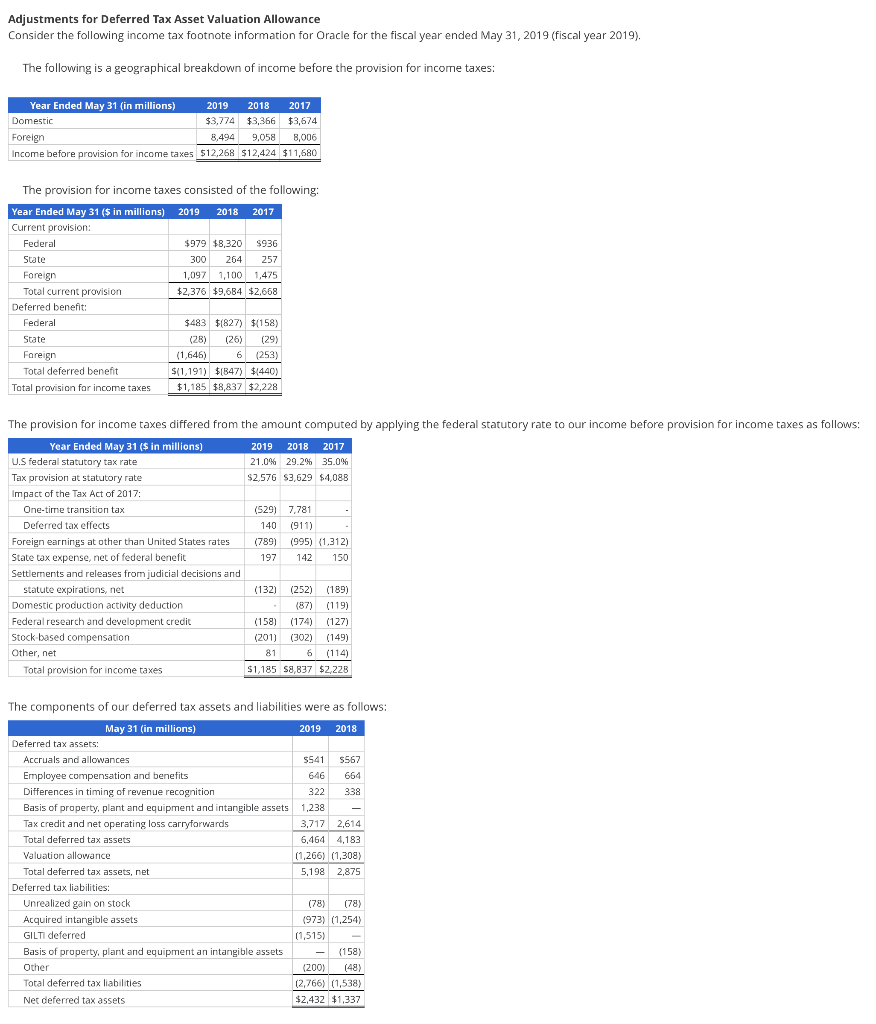

Adjustments for Deferred Tax Asset Valuation Allowance Consider the following income tax footnote information for Oracle for the fiscal year ended May 31, 2019 (fiscal year 2019). The following is a geographical breakdown of income before the provision for income taxes: Year Ended May 31 (in millions) Domestic 2019 2018 2017 $3,774 $3,366 $3,674 Foreign 8,494 9,058 8,006 Income before provision for income taxes $12,268 $12,424 $11,680 The provision for income taxes consisted of the following: Year Ended May 31 ($ in millions) Current provision: Federal State 2019 2018 2017 $979 $8,320 $936 257 300 264 1,097 1,100 1,475 Foreign Total current provision $2,376 $9,684 $2,668 Deferred benefit: Federal State Foreign Total deferred benefit Total provision for income taxes $483 $(827) $(158) (28) (26) (29) (1,646) 6 (253) $(1,191) $(847) $(440) $1,185 $8,837 $2,228 The provision for income taxes differed from the amount computed by applying the federal statutory rate to our income before provision for income taxes as follows: Year Ended May 31 ($ in millions) U.S federal statutory tax rate Tax provision at statutory rate 2019 2018 2017 21.0% 29.2% 35.0% $2,576 $3,629 $4,088 Impact of the Tax Act of 2017: One-time transition tax (529) 7,781 Deferred tax effects 140 (911) Foreign earnings at other than United States rates (789) (995) (1,312) State tax expense, net of federal benefit 197 142 150 Settlements and releases from judicial decisions and statute expirations, net (132) (252) (189) Domestic production activity deduction (87) (119) Federal research and development credit (158) (174) (127) Stock-based compensation (201) (302) (149) Other, net 81 6 (114) Total provision for income taxes $1,185 $8,837 $2,228 The components of our deferred tax assets and liabilities were as follows: May 31 (in millions) 2019 2018 Deferred tax assets: Accruals and allowances $541 $567 Employee compensation and benefits 646 664 Differences in timing of revenue recognition 322 338 Basis of property, plant and equipment and intangible assets 1,238 - Tax credit and net operating loss carryforwards 3,717 2,614 Total deferred tax assets 6,464 4,183 Valuation allowance Total deferred tax assets, net (1,266) (1,308) 5,198 2,875 Deferred tax liabilities: Unrealized gain on stock Acquired intangible assets (78) (78) (973) (1,254) GILTI deferred Basis of property, plant and equipment an intangible assets Other Total deferred tax liabilities Net deferred tax assets (1,515) (158) (200) (48) (2,766) (1,538) $2,432 $1,337 Required a. Use the four-year average valuation allowance to deferred tax assets (2016-2019) of 22.55% to adjust the income statement for each of the four years 2016-2019. Follow Analyst Adjustments 10.3 for guidance in the adjustment process. Note: Use a negative sign to indicate an income statement reversal. Note: Do not round until your final answer; round your final answers below to the nearest whole dollar. Income Statement Adjustments ($ millions) Income tax expense Net income 2016 2017 2018 2019 $ $ $ $ b. Adjust the balance sheet for each of the four years 2016-2019. Note: Use a negative sign to indicate a decrease of the balance sheet accounts. Note: Round your answers to the nearest whole dollar. Balance Sheet Adjustments ($ millions) Valuation allowance Deferred tax assets, net Total assets Retained Earnings 2016 2017 2018 2019 $ $ $ $

Adjustments for Deferred Tax Asset Valuation Allowance Consider the following income tax footnote information for Oracle for the fiscal year ended May 31, 2019 (fiscal year 2019). The following is a geographical breakdown of income before the provision for income taxes: Year Ended May 31 (in millions) Domestic 2019 2018 2017 $3,774 $3,366 $3,674 Foreign 8,494 9,058 8,006 Income before provision for income taxes $12,268 $12,424 $11,680 The provision for income taxes consisted of the following: Year Ended May 31 ($ in millions) Current provision: Federal State 2019 2018 2017 $979 $8,320 $936 257 300 264 1,097 1,100 1,475 Foreign Total current provision $2,376 $9,684 $2,668 Deferred benefit: Federal State Foreign Total deferred benefit Total provision for income taxes $483 $(827) $(158) (28) (26) (29) (1,646) 6 (253) $(1,191) $(847) $(440) $1,185 $8,837 $2,228 The provision for income taxes differed from the amount computed by applying the federal statutory rate to our income before provision for income taxes as follows: Year Ended May 31 ($ in millions) U.S federal statutory tax rate Tax provision at statutory rate 2019 2018 2017 21.0% 29.2% 35.0% $2,576 $3,629 $4,088 Impact of the Tax Act of 2017: One-time transition tax (529) 7,781 Deferred tax effects 140 (911) Foreign earnings at other than United States rates (789) (995) (1,312) State tax expense, net of federal benefit 197 142 150 Settlements and releases from judicial decisions and statute expirations, net (132) (252) (189) Domestic production activity deduction (87) (119) Federal research and development credit (158) (174) (127) Stock-based compensation (201) (302) (149) Other, net 81 6 (114) Total provision for income taxes $1,185 $8,837 $2,228 The components of our deferred tax assets and liabilities were as follows: May 31 (in millions) 2019 2018 Deferred tax assets: Accruals and allowances $541 $567 Employee compensation and benefits 646 664 Differences in timing of revenue recognition 322 338 Basis of property, plant and equipment and intangible assets 1,238 - Tax credit and net operating loss carryforwards 3,717 2,614 Total deferred tax assets 6,464 4,183 Valuation allowance Total deferred tax assets, net (1,266) (1,308) 5,198 2,875 Deferred tax liabilities: Unrealized gain on stock Acquired intangible assets (78) (78) (973) (1,254) GILTI deferred Basis of property, plant and equipment an intangible assets Other Total deferred tax liabilities Net deferred tax assets (1,515) (158) (200) (48) (2,766) (1,538) $2,432 $1,337 Required a. Use the four-year average valuation allowance to deferred tax assets (2016-2019) of 22.55% to adjust the income statement for each of the four years 2016-2019. Follow Analyst Adjustments 10.3 for guidance in the adjustment process. Note: Use a negative sign to indicate an income statement reversal. Note: Do not round until your final answer; round your final answers below to the nearest whole dollar. Income Statement Adjustments ($ millions) Income tax expense Net income 2016 2017 2018 2019 $ $ $ $ b. Adjust the balance sheet for each of the four years 2016-2019. Note: Use a negative sign to indicate a decrease of the balance sheet accounts. Note: Round your answers to the nearest whole dollar. Balance Sheet Adjustments ($ millions) Valuation allowance Deferred tax assets, net Total assets Retained Earnings 2016 2017 2018 2019 $ $ $ $

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 12P: Comprehensive Colt Company reports pretax financial income of 143,000 in 2019. In addition to pretax...

Related questions

Question

Transcribed Image Text:Adjustments for Deferred Tax Asset Valuation Allowance

Consider the following income tax footnote information for Oracle for the fiscal year ended May 31, 2019 (fiscal year 2019).

The following is a geographical breakdown of income before the provision for income taxes:

Year Ended May 31 (in millions)

Domestic

2019

2018

2017

$3,774 $3,366 $3,674

Foreign

8,494 9,058 8,006

Income before provision for income taxes $12,268 $12,424 $11,680

The provision for income taxes consisted of the following:

Year Ended May 31 ($ in millions)

Current provision:

Federal

State

2019 2018 2017

$979 $8,320 $936

257

300 264

1,097 1,100 1,475

Foreign

Total current provision

$2,376 $9,684 $2,668

Deferred benefit:

Federal

State

Foreign

Total deferred benefit

Total provision for income taxes

$483 $(827) $(158)

(28) (26) (29)

(1,646)

6 (253)

$(1,191) $(847) $(440)

$1,185 $8,837 $2,228

The provision for income taxes differed from the amount computed by applying the federal statutory rate to our income before provision for income taxes as follows:

Year Ended May 31 ($ in millions)

U.S federal statutory tax rate

Tax provision at statutory rate

2019 2018 2017

21.0% 29.2% 35.0%

$2,576 $3,629 $4,088

Impact of the Tax Act of 2017:

One-time transition tax

(529) 7,781

Deferred tax effects

140 (911)

Foreign earnings at other than United States rates

(789)

(995) (1,312)

State tax expense, net of federal benefit

197

142 150

Settlements and releases from judicial decisions and

statute expirations, net

(132)

(252) (189)

Domestic production activity deduction

(87) (119)

Federal research and development credit

(158)

(174) (127)

Stock-based compensation

(201) (302) (149)

Other, net

81

6 (114)

Total provision for income taxes

$1,185 $8,837 $2,228

The components of our deferred tax assets and liabilities were as follows:

May 31 (in millions)

2019

2018

Deferred tax assets:

Accruals and allowances

$541 $567

Employee compensation and benefits

646

664

Differences in timing of revenue recognition

322

338

Basis of property, plant and equipment and intangible assets

1,238

-

Tax credit and net operating loss carryforwards

3,717 2,614

Total deferred tax assets

6,464 4,183

Valuation allowance

Total deferred tax assets, net

(1,266) (1,308)

5,198 2,875

Deferred tax liabilities:

Unrealized gain on stock

Acquired intangible assets

(78) (78)

(973) (1,254)

GILTI deferred

Basis of property, plant and equipment an intangible assets

Other

Total deferred tax liabilities

Net deferred tax assets

(1,515)

(158)

(200) (48)

(2,766) (1,538)

$2,432 $1,337

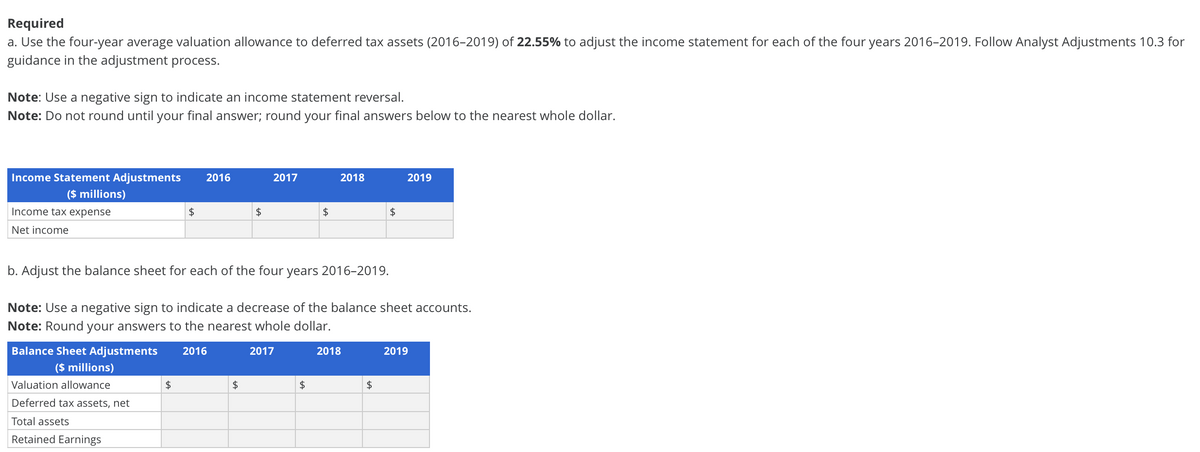

Transcribed Image Text:Required

a. Use the four-year average valuation allowance to deferred tax assets (2016-2019) of 22.55% to adjust the income statement for each of the four years 2016-2019. Follow Analyst Adjustments 10.3 for

guidance in the adjustment process.

Note: Use a negative sign to indicate an income statement reversal.

Note: Do not round until your final answer; round your final answers below to the nearest whole dollar.

Income Statement Adjustments

($ millions)

Income tax expense

Net income

2016

2017

2018

2019

$

$

$

$

b. Adjust the balance sheet for each of the four years 2016-2019.

Note: Use a negative sign to indicate a decrease of the balance sheet accounts.

Note: Round your answers to the nearest whole dollar.

Balance Sheet Adjustments

($ millions)

Valuation allowance

Deferred tax assets, net

Total assets

Retained Earnings

2016

2017

2018

2019

$

$

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning