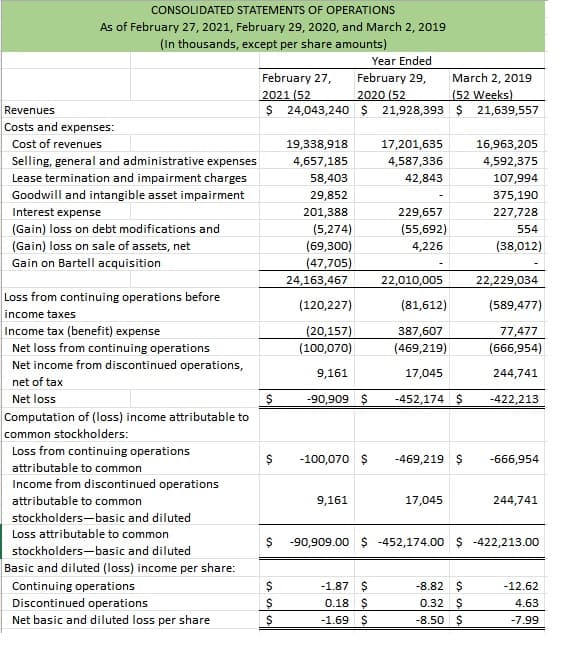

CONSOLIDATED STATEMENTS OF OPERATIONS As of February 27, 2021, February 29, 2020, and March 2, 2019 (In thousands, except per share amounts) Year Ended February 29, 2020 (52 $ 24,043,240 Ş 21,928,393 $ 21,639,557 February 27, March 2, 2019 2021 (52 (52 Weeks) Revenues Costs and expenses: Cost of revenues 19,338,918 17,201,635 16,963,205 Selling, general and administrative expenses Lease termination and impairment charges Goodwill and intangible asset impairment 4,657,185 4,587,336 4,592,375 58,403 42,843 107,994 29,852 375,190 227,728 Interest expense 201,388 229,657 (Gain) loss on debt modifications and (Gain) loss on sale of assets, net Gain on Bartell acquisition (5,274) (69,300) (55,692) 554 4,226 (38,012) (47,705) 24,163,467 22,010,005 22,229,034 Loss from continuing operations before (120,227) (81,612) (589,477) income taxes Income tax (benefit) expense Net loss from continuing operations Net income from discontinued operations, (20,157) (100,070) 387,607 77,477 (469,219) (666,954) 9,161 17,045 244,741 net of tax Net loss -90,909 $ -452,174 $ -422,213 Computation of (loss) income attributable to common stockholders: Loss from continuing operations $ -100,070 $ -469,219 $ -666,954 attributable to common Income from discontinued operations attributable to common 9,161 17,045 244,741 stockholders-basic and diluted Loss attributable to common $ - 90,909.00 -452,174.00 $ -422,213.00 stockholders-basic and diluted Basic and diluted (loss) income per share: Continuing operations -1.87 $ -8.82 $ -12.62 Discontinued operations 0.18 $ 0.32 $ 4.63 Net basic and diluted loss per share -1.69 $ -8.50 $ -7.99 %24

CONSOLIDATED STATEMENTS OF OPERATIONS As of February 27, 2021, February 29, 2020, and March 2, 2019 (In thousands, except per share amounts) Year Ended February 29, 2020 (52 $ 24,043,240 Ş 21,928,393 $ 21,639,557 February 27, March 2, 2019 2021 (52 (52 Weeks) Revenues Costs and expenses: Cost of revenues 19,338,918 17,201,635 16,963,205 Selling, general and administrative expenses Lease termination and impairment charges Goodwill and intangible asset impairment 4,657,185 4,587,336 4,592,375 58,403 42,843 107,994 29,852 375,190 227,728 Interest expense 201,388 229,657 (Gain) loss on debt modifications and (Gain) loss on sale of assets, net Gain on Bartell acquisition (5,274) (69,300) (55,692) 554 4,226 (38,012) (47,705) 24,163,467 22,010,005 22,229,034 Loss from continuing operations before (120,227) (81,612) (589,477) income taxes Income tax (benefit) expense Net loss from continuing operations Net income from discontinued operations, (20,157) (100,070) 387,607 77,477 (469,219) (666,954) 9,161 17,045 244,741 net of tax Net loss -90,909 $ -452,174 $ -422,213 Computation of (loss) income attributable to common stockholders: Loss from continuing operations $ -100,070 $ -469,219 $ -666,954 attributable to common Income from discontinued operations attributable to common 9,161 17,045 244,741 stockholders-basic and diluted Loss attributable to common $ - 90,909.00 -452,174.00 $ -422,213.00 stockholders-basic and diluted Basic and diluted (loss) income per share: Continuing operations -1.87 $ -8.82 $ -12.62 Discontinued operations 0.18 $ 0.32 $ 4.63 Net basic and diluted loss per share -1.69 $ -8.50 $ -7.99 %24

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 2P

Related questions

Question

| Quick Ratio |

| Leverage Ratio |

| Debt to Total Assets Ratio |

| Debt Equity Ratio |

| Long-Term Debt to Equity |

| Times Interest Earned Ratio |

| Activity Ratios |

| Inventory Turnover |

| Fixed Assets Turnover |

| Total Assets Turnover |

| Average Collection Period |

| Profitability Ratios |

| Gross Profit Margin |

| Operating Profit Margin |

| Net Profit Margin |

| Return on Total Assets (ROA) |

| Return on |

| Earnings Per Share (EPS) |

| Price Earnings Ratio |

Please provide the numbers for the ratios.

Transcribed Image Text:CONSOLIDATED STATEMENTS OF OPERATIONS

As of February 27, 2021, February 29, 2020, and March 2, 2019

(In thousands, except per share amounts)

Year Ended

February 27,

February 29,

2020 (52

$ 24,043,240 $ 21,928,393 $ 21,639,557

March 2, 2019

2021 (52

(52 Weeks)

Revenues

Costs and expenses:

Cost of revenues

19,338,918

17,201,635

16,963,205

Selling, general and administrative expenses

4,657,185

4,587,336

4,592,375

Lease termination and impairment charges

58,403

42,843

107,994

Goodwill and intangible asset impairment

29,852

375,190

229,657

Interest expense

(Gain) loss on debt modifications and

201,388

227,728

(5,274)

(55,692)

554

(Gain) loss on sale of assets, net

(69,300)

4,226

(38,012)

Gain on Bartell acquisition

(47,705)

24,163,467

22,010,005

22,229,034

Loss from continuing operations before

(120,227)

(81,612)

(589,477)

income taxes

Income tax (benefit) expense

(20,157)

387,607

77,477

Net loss from continuing operations

Net income from discontinued operations,

(100,070)

(469,219)

(666,954)

9,161

17,045

244,741

net of tax

Net loss

-90,909 $

-452,174 $

-422,213

Computation of (loss) income attributable to

common stockholders:

Loss from continuing operations

-100,070 $

-469,219 $

-666,954

attributable to common

Income from discontinued operations

attributable to common

9,161

17,045

244,741

stockholders-basic and diluted

Loss attributable to common

-90,909.00 $ -452,174.00 $ -422,213.00

stockholders-basic and diluted

Basic and diluted (loss) income per share:

-1.87 $

0.18 $

Continuing operations

-8.82

-12.62

Discontinued operations

0.32

4.63

Net basic and diluted loss per share

-1.69 $

-8.50 $

-7.99

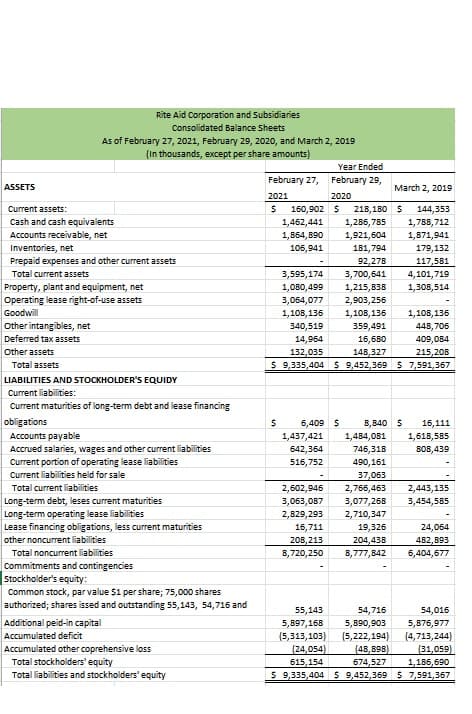

Transcribed Image Text:Rite Aid Corporation and Subsidiaries

Consolidated Balance Sheets

As of February 27, 2021, February 29, 2020, and March 2, 2019

(In thousands, except per share amounts)

Year Ended

February 27, February 29,

ASSETS

March 2, 2019

2021

2020

Current assets:

$ 160,902S

218,180 S

144,353

Cash and cash equivalents

Accounts receivable, net

Inventories, net

Prepaid expenses and other current assets

1,462,441

1,286,785

1,788,712

1,864, 890

1,921,604

1,871,941

105,941

181,794

179,132

92,278

117,581

4,101,719

1,308,514

Total current assets

3,595,174

3,700,641

Property, plant and equipment, net

Operating lease right-of-use assets

Goodwill

1,080,499

1,215,838

3,064,077

2,903,256

1,108,136

1,108,136

1,108,136

Other intangibles, net

Deferred tax assets

340,519

359,491

448, 706

14,964

16,680

409,084

Other assets

148,327

$ 9,335,404 $ 9,452,369 $ 7,591,367

132,035

215,208

Total assets

LIABILITIES AND STOCKHOLDER'S EQUIDY

Current liabilities:

Current maturities of long-term debt and lease financing

obligations

Accounts payable

Accrued salaries, wages and other current liabilities

Current portion of operating lease liabilities

6,409 $

1,437,421

8,840 S

16,111

1,484,081

1,618,585

642,364

746,318

BOB,439

516,752

490,161

Current liabilities held for sale

37,063

Total current liabilities

2,602,945

2,766,453

2,443,135

Long-term debt, leses current maturities

Long-term operating lease liabilities

Lease financing obligations, less current maturities

other noncurrent liabilities

Total noncurrent liabilities

3,063,087

3,077,268

3,454,585

2,829,293

2,710,347

16,711

19,326

24,064

208,213

204,438

482,693

8,720,250

8,777,842

6,404,677

Commitments and contingencies

Stockholder's equity:

Common stock, par value $1 per share; 75,000 shares

authorized; shares issed and outstanding 55,143, 54,716 and

55,143

54,716

54,016

Additional peid-in capital

5,876,977

(4,713,244)

5,897,168

5,890,903

Accumulated deficit

(5,313,103)

(5,222,194)

Accumulated other coprehensive loss

Total stockholders' equity

Total liabilities and stockholders' equity

(48,898)

674,527

$ 9,335,404 $ 9,452,369 S 7,591,367

(24,054)

615,154

(31,059)

1,185,690

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College