CO Preble Company manufactures one product Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct material: 4 pounds at $10.00 per pound Direct labor: 2 hours at $16 per hour Variable overhead: 2 hours at $6 per hour 00 ZT Total standard variable cost per unit 00 The company also established the following cost formulas for its selling expenses: Fixed Cost per Month Variable Cost per Unit Sold Advertising Sales salaries and commissions Shipping expenses $10.00 The planning budget for March was based on producing and selling 30,000 units. However, during March the company actually produced and sold 34,500 units and incurred the following costs: a. Purchased 150,000 pounds of raw materials at a cost of $9.20 per pound. All of this material was used in production. b. Direct-laborers worked 62,000 hours at a rate of $17.00 per hour. C. Total variable manufacturing overhead for the month was $390,600. d. Total advertising, sales salaries and commissions, and shipping expenses were $280,000, $490,000, and $185,000, respectively. 7. What is the direct labor efficiency variance for March? (Indlcate the effect of each verlance by selecting "F" for favoreble, "U" for unfavorable, and "None" for no effect (l.e., zero verlance.). Input the amount as a posltive value.) Direct labor efficency vaniance, Prev 7 8 9 15 of 15 to search 7120 F5 F4 F7

CO Preble Company manufactures one product Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct material: 4 pounds at $10.00 per pound Direct labor: 2 hours at $16 per hour Variable overhead: 2 hours at $6 per hour 00 ZT Total standard variable cost per unit 00 The company also established the following cost formulas for its selling expenses: Fixed Cost per Month Variable Cost per Unit Sold Advertising Sales salaries and commissions Shipping expenses $10.00 The planning budget for March was based on producing and selling 30,000 units. However, during March the company actually produced and sold 34,500 units and incurred the following costs: a. Purchased 150,000 pounds of raw materials at a cost of $9.20 per pound. All of this material was used in production. b. Direct-laborers worked 62,000 hours at a rate of $17.00 per hour. C. Total variable manufacturing overhead for the month was $390,600. d. Total advertising, sales salaries and commissions, and shipping expenses were $280,000, $490,000, and $185,000, respectively. 7. What is the direct labor efficiency variance for March? (Indlcate the effect of each verlance by selecting "F" for favoreble, "U" for unfavorable, and "None" for no effect (l.e., zero verlance.). Input the amount as a posltive value.) Direct labor efficency vaniance, Prev 7 8 9 15 of 15 to search 7120 F5 F4 F7

Chapter2: Building Blocks Of Managerial Accounting

Section: Chapter Questions

Problem 5EB: Baxter Company has a relevant range of production between 15,000 and 30,000 units. The following...

Related questions

Question

Transcribed Image Text:CO

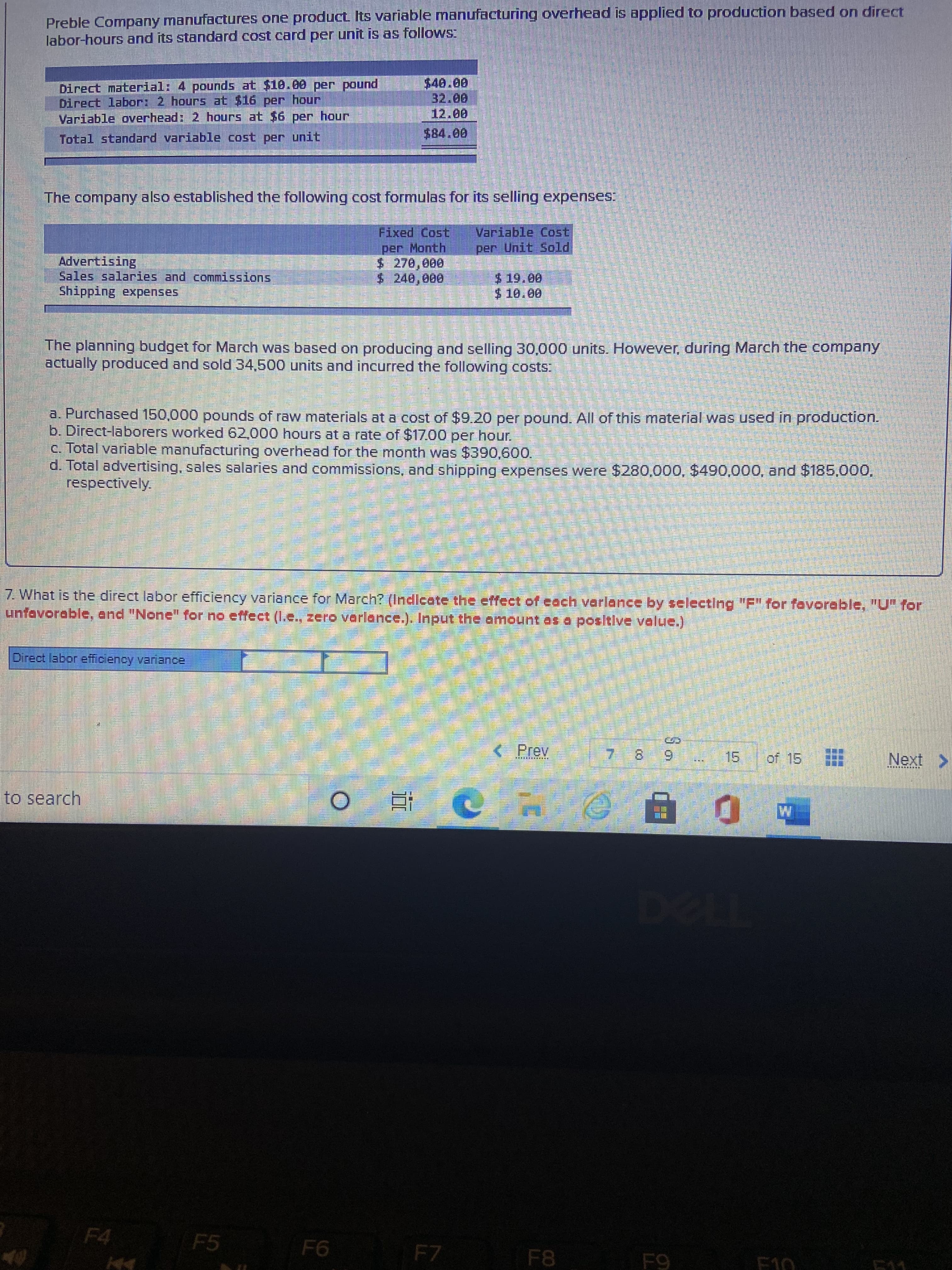

Preble Company manufactures one product Its variable manufacturing overhead is applied to production based on direct

labor-hours and its standard cost card per unit is as follows:

Direct material: 4 pounds at $10.00 per pound

Direct labor: 2 hours at $16 per hour

Variable overhead: 2 hours at $6 per hour

00 ZT

Total standard variable cost per unit

00

The company also established the following cost formulas for its selling expenses:

Fixed Cost

per Month

Variable Cost

per Unit Sold

Advertising

Sales salaries and commissions

Shipping expenses

$10.00

The planning budget for March was based on producing and selling 30,000 units. However, during March the company

actually produced and sold 34,500 units and incurred the following costs:

a. Purchased 150,000 pounds of raw materials at a cost of $9.20 per pound. All of this material was used in production.

b. Direct-laborers worked 62,000 hours at a rate of $17.00 per hour.

C. Total variable manufacturing overhead for the month was $390,600.

d. Total advertising, sales salaries and commissions, and shipping expenses were $280,000, $490,000, and $185,000,

respectively.

7. What is the direct labor efficiency variance for March? (Indlcate the effect of each verlance by selecting "F" for favoreble, "U" for

unfavorable, and "None" for no effect (l.e., zero verlance.). Input the amount as a posltive value.)

Direct labor efficency vaniance,

Prev

7 8 9

15 of 15

to search

7120

F5

F4

F7

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,