The James Island Clothing Company began operations on July 1, 2018. The adjusted trial balance as of December 31, 2018 appears below, along with transaction data for 2018. THE JAMES ISLAND CLOTHING COMPANY Worksheet 12/31/18 Account Title Cash Accounts Receivable Inventory Office Equipment Truck 6,000 Accumulated Depreciation-Plant Assets Accounts Payable Note Payable-Short Term 5,500 10,000 33,000 100,000 Note Payable-Long Term Common Stock Retained Earnings Dividends 1,000 Sales Revenue 15,000 Cost of Goods Sold 3,600 Rent Expense 2,000 Advertising Expense 800 Depreciation Expense 6,000 169,500 $ 169,500 Transaction Data for 2018 Cash paid for purchase of office equipment 6,000 Cash paid for purchase of truck 5,000 Acquisition of Property, Plant, and Equipment with Notes Payable-Long-term Cash payment of dividends 33,000 1,000 100,000 Cash receipt from issuance of common stock Requirements: 1. Complete the worksheet for the James Island Clothing Company, filling in the transaction analysis columns. Note: Some of the input cells marked in blue may not require entries. 2. Prepare the James Island Clothing Company statement of cash flows for the six months ended December 31, 2018. Use the indirect method. Note: Some of the input cells marked in blue may not require entries. Excel Skills: 1. Use cell references in formulas. 2 Format cells with comma format, dollar format, and underlines as appropriate. $ $ Adjusted Trial Balance Debit Credit 95,700 12,000 4,400 26,000 18,000 $

The James Island Clothing Company began operations on July 1, 2018. The adjusted trial balance as of December 31, 2018 appears below, along with transaction data for 2018. THE JAMES ISLAND CLOTHING COMPANY Worksheet 12/31/18 Account Title Cash Accounts Receivable Inventory Office Equipment Truck 6,000 Accumulated Depreciation-Plant Assets Accounts Payable Note Payable-Short Term 5,500 10,000 33,000 100,000 Note Payable-Long Term Common Stock Retained Earnings Dividends 1,000 Sales Revenue 15,000 Cost of Goods Sold 3,600 Rent Expense 2,000 Advertising Expense 800 Depreciation Expense 6,000 169,500 $ 169,500 Transaction Data for 2018 Cash paid for purchase of office equipment 6,000 Cash paid for purchase of truck 5,000 Acquisition of Property, Plant, and Equipment with Notes Payable-Long-term Cash payment of dividends 33,000 1,000 100,000 Cash receipt from issuance of common stock Requirements: 1. Complete the worksheet for the James Island Clothing Company, filling in the transaction analysis columns. Note: Some of the input cells marked in blue may not require entries. 2. Prepare the James Island Clothing Company statement of cash flows for the six months ended December 31, 2018. Use the indirect method. Note: Some of the input cells marked in blue may not require entries. Excel Skills: 1. Use cell references in formulas. 2 Format cells with comma format, dollar format, and underlines as appropriate. $ $ Adjusted Trial Balance Debit Credit 95,700 12,000 4,400 26,000 18,000 $

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter12: The Statement Of Cash Flows

Section: Chapter Questions

Problem 12.1P

Related questions

Question

Not sure how to complete

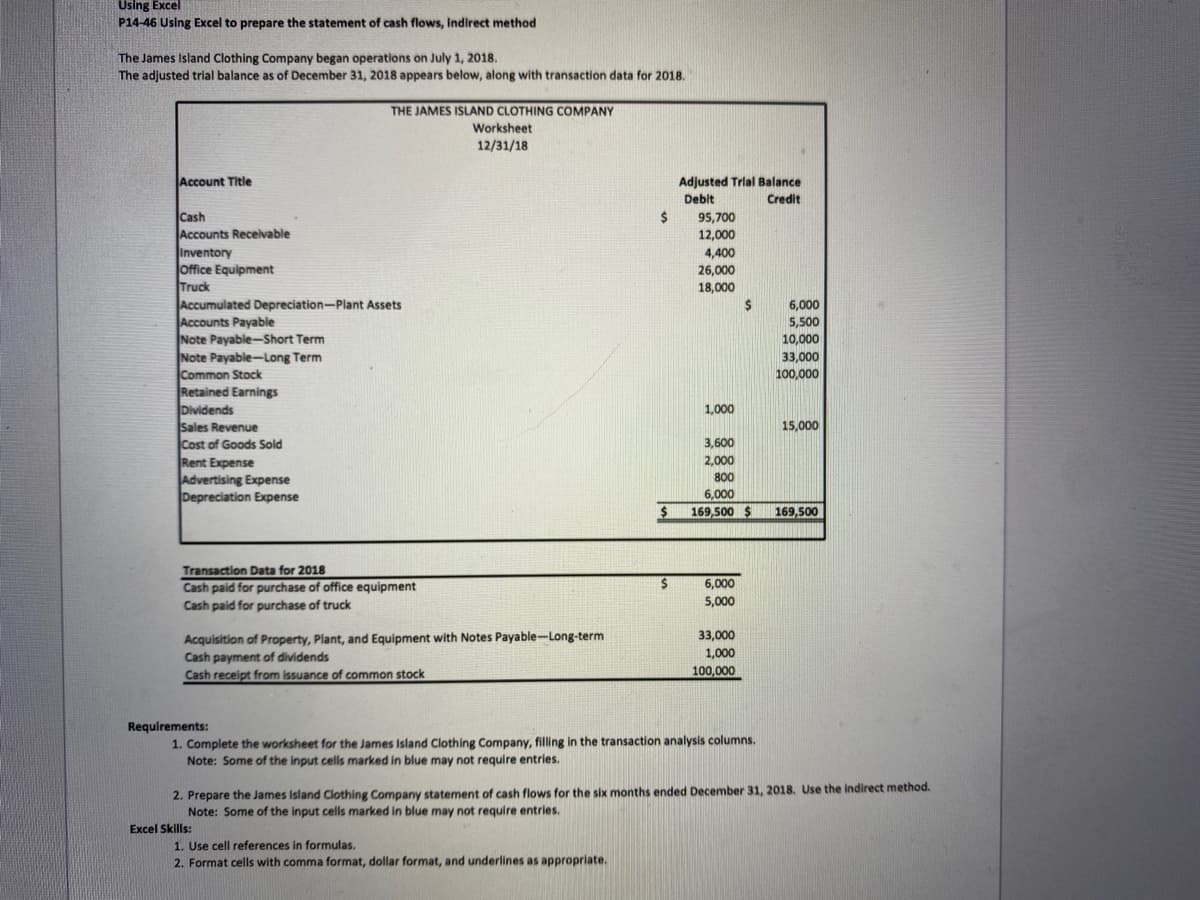

Transcribed Image Text:Using Excel

P14-46 Using Excel to prepare the statement of cash flows, indirect method

The James Island Clothing Company began operations on July 1, 2018.

The adjusted trial balance as of December 31, 2018 appears below, along with transaction data for 2018.

THE JAMES ISLAND CLOTHING COMPANY

Worksheet

12/31/18

Account Title

Adjusted Trial Balance

Debit

Credit

Cash

95,700

12,000

Accounts Receivable

Inventory

Office Equipment

4,400

26,000

18,000

Truck

Accumulated Depreciation-Plant Assets

Accounts Payable

Note Payable-Short Term

Note Payable-Long Term

Common Stock

Retained Earnings

Dividends

1,000

Sales Revenue

Cost of Goods Sold

3,600

Rent Expense

2,000

Advertising Expense

800

Depreciation Expense

6,000

$ 169,500 $

Transaction Data for 2018

Cash paid for purchase of office equipment

$

6,000

Cash paid for purchase of truck

5,000

Acquisition of Property, Plant, and Equipment with Notes Payable-Long-term

Cash payment of dividends

33,000

1,000

100,000

Cash receipt from issuance of common stock

Requirements:

1. Complete the worksheet for the James Island Clothing Company, filling in the transaction analysis columns.

Note: Some of the input cells marked in blue may not require entries.

2. Prepare the James Island Clothing Company statement of cash flows for the six months ended December 31, 2018. Use the indirect method.

Note: Some of the input cells marked in blue may not require entries.

Excel Skills:

1. Use cell references in formulas.

2. Format cells with comma format, dollar format, and underlines as appropriate.

$

$

6,000

5,500

10,000

33,000

100,000

15,000

169,500

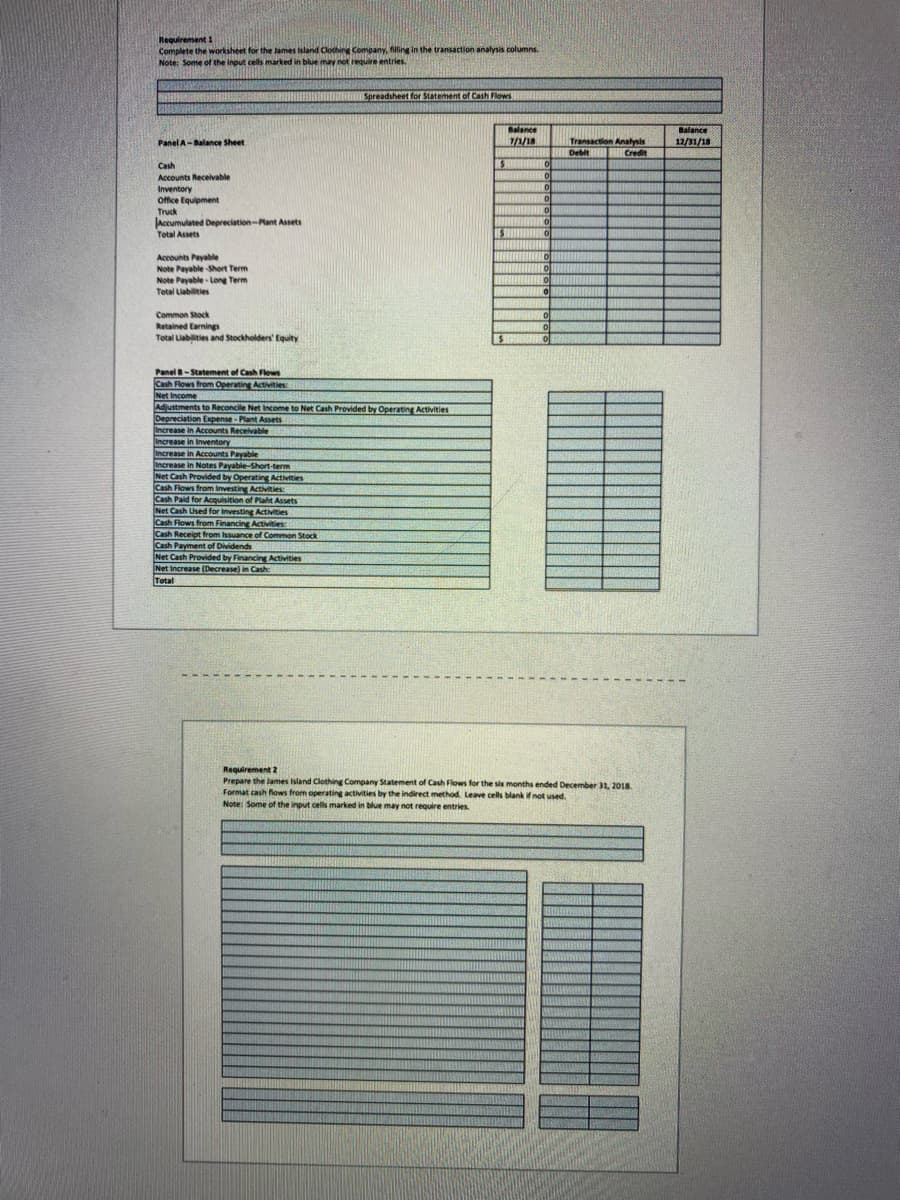

Transcribed Image Text:Requirement 1

Complete the worksheet for the James Island Clothing Company, filling in the transaction analysis columns.

Note: Some of the input cells marked in blue may not require entries.

Spreadsheet for Statement of Cash Flows

Panel A-Balance Sheet

Cash

Accounts Receivable

Inventory

Office Equipment

Truck

Accumulated Depreciation-Plant Assets

Total Assets

Accounts Payable

Note Payable -Short Term

Note Payable Long Term

Total Liabilities

Common Stock

Retained Earnings

Total Liabilities and Stockholders' Equity

Panel B-Statement of Cash Flows

Cash Flows from Operating Activities:

Net Income

Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities

Depreciation Expense-Plant Assets

Increase in Accounts Receivable

Increase in Inventory

Increase in Accounts Payable

Increase in Notes Payable-Short-term

Net Cash Provided by Operating Activities

Cash Flows from Investing Activities:

Cash Paid for Acquisition of Plaht Assets

Net Cash Used for Investing Activities

Cash Flows from Financing Activities:

Cash Receipt from Issuance of Common Stock

Cash Payment of Dividends

Net Cash Provided by Financing Activities

Net Increase (Decrease) in Cash:

Total

Requirement 2

Prepare the James Island Clothing Company Statement of Cash Flows for the six months ended December 31, 2018.

Format cash flows from operating activities by the indirect method. Leave cells blank if not used.

Note: Some of the input cells marked in blue may not require entries.

Balance

7/1/18

$ SO

0

0

MO

0

0

0

0

0

$

0

0

HARTONO

TMENT O

0

10

Transaction Analysis

Debit Credit

Balance

12/31/18

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning