Exercise 3-2 Adjusting and paying accrued wages LO P3 Pablo Management has eight employees, each of whom earns $165 per day. They are paid on Fridays for work completed Monday through Friday of the same week. Near year-end, the eight employees worked Monday, December 31, and Wednesday through Friday. January 2, 3, and 4. New Year's Day (January 1) was an unpaid holiday. Prepare the year-end adjusting entry for wages expense and record payment of the employees' wages on Friday, January 4. View transaction list Journal entry worksheet Record the year-end adjusting entry for wages expense. Note: Enter debits before credits. Date General Journal Debit Credit December 31 Record entry Clear entry View general journal

Exercise 3-2 Adjusting and paying accrued wages LO P3 Pablo Management has eight employees, each of whom earns $165 per day. They are paid on Fridays for work completed Monday through Friday of the same week. Near year-end, the eight employees worked Monday, December 31, and Wednesday through Friday. January 2, 3, and 4. New Year's Day (January 1) was an unpaid holiday. Prepare the year-end adjusting entry for wages expense and record payment of the employees' wages on Friday, January 4. View transaction list Journal entry worksheet Record the year-end adjusting entry for wages expense. Note: Enter debits before credits. Date General Journal Debit Credit December 31 Record entry Clear entry View general journal

Corporate Financial Accounting

15th Edition

ISBN:9781337398169

Author:Carl Warren, Jeff Jones

Publisher:Carl Warren, Jeff Jones

Chapter4: The Accounting Cycle

Section: Chapter Questions

Problem 4.27EX: Appendix 2 Adjusting and reversing entries On the basis of the following data, (A) journalize the...

Related questions

Question

Thank you!

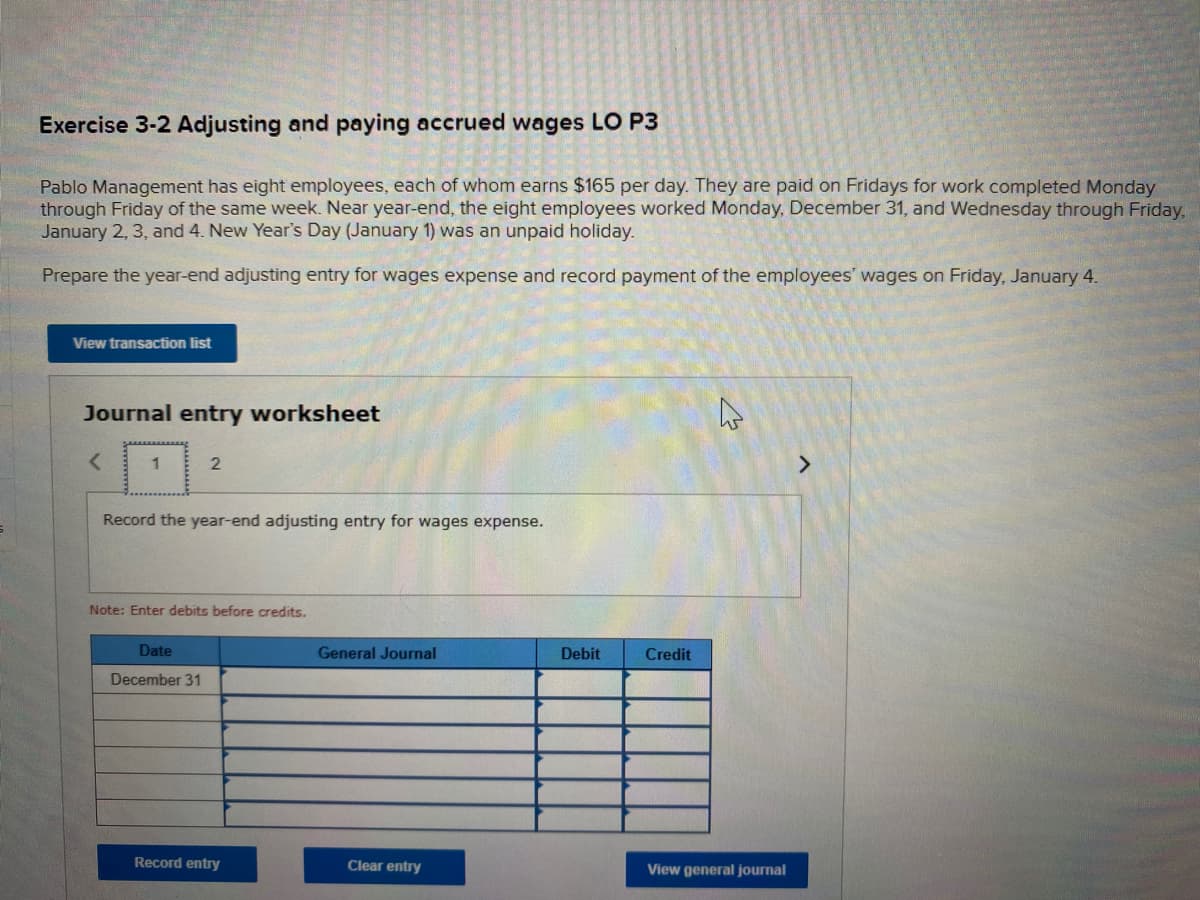

Transcribed Image Text:Exercise 3-2 Adjusting and paying accrued wages LO P3

Pablo Management has eight employees, each of whom earns $165 per day. They are paid on Fridays for work completed Monday

through Friday of the same week. Near year-end, the eight employees worked Monday, December 31, and Wednesday through Friday,

January 2, 3, and 4. New Year's Day (January 1) was an unpaid holiday.

Prepare the year-end adjusting entry for wages expense and record payment of the employees' wages on Friday, January 4.

View transaction list

Journal entry worksheet

1

<>

Record the year-end adjusting entry for wages expense.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

December 31

Record entry

Clear entry

View general journal

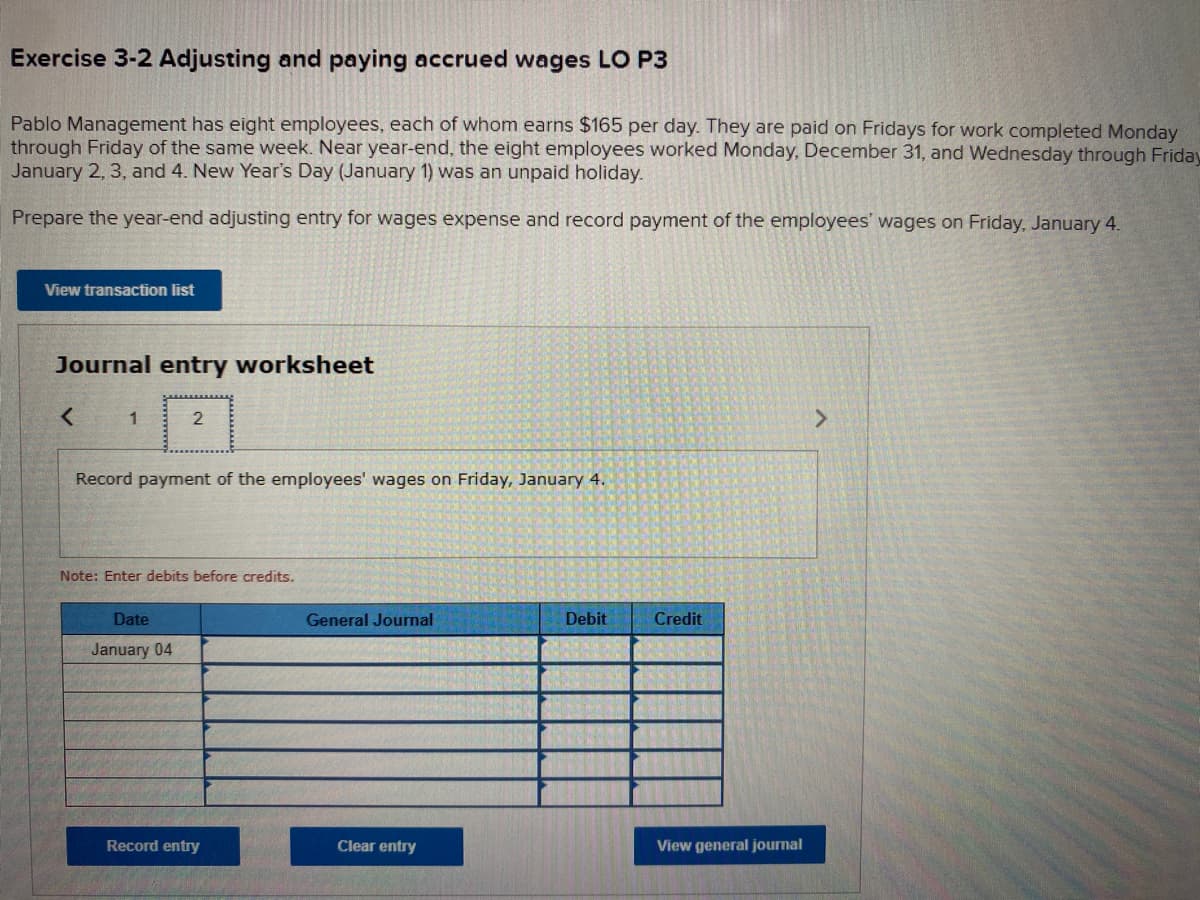

Transcribed Image Text:Exercise 3-2 Adjusting and paying accrued wages LO P3

Pablo Management has eight employees, each of whom earns $165 per day. They are paid on Fridays for work completed Monday

through Friday of the same week. Near year-end, the eight employees worked Monday, December 31, and Wednesday through Friday

January 2, 3, and 4. New Year's Day (January 1) was an unpaid holiday.

Prepare the year-end adjusting entry for wages expense and record payment of the employees' wages on Friday, January 4.

View transaction list

Journal entry worksheet

1

2

Record payment of the employees' wages on Friday, January 4.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

January 04

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning