EXIAN SYSTEMS, INC. Income Statement For the Year Ended December 31, 2021 (S in millions, except earnings per share) Sales revenue Cost of goods sold Gross profit Operating expenses: Selling and administrative expense Restructuring costs Total operating expenses Operating income Other income: Interest revenue Gain on sale of investments Total other income Income from continuing operations before income taxes Income tax expense Income from continuing operations Discontinued operations: Income from operations of discontinued component (incl. gain on disposal of $30)

EXIAN SYSTEMS, INC. Income Statement For the Year Ended December 31, 2021 (S in millions, except earnings per share) Sales revenue Cost of goods sold Gross profit Operating expenses: Selling and administrative expense Restructuring costs Total operating expenses Operating income Other income: Interest revenue Gain on sale of investments Total other income Income from continuing operations before income taxes Income tax expense Income from continuing operations Discontinued operations: Income from operations of discontinued component (incl. gain on disposal of $30)

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 22BEA: The income statement, statement of retained earnings, and balance sheet for Somerville Company are...

Related questions

Question

The income statement is incomplete but that is the format that is needed

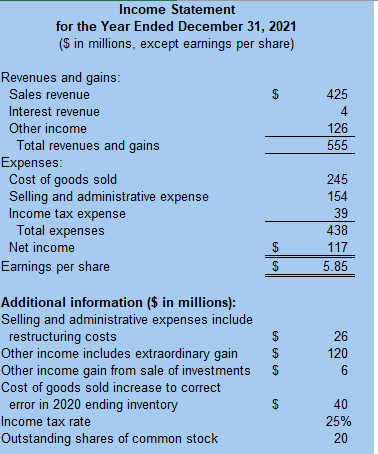

Transcribed Image Text:Income Statement

for the Year Ended December 31, 2021

(S in millions, except earnings per share)

Revenues and gains:

Sales revenue

425

Interest revenue

4

Other income

126

Total revenues and gains

Expenses:

Cost of goods sold

Selling and administrative expense

Income tax expense

555

245

154

39

Total expenses

Net income

438

$

117

Earnings per share

$

5.85

Additional information ($ in millions):

Selling and administrative expenses include

restructuring costs

Other income includes extraordinary gain

Other income gain from sale of investments

Cost of goods sold increase to correct

error in 2020 ending inventory

Income tax rate

26

$

120

$

40

25%

Outstanding shares of common stock

20

%24

%24

%24

%24

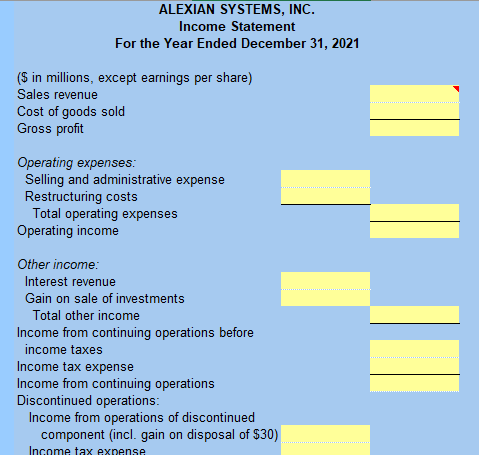

Transcribed Image Text:ALEXIAN SYSTEMS, INC.

Income Statement

For the Year Ended December 31, 2021

(S in millions, except earnings per share)

Sales revenue

Cost of goods sold

Gross profit

Operating expenses:

Selling and administrative expense

Restructuring costs

Total operating expenses

Operating income

Other income:

Interest revenue

Gain on sale of investments

Total other income

Income from continuing operations before

income taxes

Income tax expense

Income from continuing operations

Discontinued operations:

Income from operations of discontinued

component (incl. gain on disposal of $30)

Income tax exnense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning