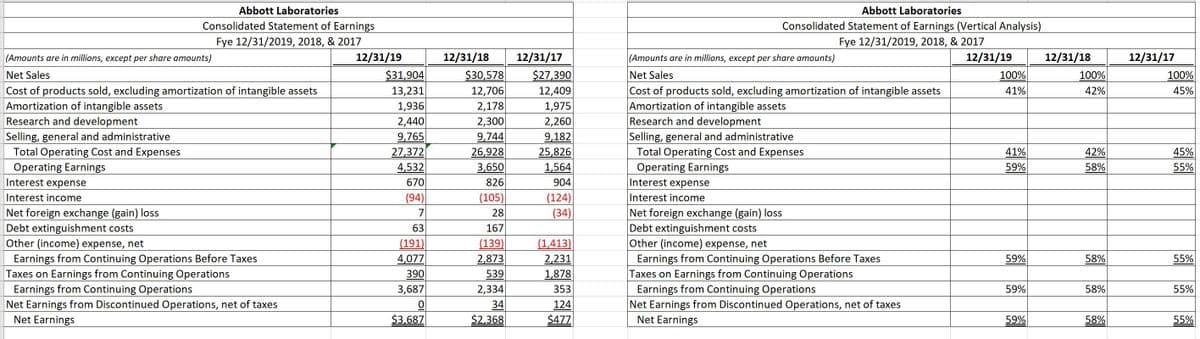

Abbott Laboratories Abbott Laboratories Consolidated Statement of Earnings Fye 12/31/2019, 2018, & 2017 Consolidated Statement of Earnings (Vertical Analysis) Fye 12/31/2019, 2018, & 2017 (Amounts are in millions, except per share amounts) Net Sales Cost of products sold, excluding amortization of intangible assets (Amounts are in millions, except per share amounts) Net Sales Cost of products sold, excluding amortization of intangible assets Amortization of intangible assets Research and development Selling, general and administrative Total Operating Cost and Expenses Operating Earnings Interest expense Interest income 12/31/19 12/31/18 12/31/17 12/31/19 12/31/18 12/31/17 100% 42% $31,904 13,231 1,936 2,440 9.765 $27,390 12,409 1,975 2,260 100% 41% 100% $30,578 12,706 2,178 2,300 9.744 26,928 3,650 45% Amortization of intangible assets Research and development Selling, general and administrative Total Operating Cost and Expenses Operating Earnings Interest expense Interest income 9.182 25,826 1.564 45% 55% 27,372 41% 59% 42% 4,532 58% 670 826 904 (94) (105) (124) (34) Net foreign exchange (gain) loss Debt extinguishment costs Other (income) expense, net Earnings from Continuing Operations Before Taxes Taxes on Earnings from Continuing Operations Net foreign exchange (gain) loss Debt extinguishment costs Other (income) expense, net Earnings from Continuing Operations Before Taxes Taxes on Earnings from Continuing Operations Earnings from Continuing Operations Net Earnings from Discontinued Operations, net of taxes 28 63 167 (139)| 2,873 539 2,334 34 $2.368 (1,413) 2.231 1,878 353 124 $477 (191) 59% 58% 55% 4.077 390 3,687 59% Earnings from Continuing Operations Net Earnings from Discontinued Operations, net of taxes Net Earnings 58% 55% $3.687 Net Earnings 59% 58% 55%

Abbott Laboratories Abbott Laboratories Consolidated Statement of Earnings Fye 12/31/2019, 2018, & 2017 Consolidated Statement of Earnings (Vertical Analysis) Fye 12/31/2019, 2018, & 2017 (Amounts are in millions, except per share amounts) Net Sales Cost of products sold, excluding amortization of intangible assets (Amounts are in millions, except per share amounts) Net Sales Cost of products sold, excluding amortization of intangible assets Amortization of intangible assets Research and development Selling, general and administrative Total Operating Cost and Expenses Operating Earnings Interest expense Interest income 12/31/19 12/31/18 12/31/17 12/31/19 12/31/18 12/31/17 100% 42% $31,904 13,231 1,936 2,440 9.765 $27,390 12,409 1,975 2,260 100% 41% 100% $30,578 12,706 2,178 2,300 9.744 26,928 3,650 45% Amortization of intangible assets Research and development Selling, general and administrative Total Operating Cost and Expenses Operating Earnings Interest expense Interest income 9.182 25,826 1.564 45% 55% 27,372 41% 59% 42% 4,532 58% 670 826 904 (94) (105) (124) (34) Net foreign exchange (gain) loss Debt extinguishment costs Other (income) expense, net Earnings from Continuing Operations Before Taxes Taxes on Earnings from Continuing Operations Net foreign exchange (gain) loss Debt extinguishment costs Other (income) expense, net Earnings from Continuing Operations Before Taxes Taxes on Earnings from Continuing Operations Earnings from Continuing Operations Net Earnings from Discontinued Operations, net of taxes 28 63 167 (139)| 2,873 539 2,334 34 $2.368 (1,413) 2.231 1,878 353 124 $477 (191) 59% 58% 55% 4.077 390 3,687 59% Earnings from Continuing Operations Net Earnings from Discontinued Operations, net of taxes Net Earnings 58% 55% $3.687 Net Earnings 59% 58% 55%

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 86PSB

Related questions

Question

100%

Please complet the vertical analysis table and summurize your observations about changes in finacial trends, in the following income statement line items ( net sales, operting income and net earnings attributable to proter and gamble)

Transcribed Image Text:Abbott Laboratories

Abbott Laboratories

Consolidated Statement of Earnings

Consolidated Statement of Earnings (Vertical Analysis)

Fye 12/31/2019, 2018, & 2017

Fye 12/31/2019, 2018, & 2017

12/31/19

$31,904

12/31/18

$30,578

12,706

12/31/17

$27,390

12,409

1,975

2,260

9,182

25,826

(Amounts are in millions, except per share amounts)

(Amounts are in millions, except per share amounts)

12/31/19

12/31/18

12/31/17

Net Sales

Net Sales

100%

100%

100%

Cost of products sold, excluding amortization of intangible assets

Amortization of intangible assets

Research and development

Selling, general and administrative

Total Operating Cost and Expenses

Operating Earnings

Interest expense

41%

42%

45%

Cost of products sold, excluding amortization of intangible assets

Amortization of intangible assets

Research and development

Selling, general and administrative

Total Operating Cost and Expenses

Operating Earnings

Interest expense

13,231

1,936

2,440

9,765

27,372

4,532

2,178

2,300

9,744

26,928

41%

42%

45%

3,650

1,564

59%

58%

55%

670

826

904

Interest income

(94)

(105)

Interest income

(124)

(34)

Net foreign exchange (gain) loss

Debt extinguishment costs

Other (income) expense, net

Earnings from Continuing Operations Before Taxes

Taxes on Earnings from Continuing Operations

Earnings from Continuing Operations

Net Earnings from Discontinued Operations, net of taxes

Net Earnings

Net foreign exchange (gain) loss

Debt extinguishment costs

Other (income) expense, net

Earnings from Continuing Operations Before Taxes

Taxes on Earnings from Continuing Operations

Earnings from Continuing Operations

Net Earnings from Discontinued Operations, net of taxes

Net Earnings

7

28

63

167

(191)

4,077

(1,413)

2,231

1,878

(139)

2,873

59%

58%

55%

390

539

3,687

2,334

353

59%

58%

55%

34

124

$3,687

$2,368

$477

59%

58%

55%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning