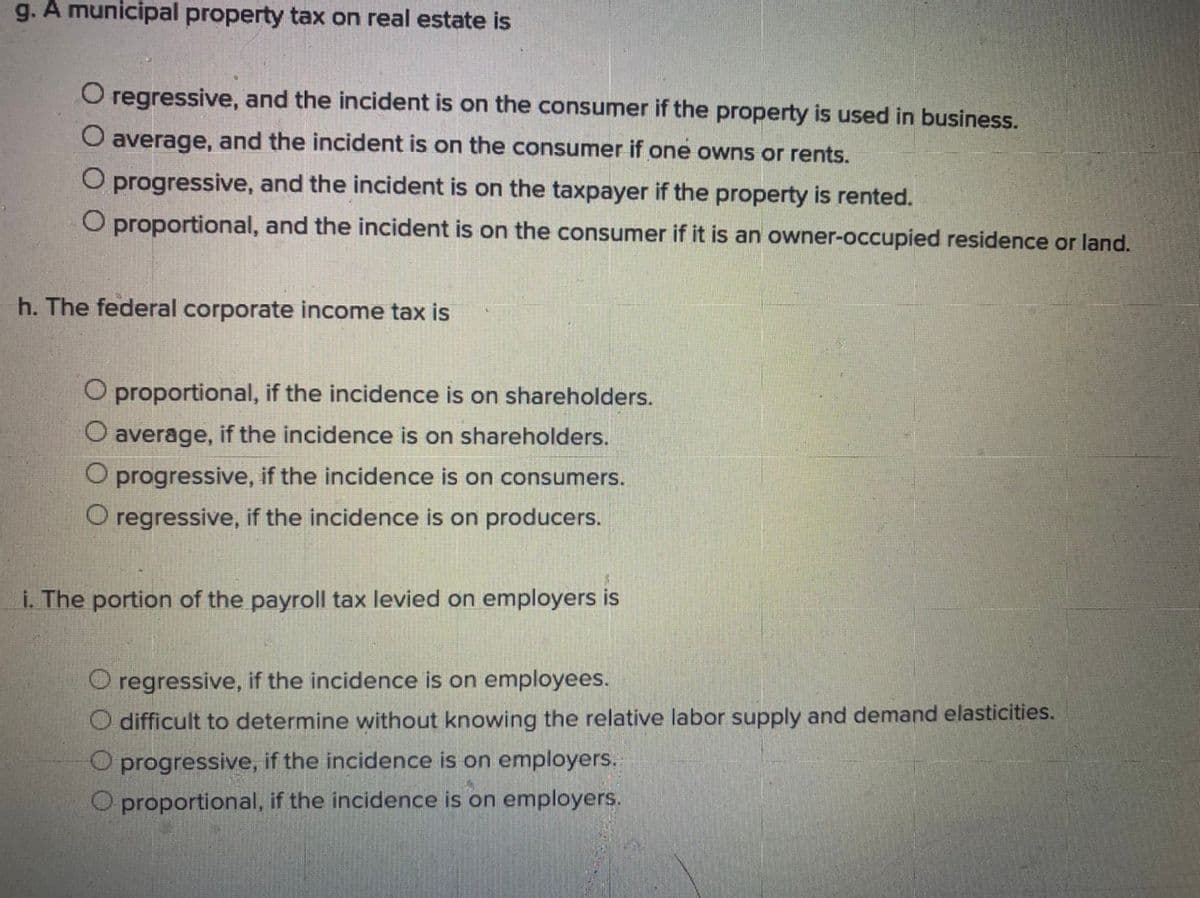

Transcribed Image Text:g. A municipal property tax on real estate is

O regressive, and the incident is on the consumer if the property is used in business.

O average, and the incident is on the consumer if one owns or rents.

O progressive, and the incident is on the taxpayer if the property is rented.

O proportional, and the incident is on the consumer if it is an owner-occupied residence or land.

h. The federal corporate income tax is

proportional, if the incidence is on shareholders.

O average, if the incidence is on shareholders.

O progressive, if the incidence is on consumers.

O regressive, if the incidence is on producers.

i. The portion of the payroll tax levied on employers is

O regressive, if the incidence is on employees.

O difficult to determine without knowing the relative labor supply and demand elasticities.

O progressive, if the incidence is on employers.

O proportional, if the incidence is on employers.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning