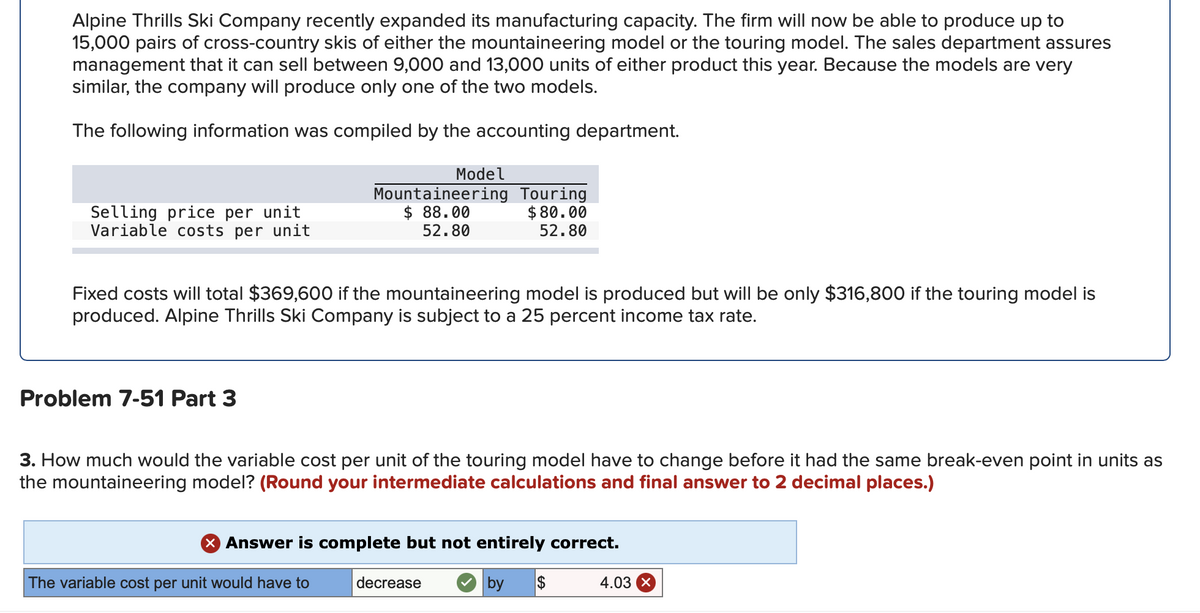

Alpine Thrills Ski Company recently expanded its manufacturing capacity. The firm will now be able to produce up to 15,000 pairs of cross-country skis of either the mountaineering model or the touring model. The sales department assures management that it can sell between 9,000 and 13,000 units of either product this year. Because the models are very similar, the company will produce only one of the two models. The following information was compiled by the accounting department. Selling price per unit Variable costs per unit Problem 7-51 Part 3 Fixed costs will total $369,600 if the mountaineering model is produced but will be only $316,800 if the touring model is produced. Alpine Thrills Ski Company is subject to a 25 percent income tax rate. Model Mountaineering Touring $ 88.00 52.80 $80.00 52.80 3. How much would the variable cost per unit of the touring model have to change before it had the same break-even point in units as the mountaineering model? (Round your intermediate calculations and final answer to 2 decimal places.) The variable cost per unit would have to X Answer is complete but not entirely correct. decrease by $ 4.03 X

Alpine Thrills Ski Company recently expanded its manufacturing capacity. The firm will now be able to produce up to 15,000 pairs of cross-country skis of either the mountaineering model or the touring model. The sales department assures management that it can sell between 9,000 and 13,000 units of either product this year. Because the models are very similar, the company will produce only one of the two models. The following information was compiled by the accounting department. Selling price per unit Variable costs per unit Problem 7-51 Part 3 Fixed costs will total $369,600 if the mountaineering model is produced but will be only $316,800 if the touring model is produced. Alpine Thrills Ski Company is subject to a 25 percent income tax rate. Model Mountaineering Touring $ 88.00 52.80 $80.00 52.80 3. How much would the variable cost per unit of the touring model have to change before it had the same break-even point in units as the mountaineering model? (Round your intermediate calculations and final answer to 2 decimal places.) The variable cost per unit would have to X Answer is complete but not entirely correct. decrease by $ 4.03 X

Chapter3: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 10EB: Keleher Industries manufactures pet doors and sells them directly to the consumer via their web...

Related questions

Question

Aa.11.

Transcribed Image Text:Alpine Thrills Ski Company recently expanded its manufacturing capacity. The firm will now be able to produce up to

15,000 pairs of cross-country skis of either the mountaineering model or the touring model. The sales department assures

management that it can sell between 9,000 and 13,000 units of either product this year. Because the models are very

similar, the company will produce only one of the two models.

The following information was compiled by the accounting department.

Selling price per unit

Variable costs per unit

Problem 7-51 Part 3

Fixed costs will total $369,600 if the mountaineering model is produced but will be only $316,800 if the touring model is

produced. Alpine Thrills Ski Company is subject to a 25 percent income tax rate.

Model

Mountaineering Touring

$ 88.00

52.80

$80.00

52.80

3. How much would the variable cost per unit of the touring model have to change before it had the same break-even point in units as

the mountaineering model? (Round your intermediate calculations and final answer to 2 decimal places.)

The variable cost per unit would have to

X Answer is complete but not entirely correct.

decrease

by

$

4.03 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning