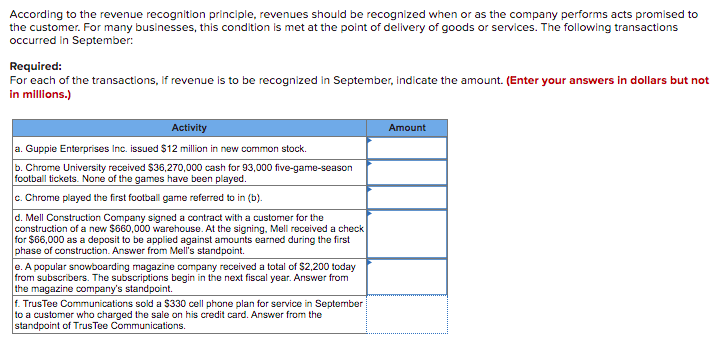

According to the revenue recognition principle, revenues should be recognized when or as the company performs acts promised to the customer. For many businesses, this condition is met at the point of delivery of goods or services. The following transactions occurred in September: Required: For each of the transactions, if revenue is to be recognized in September, indicate the amount. (Enter your answers in dollars but not in millions.) Activity Amount a. Guppie Enterprises Inc. issued $12 million in new common stock. b. Chrome University received $36,270,000 cash for 93,000 five-game-season football tickets. None of the games have been played. c. Chrome played the first football game referred to in (b). d. Mell Construction Company signed a contract with a customer for the construction of a new $660,000 warehouse. At the signing, Mell received a check for $66,000 as a deposit to be applied against amounts earned during the first phase of construction. Answer from Mell's standpoint. e. A popular snowboarding magazine company received a total of $2,200 today from subscribers. The subscriptions begin in the next fiscal year. Answer from the magazine company's standpoint. f. TrusTee Communications sold a $330 cell phone plan for service in September to a customer who charged the sale on his credit card. Answer from the standpoint of TrusTee Communications.

According to the revenue recognition principle, revenues should be recognized when or as the company performs acts promised to the customer. For many businesses, this condition is met at the point of delivery of goods or services. The following transactions occurred in September: Required: For each of the transactions, if revenue is to be recognized in September, indicate the amount. (Enter your answers in dollars but not in millions.) Activity Amount a. Guppie Enterprises Inc. issued $12 million in new common stock. b. Chrome University received $36,270,000 cash for 93,000 five-game-season football tickets. None of the games have been played. c. Chrome played the first football game referred to in (b). d. Mell Construction Company signed a contract with a customer for the construction of a new $660,000 warehouse. At the signing, Mell received a check for $66,000 as a deposit to be applied against amounts earned during the first phase of construction. Answer from Mell's standpoint. e. A popular snowboarding magazine company received a total of $2,200 today from subscribers. The subscriptions begin in the next fiscal year. Answer from the magazine company's standpoint. f. TrusTee Communications sold a $330 cell phone plan for service in September to a customer who charged the sale on his credit card. Answer from the standpoint of TrusTee Communications.

College Accounting (Book Only): A Career Approach

12th Edition

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cathy J. Scott

Chapter5: Closing Entries And The Post-closing Trial Balance

Section: Chapter Questions

Problem 8E

Related questions

Question

Transcribed Image Text:According to the revenue recognition principle, revenues should be recognized when or as the company performs acts promised to

the customer. For many businesses, this condition is met at the point of delivery of goods or services. The following transactions

occurred in September:

Required:

For each of the transactions, if revenue is to be recognized in September, indicate the amount. (Enter your answers in dollars but not

in millions.)

Activity

Amount

a. Guppie Enterprises Inc. issued $12 million in new common stock.

b. Chrome University received $36,270,000 cash for 93,000 five-game-season

football tickets. None of the games have been played.

c. Chrome played the first football game referred to in (b).

d. Mell Construction Company signed a contract with a customer for the

construction of a new $660,000 warehouse. At the signing, Mell received a check

for $66,000 as a deposit to be applied against amounts earned during the first

phase of construction. Answer from Mell's standpoint.

e. A popular snowboarding magazine company received a total of $2,200 today

from subscribers. The subscriptions begin in the next fiscal year. Answer from

the magazine company's standpoint.

f. TrusTee Communications sold a $330 cell phone plan for service in September

to a customer who charged the sale on his credit card. Answer from the

standpoint of TrusTee Communications.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning