Presented below are data taken from the records of Sheffield Company. December 31, 2020 December 31, 2019 Cash $15,100 $7,900 Current assets other than cash 85,800 59,800 Long-term investments 10,100 53,000 Plant assets 335,200 214,500 $446,200 $335,200 Accumulated depreciation $20,200 $40,200 Current liabilities 39,600 22,000 Bonds payable 75,800 –0– Common stock 252,800 252,800 Retained earnings 57,800 20,200 $446,200 $335,200 Additional information: 1. Held-to-maturity debt securities carried at a cost of $42,900 on December 31, 2019, were sold in 2020 for $33,600. The loss (not unusual) was incorrectly charged directly to Retained Earnings. 2. Plant assets that cost $49,600 and were 80% depreciated were sold during 2020 for $7,900. The loss was incorrectly charged directly to Retained Earnings. 3. Net income as reported on the income statement for the year was $56,500. 4. Dividends paid amounted to $7,580. 5. Depreciation charged for the year was $19,680. Prepare a statement of cash flows for the year 2020 using the indirect method. (Show amounts that decrease cash flow with

Presented below are data taken from the records of Sheffield Company. December 31, 2020 December 31, 2019 Cash $15,100 $7,900 Current assets other than cash 85,800 59,800 Long-term investments 10,100 53,000 Plant assets 335,200 214,500 $446,200 $335,200 Accumulated depreciation $20,200 $40,200 Current liabilities 39,600 22,000 Bonds payable 75,800 –0– Common stock 252,800 252,800 Retained earnings 57,800 20,200 $446,200 $335,200 Additional information: 1. Held-to-maturity debt securities carried at a cost of $42,900 on December 31, 2019, were sold in 2020 for $33,600. The loss (not unusual) was incorrectly charged directly to Retained Earnings. 2. Plant assets that cost $49,600 and were 80% depreciated were sold during 2020 for $7,900. The loss was incorrectly charged directly to Retained Earnings. 3. Net income as reported on the income statement for the year was $56,500. 4. Dividends paid amounted to $7,580. 5. Depreciation charged for the year was $19,680. Prepare a statement of cash flows for the year 2020 using the indirect method. (Show amounts that decrease cash flow with

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter16: Statement Of Cash Flows

Section: Chapter Questions

Problem 7E

Related questions

Question

Presented below are data taken from the records of Sheffield Company.

|

December 31,

2020 |

December 31,

2019 |

|||

| Cash |

$15,100

|

$7,900

|

||

| Current assets other than cash |

85,800

|

59,800

|

||

| Long-term investments |

10,100

|

53,000

|

||

| Plant assets |

335,200

|

214,500

|

||

|

$446,200

|

$335,200

|

|||

|

$20,200

|

$40,200

|

|||

| Current liabilities |

39,600

|

22,000

|

||

| Bonds payable |

75,800

|

–0–

|

||

| Common stock |

252,800

|

252,800

|

||

|

57,800

|

20,200

|

|||

|

$446,200

|

$335,200

|

Additional information:

| 1. | Held-to-maturity debt securities carried at a cost of $42,900 on December 31, 2019, were sold in 2020 for $33,600. The loss (not unusual) was incorrectly charged directly to Retained Earnings. | |

| 2. | Plant assets that cost $49,600 and were 80% |

|

| 3. | Net income as reported on the income statement for the year was $56,500. | |

| 4. | Dividends paid amounted to $7,580. | |

| 5. | Depreciation charged for the year was $19,680. |

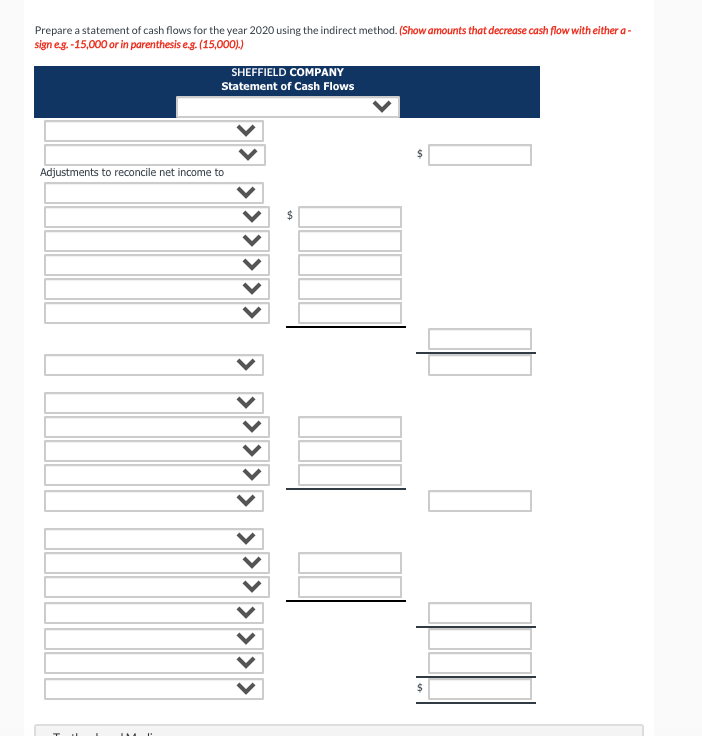

Prepare a statement of cash flows for the year 2020 using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).)

Transcribed Image Text:Prepare a statement of cash flows for the year 2020 using the indirect method. (Show amounts that decrease cash flow with either a -

sign eg. -15,000 or in parenthesis e.g. (15,000))

SHEFFIELD COMPANY

Statement of Cash Flows

Adjustments to reconcile net income to

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,