Activity Bese Number of customer service Machine Number of Number ofr Customer Hours Setups Inspectione Orders res 0.25 machine hour per 非! il川 i

Activity Bese Number of customer service Machine Number of Number ofr Customer Hours Setups Inspectione Orders res 0.25 machine hour per 非! il川 i

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter4: Activity-based Costing

Section: Chapter Questions

Problem 4PB: Activity-based product costing Sweet Sugar Company manufactures three products (white sugar, brown...

Related questions

Question

100%

Transcribed Image Text:Activity-Based Costing

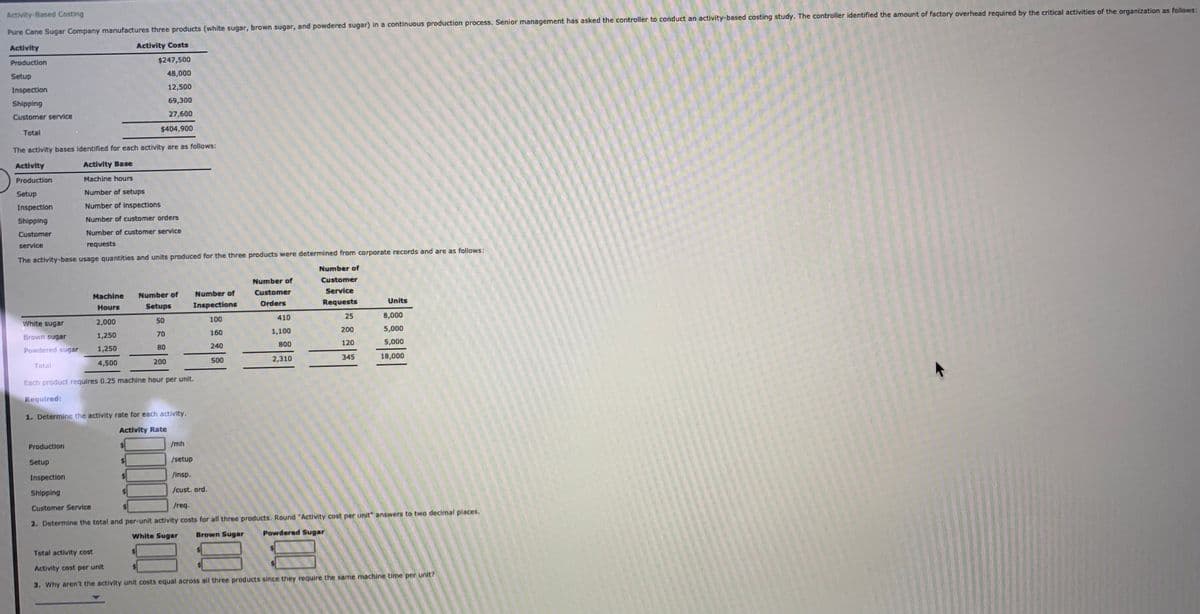

Pure Cane Sugar Company manufactures three products (white sugar, brown sugar, and powdered sugar) in a continuous production process. Senior management has asked the controller to conduct an activity-based costing study. The controller identified the amount of factory overhead required by the critical activities of the organization as follows:

Activity

Activity Costs

Production

$247,500

Setup

48,000

Inspection

12,500

Shipping

69,300

27,600

Customer service

$404,900

Total

The activity bases identified for each activity are as follows:

Activity

Activity Base

Production

Machine hours

Setup

Number of setups

Inspection

Number of inspections

Shipping

Number of customer orders

Customer

Number of customer service

service

requests

The activity-base usage quantities and units produced for the three products were determined from corporate records and are as follows:

Number of

Number of

Customer

Customer

Service

Machine

Number of

Number of

Orders

Requests

Units

Hours

Setups

Inspections

410

25

8,000

White sugar

2,000

50

100

1,100

200

5,000

Brown sugar

1,250

70

160

800

120

5,000

Powdered sugar

1,250

80

240

2,310

345

18,000

4,500

200

500

Total

Each product requires 0.25 machine hour per unit.

Required:

1. Determine the activity rate for each activity.

Activity Rate

Production

/mh

Setup

%24

/setup

Inspection

finsp.

Shipping

/cust. ord.

Customer Service

/req.

2. Determine the total and per-unit activity costs for all three products. Round "Activity cost per unit" answers to two decimal places.

White Sugar

Brown Sugar

Powdered Sugar

Total activity cost

%24

Activity cost per unit

3. Why aren't the activity unit costs equal across all three products since they require the same machine time per unit?

Expert Solution

Step 1

Activity rate for overhead allocation = Total overhead cost/ Activity level

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning