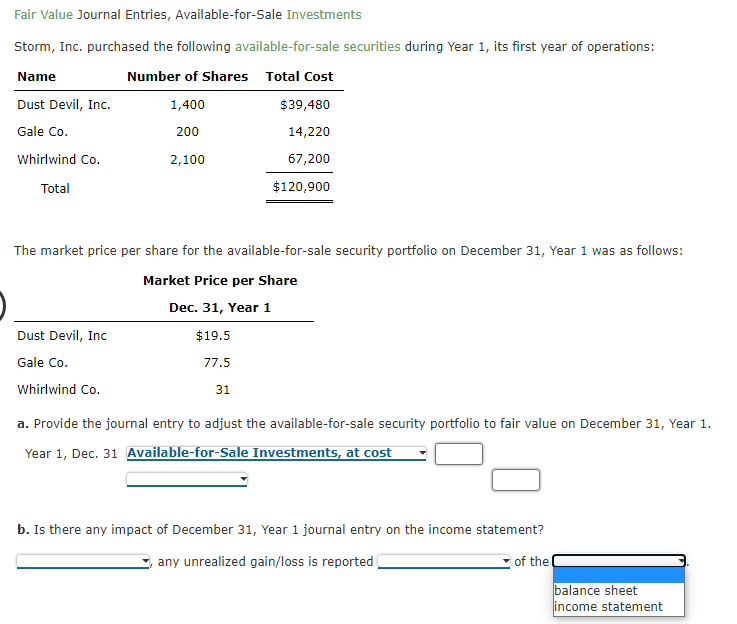

Fair Value Journal Entries, Available-for-Sale Investments Storm, Inc. purchased the following available-for-sale securities during Year 1, its first year of operations: Name Number of Shares Total Cost Dust Devil, Inc. 1,400 $39,480 Gale Co. 200 14,220 Whirlwind Co. 2,100 67,200 Total $120,900 The market price per share for the available-for-sale security portfolio on December 31, Year 1 was as follows: Market Price per Share Dec. 31, Year 1

Fair Value Journal Entries, Available-for-Sale Investments Storm, Inc. purchased the following available-for-sale securities during Year 1, its first year of operations: Name Number of Shares Total Cost Dust Devil, Inc. 1,400 $39,480 Gale Co. 200 14,220 Whirlwind Co. 2,100 67,200 Total $120,900 The market price per share for the available-for-sale security portfolio on December 31, Year 1 was as follows: Market Price per Share Dec. 31, Year 1

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 20E: The investments of Steelers Inc. include a single investment: 33,100 shares of Bengals Inc. common...

Related questions

Question

options for a:

- Available-for-sale Investments, at cost

- cash

Retained Earnings - Unrealized gain(loss) on available-for-sale Investments

- Valuation Allowance for available-for-sale Investments

options for b

first slot is yes or no

Second slot is as other revenue/expense or in the

Transcribed Image Text:Fair Value Journal Entries, Available-for-Sale Investments

Storm, Inc. purchased the following available-for-sale securities during Year 1, its first year of operations:

Name

Number of Shares Total Cost

Dust Devil, Inc.

1,400

$39,480

Gale Co.

200

14,220

Whirlwind Co.

2,100

67,200

Total

$120,900

The market price per share for the available-for-sale security portfolio on December 31, Year 1 was as follows:

Market Price per Share

Dec. 31, Year 1

Dust Devil, Inc

$19.5

Gale Co.

77.5

Whirlwind Co.

31

a. Provide the journal entry to adjust the available-for-sale security portfolio to fair value on December 31, Year 1.

Year 1, Dec. 31 Available-for-Sale Investments, at cost

b. Is there any impact of December 31, Year 1 journal entry on the income statement?

any unrealized gain/loss is reported

of the

balance sheet

income statement

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning