A. Receivable turnover B. Leverage ratios C. Intra-comparability D. Price earnings ratio E. Solvency F. Return on Equity G. Horizontal analysis. H. Inventory Turnover 1. Book value per share J. Gross profit ratio K. Current ratio L. Inter-comparability M. Acid-test ratio N. Vertical analysis O. Asset Turnover P. Debt to Equity ratio Q. Dividend yield ratio R. Liquidity S. Return on sales T. Efficiency ratios

A. Receivable turnover B. Leverage ratios C. Intra-comparability D. Price earnings ratio E. Solvency F. Return on Equity G. Horizontal analysis. H. Inventory Turnover 1. Book value per share J. Gross profit ratio K. Current ratio L. Inter-comparability M. Acid-test ratio N. Vertical analysis O. Asset Turnover P. Debt to Equity ratio Q. Dividend yield ratio R. Liquidity S. Return on sales T. Efficiency ratios

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter17: Financial Statement Analysis

Section: Chapter Questions

Problem 6CP: The average liabilities, average stockholders' equity, and average total assets are as follows: 1....

Related questions

Question

100%

Hi! Please select the correct answer from the choices. Numbers 9-12 only thanks! No need to explain.

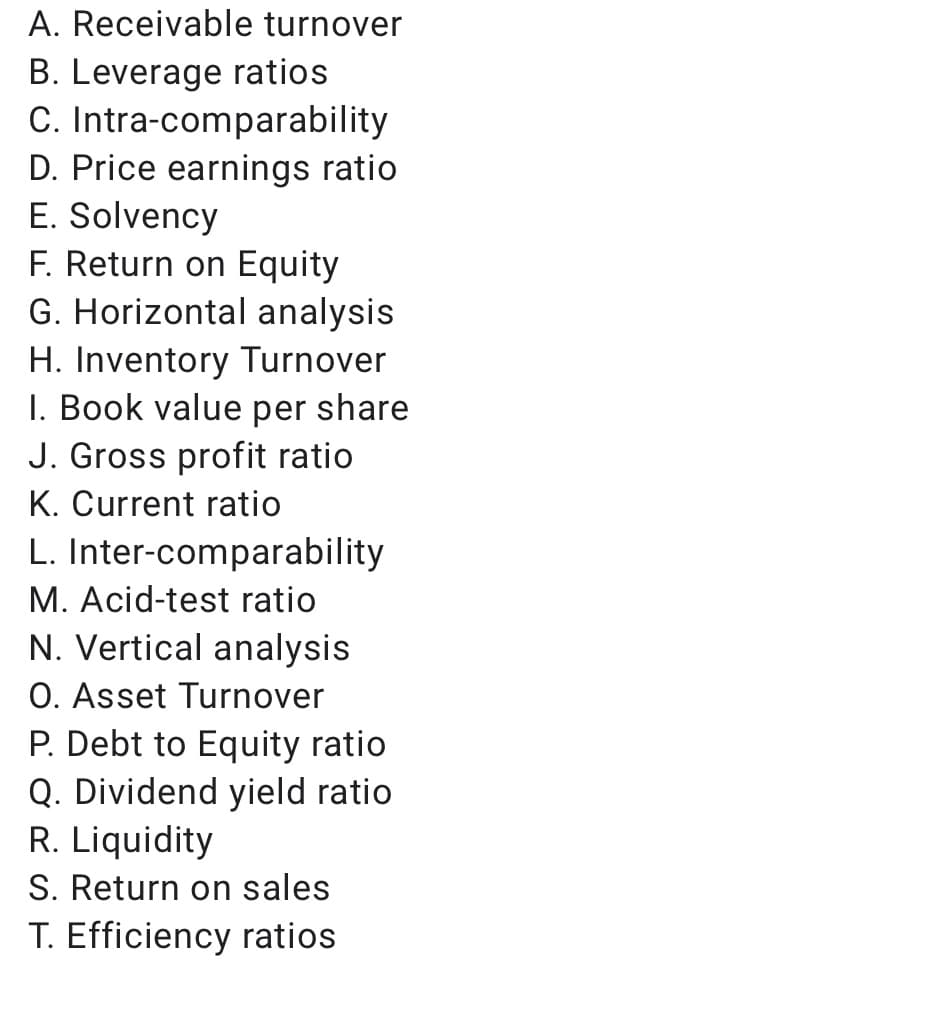

Transcribed Image Text:A. Receivable turnover

B. Leverage ratios

C. Intra-comparability

D. Price earnings ratio

E. Solvency

F. Return on Equity

G. Horizontal analysis

H. Inventory Turnover

I. Book value per share

J. Gross profit ratio

K. Current ratio

L. Inter-comparability

M. Acid-test ratio

N. Vertical analysis

O. Asset Turnover

P. Debt to Equity ratio

Q. Dividend yield ratio

R. Liquidity

S. Return on sales

T. Efficiency ratios

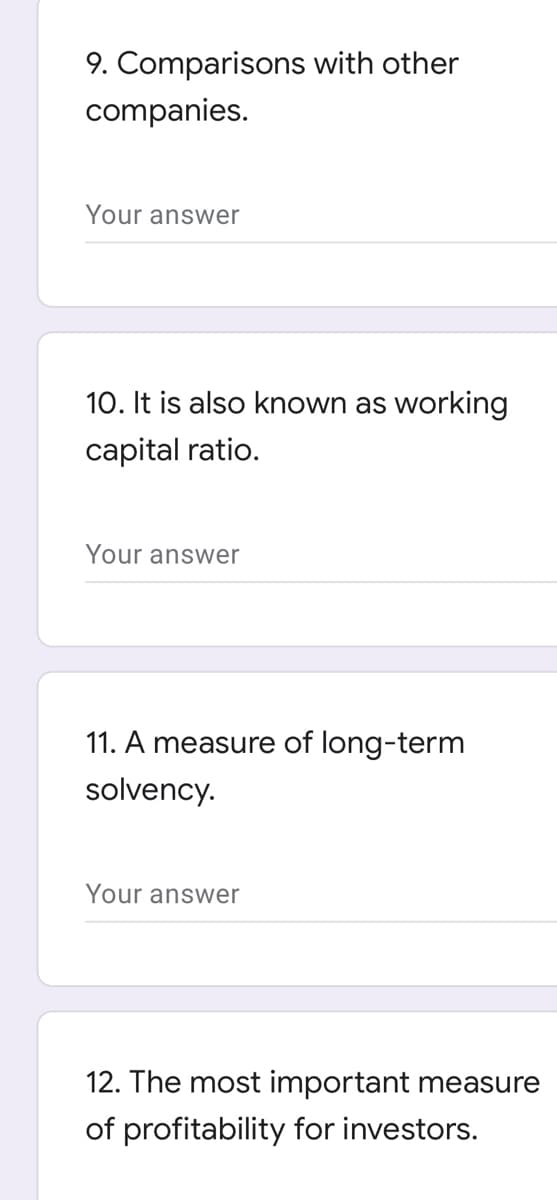

Transcribed Image Text:9. Comparisons with other

companies.

Your answer

10. It is also known as working

capital ratio.

Your answer

11. A measure of long-term

solvency.

Your answer

12. The most important measure

of profitability for investors.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning