ADDITIONAL Medicare Tax

Chapter14: Property Transact Ions: Capital Gains And Losses, § 1231, And Recapture Provisions

Section: Chapter Questions

Problem 3BCRQ

Related questions

Question

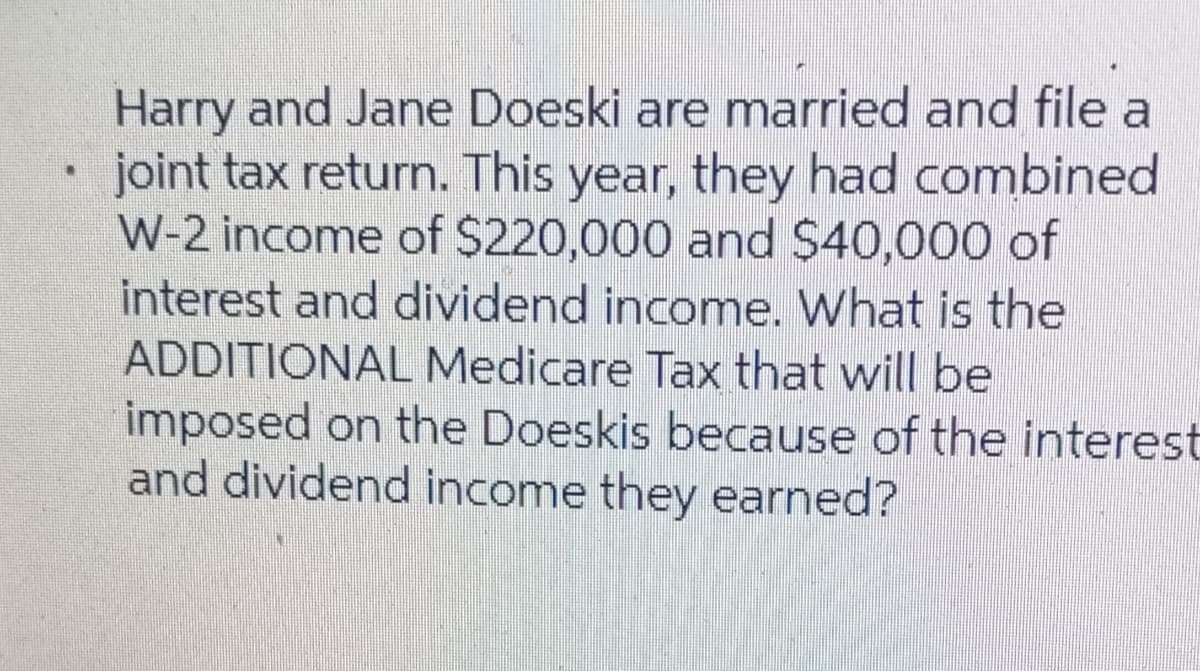

Transcribed Image Text:Harry and Jane Doeski are married and file a

joint tax return. This year, they had combined

W-2 income of $220,000 and $40,000 of

interest and dividend income. What is the

ADDITIONAL Medicare Tax that will be

imposed on the Doeskis because of the interest

and dividend income they earned?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT