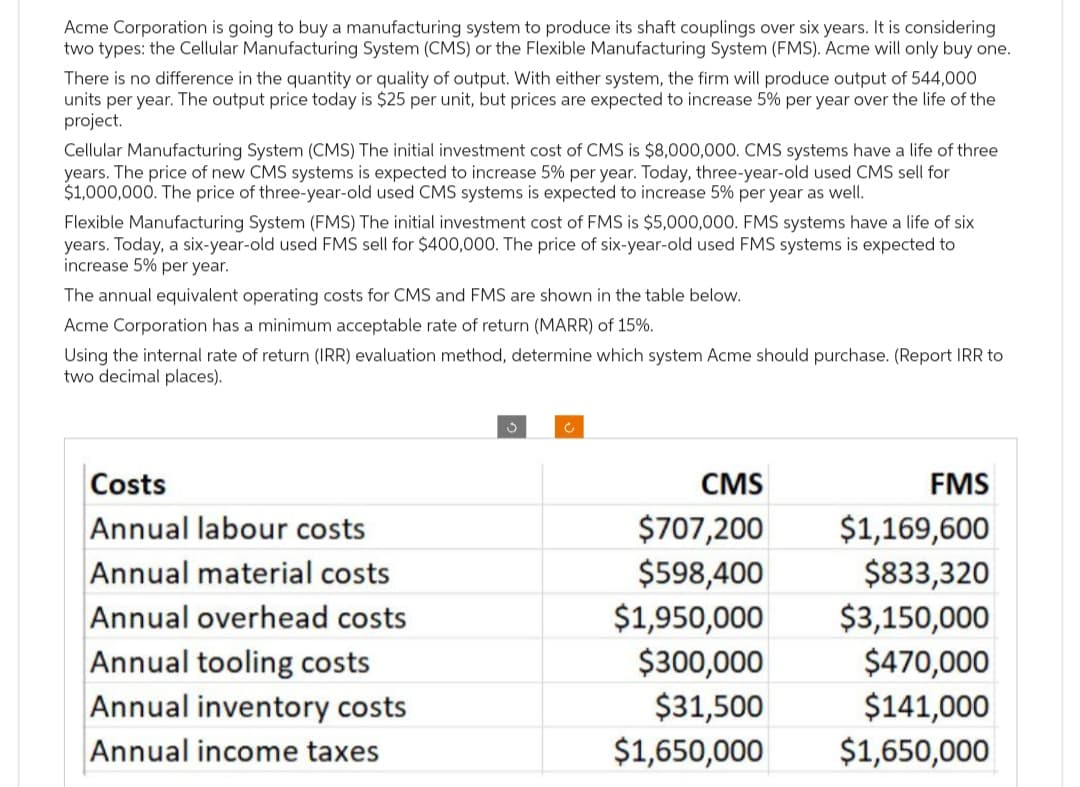

Acme Corporation is going to buy a manufacturing system to produce its shaft couplings over six years. It is considering two types: the Cellular Manufacturing System (CMS) or the Flexible Manufacturing System (FMS). Acme will only buy one. There is no difference in the quantity or quality of output. With either system, the firm will produce output of 544,000 units per year. The output price today is $25 per unit, but prices are expected to increase 5% per year over the life of the project. Cellular Manufacturing System (CMS) The initial investment cost of CMS is $8,000,000. CMS systems have a life of three years. The price of new CMS systems is expected to increase 5% per year. Today, three-year-old used CMS sell for $1,000,000. The price of three-year-old used CMS systems is expected to increase 5% per year as well. Flexible Manufacturing System (FMS) The initial investment cost of FMS is $5,000,000. FMS systems have a life of six years. Today, a six-year-old used FMS sell for $400,000. The price of six-year-old used FMS systems is expected to increase 5% per year. The annual equivalent operating costs for CMS and FMS are shown in the table below. Acme Corporation has a minimum acceptable rate of return (MARR) of 15%. Using the internal rate of return (IRR) evaluation method, determine which system Acme should purchase. (Report IRR to two decimal places).

Acme Corporation is going to buy a manufacturing system to produce its shaft couplings over six years. It is considering two types: the Cellular Manufacturing System (CMS) or the Flexible Manufacturing System (FMS). Acme will only buy one. There is no difference in the quantity or quality of output. With either system, the firm will produce output of 544,000 units per year. The output price today is $25 per unit, but prices are expected to increase 5% per year over the life of the project. Cellular Manufacturing System (CMS) The initial investment cost of CMS is $8,000,000. CMS systems have a life of three years. The price of new CMS systems is expected to increase 5% per year. Today, three-year-old used CMS sell for $1,000,000. The price of three-year-old used CMS systems is expected to increase 5% per year as well. Flexible Manufacturing System (FMS) The initial investment cost of FMS is $5,000,000. FMS systems have a life of six years. Today, a six-year-old used FMS sell for $400,000. The price of six-year-old used FMS systems is expected to increase 5% per year. The annual equivalent operating costs for CMS and FMS are shown in the table below. Acme Corporation has a minimum acceptable rate of return (MARR) of 15%. Using the internal rate of return (IRR) evaluation method, determine which system Acme should purchase. (Report IRR to two decimal places).

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 1iM

Related questions

Question

Please do not give image format

Transcribed Image Text:Acme Corporation is going to buy a manufacturing system to produce its shaft couplings over six years. It is considering

two types: the Cellular Manufacturing System (CMS) or the Flexible Manufacturing System (FMS). Acme will only buy one.

There is no difference in the quantity or quality of output. With either system, the firm will produce output of 544,000

units per year. The output price today is $25 per unit, but prices are expected to increase 5% per year over the life of the

project.

Cellular Manufacturing System (CMS) The initial investment cost of CMS is $8,000,000. CMS systems have a life of three

years. The price of new CMS systems is expected to increase 5% per year. Today, three-year-old used CMS sell for

$1,000,000. The price of three-year-old used CMS systems is expected to increase 5% per year as well.

Flexible Manufacturing System (FMS) The initial investment cost of FMS is $5,000,000. FMS systems have a life of six

years. Today, a six-year-old used FMS sell for $400,000. The price of six-year-old used FMS systems is expected to

increase 5% per year.

The annual equivalent operating costs for CMS and FMS are shown in the table below.

Acme Corporation has a minimum acceptable rate of return (MARR) of 15%.

Using the internal rate of return (IRR) evaluation method, determine which system Acme should purchase. (Report IRR to

two decimal places).

Costs

Annual labour costs

Annual material costs

Annual overhead costs

Annual tooling costs

Annual inventory costs

Annual income taxes

c

CMS

$707,200

$598,400

$1,950,000

$300,000

$31,500

$1,650,000

FMS

$1,169,600

$833,320

$3,150,000

$470,000

$141,000

$1,650,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning